An EU Net-Net Priced at 2x FCF

You just need to figure out if it's a value-trap or a growth-stock in disguise...

Mr Deep-Value also offers:

A 90% discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Today’s stock looks cheap:

NCAV Ratio = 0.7

TBV Ratio = 0.7

EV/5Y FCF Ratio = 0.7

P/5Y FCF Ratio = 2.0

It currently trades 50% below its tangible book value and around 300% below my estimate of its fair value.

It’s been successfully operating since 1985, and has more cash than debt.

FCF has been lumpy and there was a big (unrepeatable) spike in cash thanks to the COVID boom.

The game I play is pretty simple.

I find a business priced like it died, and take the bet that it won’t actually die any time soon.

The core bet is that established, healthy businesses will generate more free cash flow during their remaining life than the current market cap value.

This, in my view, is the simplest way to invest, and the surest way to long-term wealth.

I leave the complicated growth stories and the 100-baggers to the smart guys on social media.

The world is full of cheap stocks, and every one of them is cheap for a reason.

Despite being simple, this version of the game isn’t necessarily easy.

Sometimes, the ‘reasons’ are fuzzy and it’s difficult to judge whether or not the business will indeed continue, as it always has.

For example, this business lost its entire business model overnight.

This business supplies an entire industry that is in structural decline, pretty much globally.

And, this business operates between the lines of war-zones and sanctions.

They’re all ‘cheap’ but I’d think twice about owning them in real-life, and thus, the stock.

Some businesses sit right in the middle of the grey-area that makes it difficult to really make a confident decision either way.

Others provide much more conviction, and I jump at the chance to buy more stock, as the price fluctuates downward.

Today’s stock sits on my watchlist, and I wrote it up because I feel that some readers might enjoy digging deeper.

Maybe you’ll decide that it’d fit nicely inside your portfolio.

Or, maybe you won’t.

Let’s dive in…

The Business

Euromedis Groupe (ALEMG), founded in 1985, is a French distributor of medical supplies.

They sell the stuff that’s used constantly by medical professionals.

This includes things like medical gloves, needles, dressings, medical sets, catheters, drainage products, probes and, you get the idea.

They tend to buy these products from abroad and then white label them as branded products.

Interestingly, they take full regulatory responsibility for those products, and run their own quality control system to ensure everything is up to scratch.

This makes sense because they sell high-volume, recurring products to customers that use them over and over again.

From this angle, the business model is pretty nice.

As long as they don’t mess things up, the customers are inclined to at least consider their products for long-term use.

Euromedis sells, mostly, to public sector medical institutions, like hospitals and similar ‘medical collectives’.

It wins contracts via public tender processes.

In other words, it has to fight for every last order and the main weapon is price.

This is the downside to the business model. Every contract expires and the bidding wars reignite over and over again.

This keeps margins compressed and under pressure.

Most of its customers are in France with a few more in the wider-EU area.

They source their products via a supply chain consisting of around 500 different suppliers. They aim to have at least two providers for each individual product.

Therefore, they make their money on the difference between buying each product, re-branding them, and selling them on to their customers.

Why It’s Cheap

There are, of course, a few issues going on with Euromedis.

Firstly, there is the business model issue. Every cycle could, in theory, end in far less sales, because of the compulsory bidding process.

Revenues are currently heavily concentrated in this model.

This poses an obvious risk that stock market investors tend to shy away from, because it’s so uncertain what future revenues might look like.

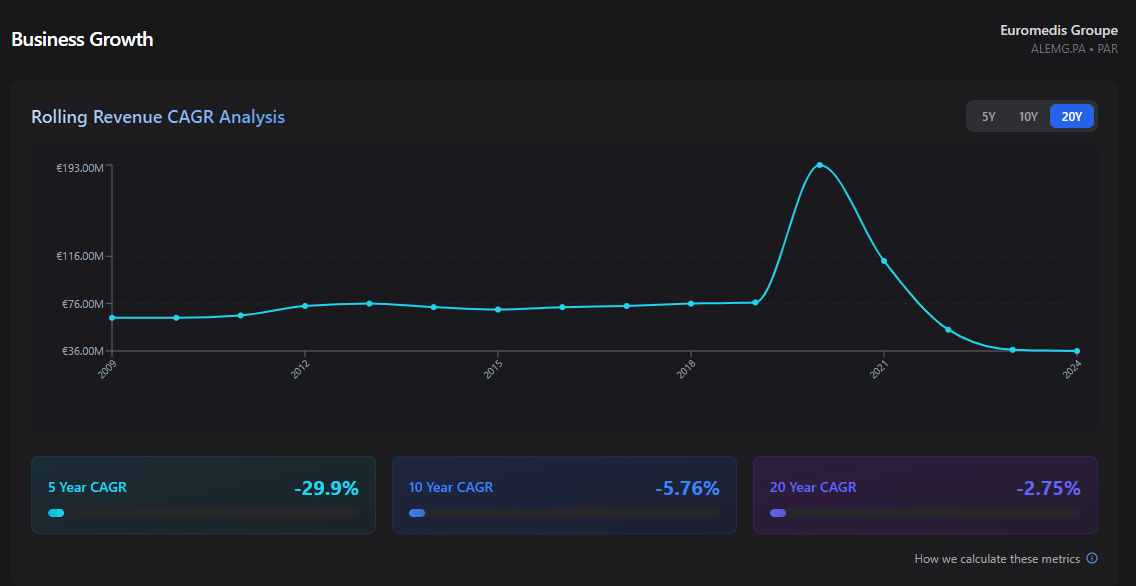

For example, let’s take a look at the historical revenues:

Generally speaking, it was flat. Then COVID happened and it spiked, before dropping back down BELOW pre-COVID levels.

This is a Rolla-Coaster, and not something that shiny-shoed investment analysts enjoy trying to figure out.

To compound this issue, 2025 is a bidding year. So at this point, it could go either way, all over again.

This isn’t anything terminal, the business has been plugging away for 40 years, but it does represent the type of uncertainty that markets hate with a passion.

Then, there is the capital structure.

Apparently, the free float is around 35%, which puts all the power in the hands of insiders.

This often deters institutional investors that might otherwise build their stake towards an activist position.

Finally, last year was a bit of a horror show in terms of accounting.

One of their main customers (Groupe Gaillard) entered liquidation, and Euromedis effectively wrote-off their €6m exposure.

This sent the accounting figures into the red, and the market panicked over the loss of €6.1m.

This was a one-off event, but it introduced more uncertainty.

There is also a tax audit going on with an unknown liability. This is probably not a major threat to the life of the business, but it’s yet more uncertainty.

As you can probably tell, there is quite a lot of uncertainty going on, from multiple different angles.

Couple this with a tiny, low-liquidity, small-cap stock, and you have the recipe for ‘cheap’.

The most important thing, however, is the likelihood of the business declining suddenly or slowly melting away into nothing.

The Risks

The business model is working-capital intensive.

They need to constantly purchase stock, ship it, check it, rebrand it, and deliver it to customers.

The business also carries some debt (€8m). This is less than cash (€15m), but when you couple this with the nature of the model, it’s not hard to see how cash could get tight.

An illustration of this risk in action was the doubling of shipping costs in 2024. This ate into margins.

The business is also exposed to FX changes more than most. They purchase things in USD but sell them in EUR.

Any significant swing in these FX rates (EUR/USD) could cause headaches in the short term, if they swung the wrong way.

The next risk is counterparty risk.

The company signs a contract and then must pay up front for the stock in order to deliver the promised products.

This becomes a major problem if the customer suddenly goes out of business. The upfront cost remains, but there is no one to sell to.

This was also illustrated last year, when their major customer went out of business.

The biggest threat, in my opinion, is the tender process.

It’s impossible to escape the cost pressure, while the exposure to failing clients remains zero-sum.

If this happened a few too many times, over a short enough period of time, Euromedis could really struggle.

Of course, we should also include the ongoing tax investigation here. However, it’s my view that the worst case liability will be similar to a tax liability with some fine attached.

I wouldn’t be concerned that this could lead to the death of the business.

But, it’s certainly something to monitor.

Aside from all this, there are general risks.

These include things like, supplier risks, FX risks, environmental risks, regulatory risks, product defect risks, and the risks posed by their debt.

These things, in my opinion, can all be mitigated effectively by standard processes and procedures.

A 40 year old business like Euromedis, so closely held, should be expected to handle these.

In fact, none of these things would put me off owning the business, because, in reality, selling products to different customers is perfectly feasible.

The biggest turn-off for me, lies in the difficulty in figuring out future cash-flows.

First of all, the COVID boom generated huge, unrepeatable cash flows. This was great and gave the company a large cushion of liquidity.

However, this soon dissipated.

Next, the business lost a very large hospital contract, which negatively impacted revenues.

This partly explains, why post-COVID revenue (€37m) is much lower then pre-COVID revenue (€73m).

Even with COVID stripped out, the core revenues took a beating, thanks to the public-tender system.

It may recover next year and triple (if they win some juicy tenders), or it may never come back, ever.

Finally, they deliberately restructured the core operating business.

They had been trying to scale a distribution network and D2C arm called Paramat. The idea was to diversify revenues and build something more sustainable.

Paramat rented out things like wheelchairs, hospital beds for the home, and other aids for disabled and elderly people.

It operated branches and centres that customers could visit to purchase their products.

Ultimately, this was not a profitable endeavour and management decided to carve it up and sell it off.

This explains the recent loss of around €20m in annual revenues.

The end result is a much smaller, leaner business that is focused on cutting costs and reducing reliance on the public tender process.

The problem with this (for me) is that it makes all the historical financials far less reliable when trying to value the business.

The only logical way to try and value this, is to try and make some future forecasts, based on managements plan.

This is usually where I stop and move on to something else.

Any valuation relying on ‘future forecasts’ increases the risk of error, exponentially (for me).

I do believe they can move the business in a better direction, I just have no idea what the financials of that will look like in 5 years.

It reminds me of a similar situation I found here.

This is the biggest investment risk with Euromedis, in my opinion.

The Investment Case

Despite all the uncertainty, there are some interesting arguments in favour of Euromedis thriving in the coming years.

First of all, they have a lot of cash, relative to their liabilities. The stock is a net-net, and has a lot of liquid assets on hand.

This is always a good sign.

They also seem to be utilising that as a springboard to a much-needed refocus and change in direction.

Despite 2024’s nightmare, the operating business was actually profitable. It swung from a -€5m loss in 2023 to a €0.5m gain in 2024.

What’s more impressive is that the gross margins remained at 26%, despite the fact that freight rates doubled last year.

This demonstrates the ability to manage costs with discipline and competence, imo.

To compound this momentum, the management team are working hard to restructure their logistics operations to further protect against similar shocks.

If sales can grow during a year when they were forced to tighten prices, and external factors squeezed costs higher, then it bodes well for less difficult years.

Perhaps the biggest positive, is that the management team have explicitly stated they are focused on reducing the reliance on public tendered contracts.

They aim to export more products and broaden their product range beyond the price sensitive, public institutions.

This is an opportunity to generate long-term contracts with higher margins and more stable relationships.

If they can restructure their business model successfully, in this way, I think this could radically alter the market’s perception of the stock.

If this coincides with all the other uncertainties slowly fading into the background, the re-rating could be huge.

To me, this business looks like it has a solid (but flawed) business model that is capable of generating profits, even during difficult times.

I believe that the management team and major shareholders have a strong incentive to point the business in a new direction, while maintaining their core competency.

Any rational owner would be working hard to reduce the pricing pressures and allow for even mild expansion.

With a few tweaks to the business model and customer mix, this could provide an opportunity to generate a significant return over the next 1-3 years.

Crucially, I believe this business will continue on for the foreseeable future, which affords the management team plenty of time to figure out the transition.

Aside, from all this, I believe that Euromedis, at this price, is a perfect bolt-on acquisition target for a competitor.

It’s established, it has a clear niche, and it’s cheap.

Any kind of reasonable offer could also generate a significant rerating from todays levels.

Improving the operating business or attracting a buyout are the two most likely catalysts in my opinion.

And neither of these options requires anything particularly magical to occur.

Mr Deep-Value also offers:

A 90% discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients