A Quality Business Trading at 0.8x EV/FCF

It also pays consistent dividends while trading at liquidation value with a P/5Y FCF ratio of just 3.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

I originally bought this stock because it was cheap to earnings rather than assets.

I like to mix things up in the portfolio.

The problem with it was the fact that it was quite tricky to figure out how long the recovery might take.

I decided to cash out when a better idea came along.

The reason I cashed this particular stock out, was that it was the least attractive (in terms of catalyst-conviction) ones I owned.

Publish price: 695 JPY

Exit Price: 665 JPY

This equates to a loss of around 4%, which isn’t the end of the world.

The original post is below in case you’d like to read it.

=

Original post published 29th October 2025:

=

Today’s stock is one I added to my portfolio recently.

It’s probably one of the most controversial stocks I’ve owned for a while.

It’s not trading below liquidation value, although its pretty close, and revenues have taken a hammer blow.

This is the deep-value equivalent of betting on future earnings growth (kind of), although we don’t exactly need miracles for it to pay off.

Here are the ratios:

NCAV Ratio = 1.3

TBV Ratio = 1.2

EV/5Y FCF Ratio = 0.8

P/5Y FCF Ratio = 3.4

The assets backing these up are mostly cash and contracted receivables.

The operating business is priced at almost zero.

Despite the fact that it has never failed to generate positive FCF over the last 20 years.

There are, of course, ‘reasons’ for this pricing.

My job is to figure out whether or not the market has correctly identified the permanent elimination of future FCF, or, incorrectly mispriced temporary uncertainty.

This is the difference between a melting ice cube and a stock that doubles within 3 years.

After thoroughly reviewing the situation, I decided to allocate a small portion of my capital to this business.

I’ll admit that this was a tough call, and I deliberated for quite some time.

However, it’s ‘different’ from all the other stocks I currently own. And that’s kind of what I like about it.

I have conviction in the future earnings of today’s stock, but you may not. And that’s the beauty of deep-value investing.

You can do it your own way, and still do well.

Everything I own is cheap, but some stocks have much better earnings potential than others.

Under normal circumstances, you only get these types of businesses, at dirt-cheap prices, where there is some kind of terrifying uncertainty that the market cannot tolerate.

In fact, one of my most popular write-ups was a business with great earnings, experiencing uncertainty that caused the market to give it away.

Today’s stock, in my opinion, is one such business.

Let’s see if you agree or not…

The Business

ValueCommerce (2491.T) is a Japanese performance marketing company.

This means that they help businesses of all types, generate more customers and more revenue through online websites and platforms.

Prior to 2025, ValueCommerce had a ‘special’ relationship with Yahoo-Japan.

First of all, Yahoo owns 28% of ValueCommerce stock.

Second, 50% of ValueCommerce revenues came from Yahoo platforms. This was split between an advertising platform and a CRM system.

VC offered this to shopping malls, who were trying to generate more customers and more revenue from their existing customers.

The current CEO, originally worked at Yahoo between 2003 and 2012, and then moved to VC as a director in 2013, becoming CEO in 2014.

The other half of revenue comes from their affiliate marketing division and their brand new travel-tech division.

Affiliate marketing appears to be their core strength, and the model that drives most revenue overall (across all the divisions).

This is central to why I have confidence in the businesses ability to power through the current uncertainty.

Since 2024, they have been working hard to build out this side of the business, with the explicit goal of replacing the Yahoo-driven revenues.

They have been investing and expanding their services with this goal in mind.

Why It’s Cheap

Back in 2024, VC decided to ‘de-risk’ their relationship with Yahoo.

They initially conducted a large share buyback, directly from Yahoo to reduce the Yahoo ownership stake in the business.

Next, in early 2025, it was announced that Yahoo would be building their own infrastructure within their platforms.

This meant that ValueCommerce would no longer be able to generate revenue from the Yahoo platforms.

Obviously, the market became terrified at the headline loss of half of their revenue.

This pushed the price down over 80% to roughly where it is today.

The Risks

The good thing about situations like this is that it’s very clear.

Will the business shrivel up and die from here? Or will the business be able to cushion the blow, and eventually, replace the lost revenues?

Yahoo concentration is obviously the top risk, but that has been (mostly) priced in.

The question now, is how confident can we be that the business will recover enough to ease the market’s concerns while making the current valuations sustainable?

There are also the standard business risks, which I tend not to worry about too much.

The risks here are all centred on the businesses ability to do what it does best.

Affiliate marketing.

The Investment Case

The detachment from Yahoo seems like a planned process. It began back in 2024, and continued through 2025.

The termination of the relationship also seems very ‘reasonable’.

For example, Yahoo has agreed to pay VC ¥1 billion (£5m) to help them build out their new platforms and make the transition.

They have also agreed to pay some ongoing revenue to VC based on historical commissions, as they transition customers over.

This cushions the blow significantly, and is a contractual agreement from Yahoo-Japan, which is a pretty sizable brand.

