A Cash-Machine Priced Below Scrap Value

A business priced at 1.3x earnings with a very strange back story.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

In the intelligent Investor, Ben Graham wrote the following:

“The investor’s chief problem, and even his worst enemy, is likely to be himself. Over many decades of experience, we have seen investors repeatedly make the same mistake: really dreadful losses have been suffered in common stocks through the purchase of mediocre issues at inflated prices. In the end, most of those who lose money in stocks do so, not because the underlying business was worthless, but because they paid far too much for it.”

Many people talk about how ‘silly’ prices have become for some of the ‘hottest’ stocks.

At the time of writing, this included things like paying 200x Enterprise value for NVDA, or paying 960x Enterprise Value for PLTR.

I agree these prices are insane, but the underlying businesses can be considered ‘world class’.

In other words, their earnings probably will continue rising and growth probably will be generated over decades.

The worst case is that you won’t make very much over those decades while you wait for the business to catch up with the hype you just paid for upfront.

I’m always reminded of Microsoft after the .com crash. From its peak, it took around 16 years to break its high again.

This isn’t great, but it's not permanent capital loss either.

For that, we need another ingredient…

A mediocre business.

The most feared type of situation is when a mediocre business is accompanied by an inflated stock price.

This is because the business won’t live up to the hype and anyone buying at those highs will become bag-holding exit liquidity for the good players.

Today’s stock is gloriously mediocre and, when I first found it, was completely overhyped.

Everything about it looked sensational.

It had revenue growth, it had earnings growth, it had equity growth. Everything was pointing upwards over the most recent 5 year period.

The stock price marched higher and higher, and looked invincible.

I was fascinated because I don’t stumble across many stocks like this, too often.

I didn’t buy it, for a couple of reasons:

Firstly, it wasn’t cheap. It was trading at around 6x TBV and 7x 5Y FCF.

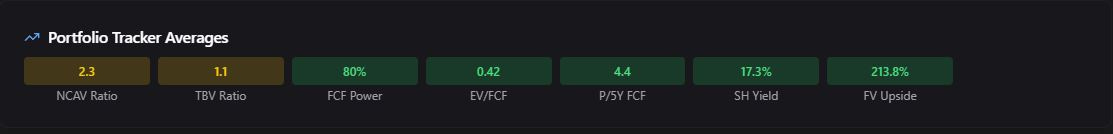

The average stock in my portfolio looks more like this:

Secondly, the actual business model reeked of mediocrity. Whatever growth they had achieved would surely be impossible to sustain.

However, I decided to keep it on my watchlist and check in on it now and again, to see how it all played out.

One day, in late 2024, the stock price had collapsed. In fact, it’s currently down over 70% from those dizzy highs.

I could hear old Ben Graham (and the sobbing bag holders)…

This stock was the most recent reminder that mediocre businesses combined with fantastical growth stories are the most toxic combination to investors.

But now, it’s cheap.

Dirt cheap.

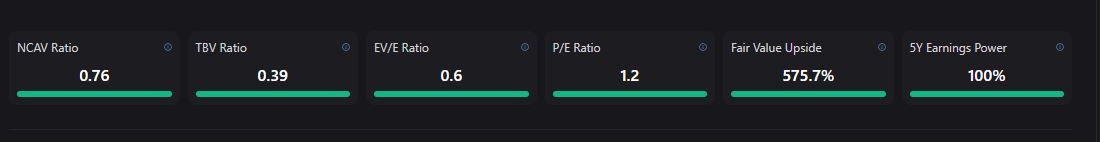

As you can imagine, I became very interested right after it became priced at just 1.3x its 5Y FCF figure.

The business is currently priced as if it will die imminently and never generate any cash flow again.

In reality, it generated more cashflow in the most recent quarter than in the entirety of the previous year (both were positive).

So I started digging into it.

Before long, I started to feel like I was in a Scooby Doo movie, or Jessica Fletcher from Murder She Wrote.

This company seemed to have the weirdest back story I’ve ever stumbled upon.

There was an underground network of people all studying this business, trying to get to the bottom of what the heck it’s been up to.

The harder I looked the weirder it became.

As strange as all this was, It didn’t put me off, and I recently bought the stock as part of my deep-value portfolio.

Allow me to explain…