The Secret Loophole I Wasn't Supposed To Find...

If you research stocks or use professional market data, it could save you £12,000+ per year...

This is the story of how I discovered a way to access the world’s No.1 competitor to the Bloomberg Terminal, Reuters Eikon (Now LSEG Workspace), at a 90%+ discount.

You can access the same discount and start with a 30-day free trial here.

But, first, the story…

Many years ago, I was a professional currency trader, and later, went into buying and selling small, private businesses in the real-world.

During that time, I acquired and built a small software business.

We supplied news, research and analysis to trading firms and brokerages, via our platform.

One of our suppliers was a small business based in the US.

One day, the owner of that US firm was in the UK, and invited me to lunch.

We met in a small Italian restaurant in the City of London, while it, typically, poured with rain, outside.

I mentioned we’d decided to switch from using Bloomberg to their main competitor, Eikon.

At the time, Bloomberg was more than twice the price, despite both platforms having all the features we needed.

He went completely silent, then looked over at his general manager.

He looked back at me, and leaned in:

“You know, we can provide access to the Eikon platform for a fraction of the headline cost.”

I looked around nervously, then asked him to explain.

Here’s what he told me:

How To Save Over 90%

Years ago, his firm was a division within Thomson-Reuters.

One day, the main CEO at TR calls the division-manager into his office at 10am, and offers him a glass of neat whisky.

The manager politely declines.

The CEO chugs down a glass regardless, and pours himself another.

He explained they didn’t really know what to do with this tiny division, so they’d just shut it down.

The manager offers to buy it instead, and they shake hands on the deal, there and then.

As part of the deal, the newly spun out firm would get preferential access to all TR news and data.

They would use it to power their technical software product, which they would sell to individual investors and small firms.

Buying data for commercial use is eye watering, and, unless you have big-company budgets, it’s futile.

This gave his small firm a huge advantage over all their competitors.

The terms of the deal also allowed them to re-sell access to a rebranded version of the Eikon platform, to individual investors, at a drastically reduced rate.

This little loop-hole was largely forgotten, because their retail clients don’t use what the Eikon platform offered.

They focus on technical analysis and charting.

I enquired about how much it would cost me to use the platform through them, instead of going direct.

“We can get you on the platform for around $100 per month.”

I nearly fell off my chair.

That was at least a 90% discount to what I was about to pay to access it directly.

A asked for a log in and went home to give it a try.

How I Got Banned By Reuters

To understand why this was such a big deal, we need to go back to 1999.

In those days, people were fretting about the millennium bug and everyone wore purple shell-suits.

Reuters had also just launched their latest product innovation to challenge the mighty Bloomberg Terminal.

They called it 3000 Xtra.

In 2008, The Thomson Group acquired Reuters in a deal, reportedly with $17 billion.

This created the Thomson-Reuters Group, which specialises in selling financial news and data.

In 2010, the TR group decided to invest $1 billion into its platform, which included upgrading the 3000 Xtra platform into the world-famous Eikon platform.

Eikon was, quite literally, a $1 billion product.

By the time 2025 rolled around, Eikon was the number one Bloomberg competitor (by market share).

The product (now owned by LSEG) was replaced by the brand new ‘LSEG Workspace’.

The goal of Workspace is to accelerate adoption and close the gap further between themselves and Bloomberg.

The point is that this product is good.

Seriously good.

And I now had the chance to access it for virtually nothing.

There was just one problem…

I had the Reuters sales-rep pestering me for a signature to the new contract.

I told the guy that I found a way to access it without paying the huge fees, and sent him on his way.

A couple days later, I received a call from the re-seller.

“Reuters have been on the phone and have told us to ban you from using our product.”

WTF.

They explained that the terms of their deal included a clause that prevented any ‘professional’ clients.

Apparently, the sales rep had gone back and reported me as a professional client, specifically to get me banned from the retail version.

I asked how they defined a ‘professional’ client, and they told me that it was basically anyone using a professional sounding email address.

Every application that comes through is checked ‘upstairs’ and anyone deemed to be a pro-client is rejected.

I created a new account, with a personal email, and restored my account.

It’s worked fine ever since and is a tool that I use daily to help me analyse companies and their financials.

Although, to be fair, company analysis is only a fraction of what it can do.

What’s Included

The platform is literally designed to compete with the Bloomberg Terminal, and has succeeded in that goal.

Its features are far too numerous to list here, but you can view the sales video here.

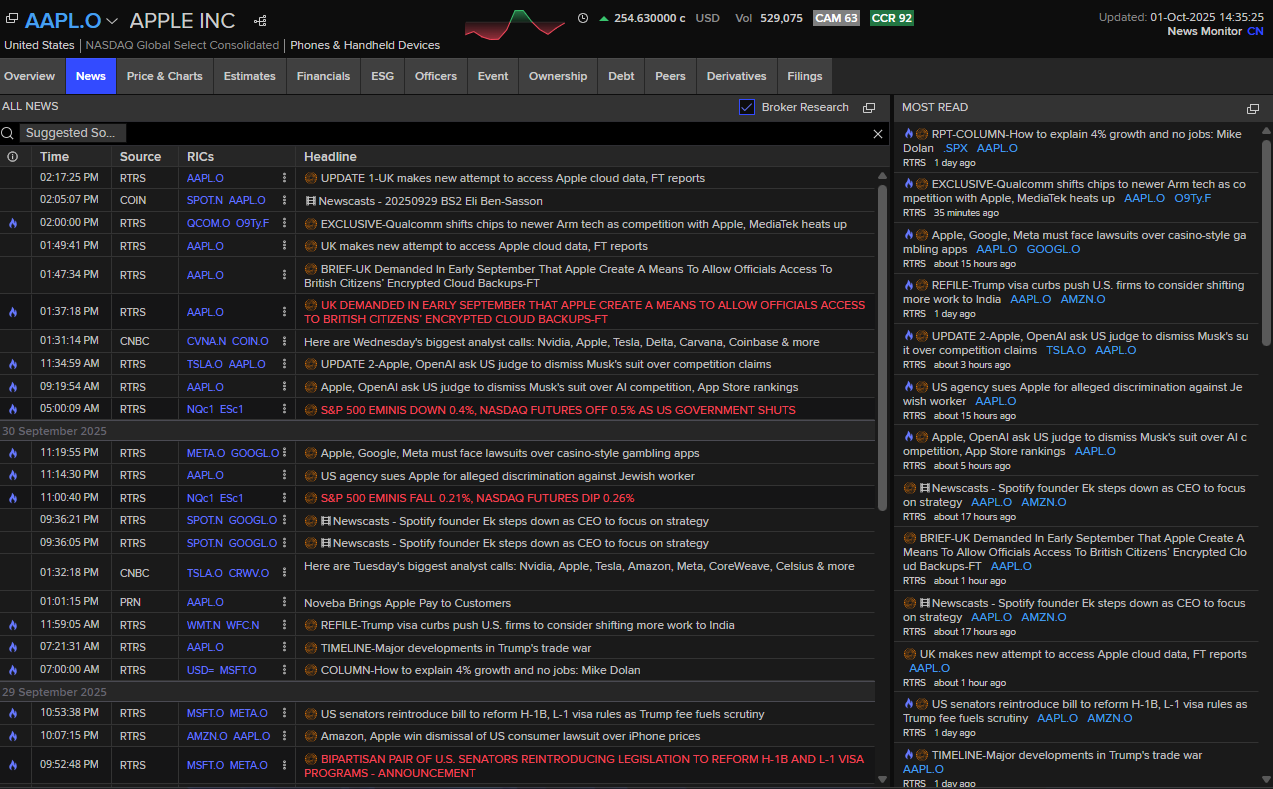

Broadly speaking, it allows users to view market data, company fundamentals and institutional-grade newswires.

It has Reuters news baked in.

You can search, analyse, and compare pretty much any asset class.

And, best of all, you can create your own customised templates and layouts to view the specific type of content that you use in your own process.

It plugs into excel natively, allowing you to build out complex analysis or valuation models and power it automatically with LSEG data.

This covers everything from macro-economic data releases to seasonal pricing patterns and even volatility tracking.

Of course, there is a catch.

It doesn’t include some features of the pro-version, such as the instant messaging feature, that allows you to connect with any major institution etc…

There are also some other features missing, such as access to the Wall St Journal articles and the high/low forecast expectations for upcoming data releases.

For stocks, it contains pretty much everything you could need to assess and analyse a company.

You can view all of the profile information, including key ratios, growth, and capital structure data.

It also allows you to view all related news, specific to any individual stock, or watchlist of stocks.

The platform also includes access to price charts, analyst forecasts and estimates along with the full suite of financial statements.

You can also access detailed information on directors, upcoming corporate events and releases, ownership information, debt structure, available derivatives, and downloadable filings.

The ability to download company reports is particularly useful for smaller stocks whose IR sites can be unreliable or difficult to navigate.

And yes, their company coverage is global and full. You can dig into even the smallest stocks.

If trading the markets is your game, then it also has fully functional pricing and asset monitors that you can customise and edit to fit your own preferences.

This allows you to track and analyse almost anything available in financial markets.

How to Access

The reseller is a company called Metastock.

Their core product is a different platform, specifically tailored for retail traders that want to conduct heavy-duty technical analysis.

This is the main reason the Eikon product has flown under the radar so much.

Most of their natural clients are just not interested in the type of fundamental data analysis that the Eikon platform is designed for.

For investors like me, it’s a hidden gold mine.

Of course they don’t sell it under the Eikon or LSEG brand names. I don’t even think they are allowed to, under the terms of the original deal.

Instead they have branded it as the ‘Xenith’ platform.

This is probably another reason it goes largely unnoticed.

This, of course, suits LSEG, who actively discourage any kind of marketing using their main brand, and still ban anyone using a professional email address or business name.

I feel that there are many people within my Substack audience that would value the Xenith platform.

Many of them are probably paying the full rate to LSEG right now.

So, I asked Metastock if I could share the offer with my audience here.

They agreed, as long as I was somewhat ‘subtle’ about promoting it.

Here’s the deal:

When you sign up through this page, you can get a 30-day free trial immediately.

At the end of the trial, you will be automatically charged $110 every calendar month, until you cancel.

There is no contract or commitment.

If you cancel during your trial, your access will simply end after the initial month with no further charges.

Metastock has telephone support and the team there is genuinely really helpful. They’re great people.

You can keep accessing it for $110 per month, for as long as you find it valuable.

They have a few other data options (at higher price points), but the basic one pretty much has everything I’ve ever needed.

Upgrading later is a simple email or phone call, and if you would like their sales guys to walk you through the specific differences they will happily do that.

That’s it.

I’m almost certain that most serious investors will find tremendous value in this product. If not, there is virtually no risk with the price being so low.

Plus you get an entire month to really test-drive it.

You can build your own layouts and templates and create your perfect analysis platform.

Click the button below to visit the sales page and sign up for the free trial offer.

REMEMBER: Use a non-professional email address and a non-business name when signing up, to avoid your application being rejected.

Your post above mentions the subscription fee as $110/monthly; whereas the pricing on the linked page (https://www.metastock.com/offer/ek?whc=mrdeepvalue) is a minimum of $165/month and this price does not include data worldwide but only for one single region. What am I missing here?