Alongside this, VC have been implementing new revenue channels since early 2024, with this scenario obviously in mind.

The fact that Yahoo also owns 28% of VC, indicates that they have a strong interest in maintaining the value of their investment.

This is a good start to such a tricky situation.

Next, the balance sheet is cash-rich and the business remains FCF positive, even up until the most recent interim report.

It seems unlikely to me that the management team (and Yahoo) would drive the business off a cliff unless they were confident it wasn’t going to just burn all its cash and die.

There is enough cash to weather any temporary periods of struggle or investment, in my opinion.

The business itself is clearly very good at what they do.

I get this impression for a few reasons.

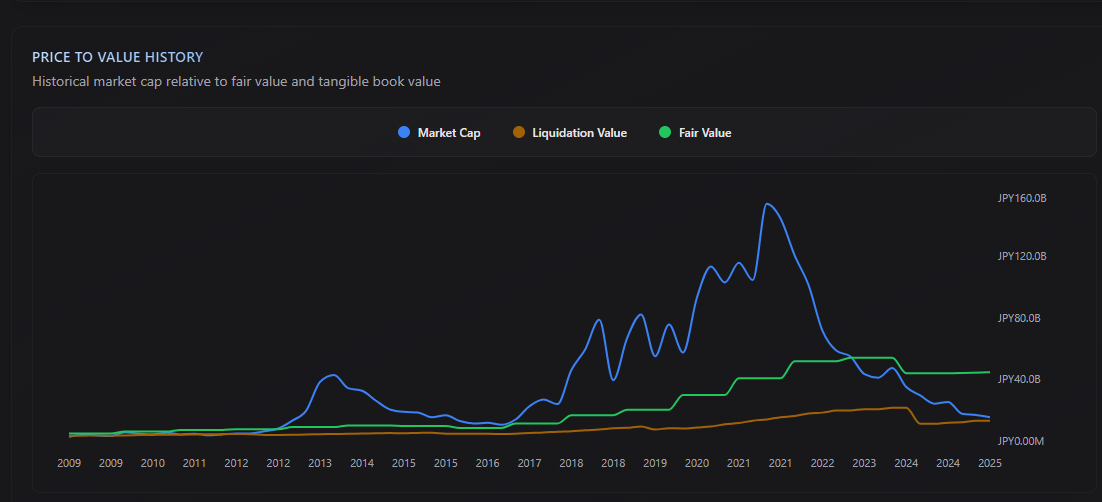

Firstly, the market has constantly valued the business at WAY higher multiples over the years.

This is unusual for a Japanese deep-value stock.

In fact, the reason it jumped out to me is that this virtually never happens with a Japanese deep-value stock.

Mostly they are cheap due investor apathy, which normally comes from a boring business with no growth potential.

In this case, the market clearly has had faith in VC’s ability to grow and generate revenues over time.

Of course, we don’t know for sure if they can replace those revenues, but it does seem like they have the competence to make a good go of it.

This also helps us on the valuation side.

Any glimmer of progress from here, will likely encourage the market to rerate the stock, quite strongly.

They don’t even need to replace all the lost revenue. They only need to show signs that their efforts are paying off.

They have multiple projects in play, and it seems likely that at least one of these will start bearing fruit.

We’re not looking to hold this stock for the long term, so any 50%-100% rerating would give us a very satisfactory exit point.

And, this would still value the business pretty cheaply, by historical standards.

Next, the management team seems pretty good.

The CEO has been in the business since 2013, and likely had a good relationship for ten years prior, when he was at Yahoo.

He owns stock in VC, and has a track record of growing the business while maintaining a core focus on delivering capital back to shareholders.

The messaging and actions of management also indicate that they have confidence in the next couple of years being ‘ok’.

For instance, they have maintained their dividend policy. This is normally the first thing to get shut down.

Next, they haven’t announced a major cost-cutting or scaling down of operations or staff. The headcount has gone up recently as they invest in their new revenue channels.

They seem, for now, pretty confident in what they’re doing and the plans they have for restoring the business.

Of course, I don’t have all of the information and anything can happen.

The situation is extreme, but the stock price now reflects that to a large degree.

The historical price indicates, to me, that this is a business and team that are respected by the market and good at what they do.

The balance sheet and Yahoo transition deal makes everything much less risky, and gives them ample time to get the new channels up and running.

In my view, this is a chance to buy into a decent quality business at a bargain basement price.

Again, this isn’t about long-term holds, but merely about snatching a quick rerating when the market receives even the smallest bit of good news.

It’s also important to note that I wouldn’t fill my portfolio with these situations. The main thing protecting us here is the fact it’s only a small piece of the portfolio.

But this one adds a unique dynamic that helps me (ironically) sleep well at night.

As ever, whenever I cash out (for any reason) I’ll update with a new write up.

Mr Deep-Value also offers:

A 90%+ discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients