2.5 x earnings and trading at 80% of TBV

This stock has lots of recent insider buying and has an average 5Y dividend yield of 15% (at todays price).

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

This was my highest conviction idea of 2025.

The business was great. The management team are obsessed with returning cash to shareholders. The issues were all cyclical and temporary.

However, the market priced it as if it would never make money again.

I cashed this out simply because it hit my estimate of fair value for the business. Any further increase in stock price from here relies on ‘growth projections’.

That’s not my game, so I took my cash and recycled it into the next one.

Publish price: £0.48

Exit price: £1.16

This equates to a gain of around 142% in under a year. This is why I buy deep-value stocks.

There is no need to predict anything, we just buy things for way less than they’re worth and wait for the inevitable rebound.

I left the original post up in case you’d like to read it.

===

Original Post published 19th April 2025:

===

Today’s deep-value opportunity:

NCAV Ratio = 1.6

TBV Ratio = 0.8

EV/FCF Ratio = 2.5

P/FCF Ratio = 5.6

Avg SH Yield = 15%

The business has been FCF Positive in 10 of the past 11 years.

Insiders have bought hundreds of thousands of shares in the past few months.

Oh, and there is a catalyst in play that I believe will bear fruit in 2025.

I conservatively estimate that there is over 100% upside in this stock for anyone buying at current levels.

It’s a cash-rich, virtually debt-free business with a free-cash-flow obsessed management team that is focused on returning value to its owners.

Recently, the markets tanked because of the Trump-Tariff uncertainty. This caused all stocks to fall in unison.

Some fell more than others. Today’s stock was already cheap, but became an absolute no-brainer.

Let’s dive in…

What It Does

Sylvania Platinum (SLP.L) recovers platinum group metals (PGMs) — primarily platinum, palladium, and rhodium — from historical tailings dumps in South Africa.

These dumps are the by-product of chrome mining operations.

Sylvania uses its own processing infrastructure to extract valuable PGMs from this material, turning industrial waste into cash.

Unlike traditional mining, this tailings retreatment model is capital-light, low-risk, and more environmentally sustainable.

There’s no need for expensive exploration, no deep shafts, and no high operating leverage.

This approach has made SLP one of the most efficient and consistent cash-generating businesses in the small-cap mining space.

SLP's PGMs are essential for catalytic converters in internal combustion engine vehicles, a market that continues to grow in emerging economies.

Even as EVs expand, ICE vehicles will dominate the global fleet for at least another decade, maintaining strong demand for SLP's output.

Why it’s so cheap

SLP’s stock has been crushed by the steep drop in rhodium and other PGM prices.

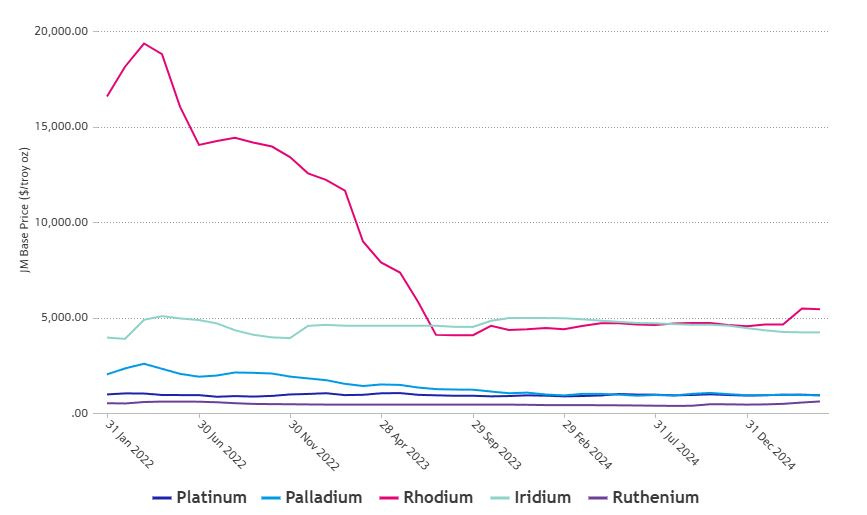

Rhodium, the most lucrative of the PGMs, experienced a super-cycle surge during 2020-2021, reaching nearly $30,000 per ounce, before falling back to ~$6,000 per ounce. Platinum and palladium also suffered sharp declines.

As a result, SLP's earnings contracted significantly.

Investors extrapolated this decline and assumed prolonged or permanent weakness. Many exited the sector entirely, causing a broad derating across PGM-related names.

However, the market has missed key distinctions:

SLP is not a deep-mine operator; it has a lower cost base.

2024 was the first negative FCF year in over 10 years

SLP carries almost no long-term debt and holds a significant cash balance.

It has continued to pay dividends and buy back shares, even during commodity price lows.

This disconnect between perception and reality presents a major opportunity.

The stock trades as if bankruptcy is imminent, yet the business remains fundamentally solid and self-funding.

The Setup: What's Changed

SLP has used the recent downturn not just to survive, but to strengthen its position.

Instead of chasing short-term growth or speculative expansion, it has focused on cash conservation, cost optimization, and high-impact, low-risk investments.

Recent strategic improvements include:

Ongoing cost controls and operational streamlining.

Significant insider buying, signalling confidence in future prospects.

Launch of the Thaba JV to secure long-term feedstock and higher-margin production.

Maintaining generous shareholder distributions despite lower earnings.

This is a textbook example of what disciplined capital allocation looks like during a downturn.

The business is not reliant on a sharp commodity price rebound to stay viable.

Instead, it is improving its structure to profit from even moderate recovery in PGMs.

The Thaba JV — A New Engine for Growth

The Thaba Joint Venture represents a significant evolution in Sylvania’s business model.

Traditionally, SLP processed tailings owned by third parties under tolling or profit-sharing agreements.

Thaba changes this by making SLP a co-owner of the resource.

What It Is:

A JV with a local South African chrome mining company.

Grants SLP long-term rights to retreat high-grade chrome tailings.

Allows processing through existing SLP plants.

Enables greater economic participation from feedstock ownership.

Why It Matters:

Feedstock Security: Historically, tailings availability has been a risk. With Thaba, SLP secures access to a consistent, high-volume stream of material for years to come, ensuring plant utilization remains high.

Margin Expansion: By owning the dump, SLP keeps more of the profits. The JV structure allows for better economics compared to traditional tolling.

Volume Growth: Increased throughput from Thaba will drive up PGM production and benefit from economies of scale at existing processing facilities.

Low-Capex Model: The JV uses current infrastructure, avoiding large upfront investment. Capital requirements are modest and funded internally.

Thaba Economics:

Expected to contribute materially to production and cash flow from 2025 onward.

Capex burden shared with the chrome partner, keeping SLP asset-light.

Internal rate of return (IRR) expected to be high due to low input costs and operational leverage.

Thaba is not just a side project; it is the blueprint for the next decade of cash flow.

It de-risks operations, enhances visibility, and lays the groundwork for further expansion of this JV-led model.

This is great news for deep-value investors like us, because we’re here for the flip. As soon as things start looking rosy again, we can exit with our outsized profits.

Margin of Safety

SLP offers one of the most robust margin-of-safety profiles among global small-cap resource stocks:

Tangible asset base well above market price

Net cash position adds a liquidity cushion

Operational costs are low enough to maintain profitability through downturns

Shareholder alignment is strong, evidenced by buybacks and insider buying

The company could shut down Thaba tomorrow, stop all capex, and still deliver solid returns. But with Thaba, the upside skews even further in our favour.

On top of this, the insiders are making all the right moves.

In the last 9 months alone, insiders bought over 100,000 shares on the open market. This illustrates that they also believe the stock price will soon be rerated higher.

Risks to Watch

As always, deep value investing requires acknowledging risks, in fact, assessing the downside is most of the analysis.

I spend most of my time looking for the ways I’ll lose money.

Here’s how I see it with SLP:

Commodity risk: Further declines in rhodium or platinum could reduce margins.

Execution risk: Delays or underperformance at Thaba could hurt credibility.

Jurisdictional risk: South African infrastructure and regulatory issues can cause disruptions.

Capital allocation drift: If management begins chasing growth over returns, the thesis weakens.

Black swan risks: Fraud or undisclosed liabilities, while rare, could impair capital.

We mitigate this through:

Position sizing (e.g. 5% of portfolio)

Active monitoring of quarterly and annual reports

Avoiding leverage or over-concentration

My Move

Portfolio Allocation: 5%

Buy Range: < £0.50

Avoid Above: £0.75

Target Exit: £1.15 or a 150% gain

This is a high-quality, cash-rich operator mispriced due to temporary sector sentiment.

We’re being paid ~15% per year (5Y average) in cash returns (at current price) to wait for a re-rating.

With the Thaba JV acting as a new profit engine, I believe this is one of the most compelling deep value cases in the market today.

The upside scenario is a tripling of earnings and multiple expansion. The downside is protected by tangible assets and ongoing free cash flow.

That’s a bet worth taking in my humble opinion.

I’ll be monitoring execution at Thaba and any changes in shareholder return policy to keep the thesis updated.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Thank you for the right up I just became a paid subscriber to read your analysis . When I pulled the stock up is says it is trading at 49 with a dividend yield of 3.19 % … am I looking at the wrong stock ? Thanks