Lessons From a French Cigar-Butt

An insight into the fine line between value-trap and cigar-butt opportunity.

Get a 90% discount off Bloomberg’s No.1 competitor. Get a 30-day free trial here

Today’s stock looks tasty:

NCAV Ratio = 1.1

TBV Ratio = 0.43

EV/5Y FCF Ratio = 0.6

P/5Y FCF Ratio = 5.7

There is 132% upside to liquidation value alone and FCF has been positive in 17 of the last 20 years, and all of the last 5 years.

However, as I dug into it, all was not what it first seemed.

Firstly, the business seemed to be a closely controlled, family empire, rather than a bog-standard listed business.

This can be either positive or negative, depending on the specific situation.

Walter Schloss always said that closely controlled stock wasn’t really an issue because it meant that management was invested into the success of the business.

Sooner or later, they’d do something accretive, even if it was just to improve their own situation.

This assumes that there is something to ‘do’ in the first place.

For example, if the share price has tanked or the business requires a turnaround etc…

In this particular case, none of those things are true.

The stock price hasn’t really moved and the business is just trundling along.

As I dug deeper, I kept switching between feelings of ‘value trap’ and Cigar-butt style ‘opportunity’.

The goal of this article is to share what I found, so you can make your own mind up.

If nothing else, this particular stock is riddled with things that should make any deep-value investor think twice, and is a great ‘learning’ experience.

Let’s take a closer look…

The Business

Compagnie de l’Odet (ODET) is essentially the main holding company of the Bollore family.

Their story is like something out of a Netflix series.

The business was originally started by two brothers in 1822, as a paper mill, based on the river Odet.

This little craft business eventually grew to become a global empire.

At its peak, it included media, energy, logistics, and industrial businesses, all bolted together as a gigantic conglomerate.

The main guy is Vincent Bollard, and he is the father of Sebatstien, Yannick, Cyrille and Marie.

He remains the major shareholder, chairman and CEO.

Sebastien is the deputy CEO and director, Cyrille is vice chairman and director, while Yannick, Marie and Cedric (Vincent’s nephew), are all listed as directors.

Today the business can be broken down into the following components:

Bollore Energy:

This essentially distributes fuel and operates strategic storage across France, Switzerland and Germany.

According to the latest interim report, this division generated €1,337m in revenue during H1 2025.

The ‘Industrials’:

This includes a smorgasbord of businesses, that includes things like films and coatings, automatic systems (biometric terminals etc), and even a bus manufacturer.

H1 2025 revenue from all this came in at €156m.

Media:

The media empire includes part-ownership of several world-famous brands, including Canal+, Havas, LHG and Universal Music Group.

These holdings were recently spun out into their own listed businesses, which means revenue from these now soaks into Compagnie l’Odet via dividends.

In H1 2025, the dividend revenue from all this came in at €210m.

In 2023, they sold the logistics empire for around €5b. This gave the balance sheet a really nice cash injection, which is why they now trade so far below TBV.

Today, their revenues primarily come from the energy and industrial divisions, with their listed-media businesses chipping in with some nice dividends.

They mostly operate in France, although they are technically ‘global’.

Why It’s Cheap

The stock price has never really suffered the sort of catastrophic declines I spend my days sifting through.

Instead, it kind of grinds higher, over time, while not doing much in the short term.

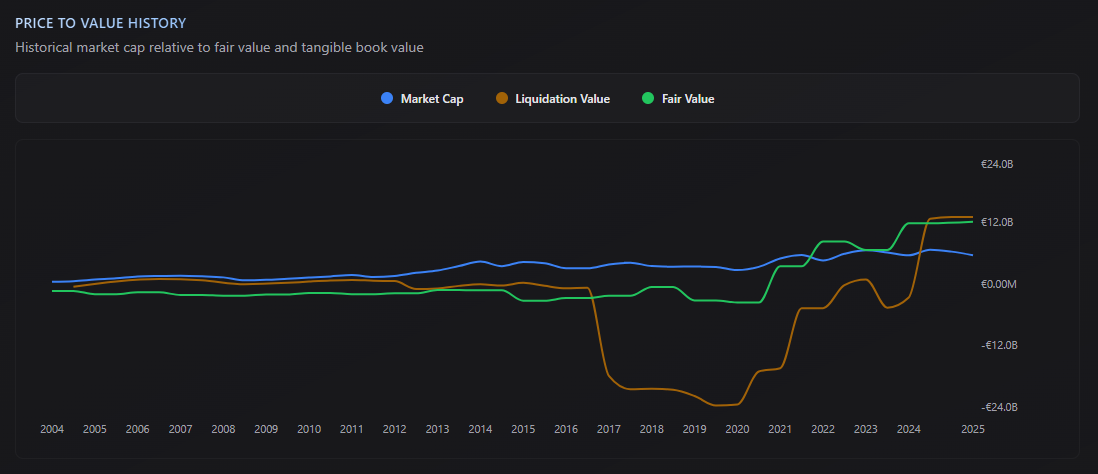

What caught my eye was the fact that the market has generally (over the last 20 years) priced the business above liquidation value and fair value.

It’s only since the recent restructuring that the market cap seems to have dipped below both of these values.

This could potentially be an opportunity to hold the stock, while the market slowly rerates it back towards its long term average.

From what I can tell, there are a couple of main reasons for this ‘grinding’ price action and short term ‘cheapness’.

Firstly, the free float is basically non-existent. Only 8% remains available for the public to purchase on the open market.

In other words, the family will always retain full control, which deters external investors.

Secondly, management are actively trying to improve the business. The recent sales and spin-offs support that notion.

The recent elimination of debts, at least points to a management that cares about the business being sustainable and even expanding.

It gives me the impression that they are just content to slowly expand their business over the years, despite having little interest in external shareholders or the ‘stock price’.

Another thing…

The family continue to, regularly, buy large chunks of stock, on the open market, above today’s price (between €1,450 - €1,500).

This is a sign that they believe that recent stock prices have enough room for long term appreciation.

The company themselves also conduct buybacks, even though they are pretty tiny.

But all of this buying does indicate that the family is confident of the future value of the business increasing from here.

You can probably see why I’m torn on whether or not this stock is a value trap or a decent little cigar-butt with a couple of puffs left in it.

The Risks

My biggest concern, aside from lack of free-float, is that future FCF is so much more difficult to figure out from here.

With all the spin-offs and sales, it’s not clear how much the business will make going forward.

Obviously, recent FCF is less reliable in this scenario.

At those levels, the business is trading far below what its worth, at a P/5Y FCF ratio of just 5.6.

I decided to fetch my big-buttoned calculator and a napkin, and perform some quick-maths.

I estimate that, after all said and done, the annual profit for the new-look business should be somewhere around €400m.

Obviously, we really need a few more full year reports to be sure.

But if that figure is even remotely close, it implies an EV/FCF figure of 1.5, and a P/FCF figure of around 14.

This makes it ‘kind of cheap’ rather than (my favourite) ‘dirt cheap’.

Aside from future earnings uncertainty, there are a few more things to be aware of.

First, they hold a big chunk of their liquid assets in listed stocks. If the stock market collapsed or prices declined for any reason, this would reduce their own value.

They also have debt (a tenth of their liquid holdings), so any devastating loss of cash or liquidity would leave them exposed.

Although, as mentioned, they have been focused on reducing their debts, significantly.

Rising interest rates would also have an impact, although given their cash balance, that would probably be a benefit more than a risk.

Beyond these things, there is the general risk of something unexpectedly bad happening in an unpredictable manner.

Basically the same risks all other large businesses face.

For me, the earnings clarity is one of the biggest turn offs at this stage.

The Investment Case

Any investment here would purely be a bet on a return to liquidation value, which has around 130% upside from today’s price.

The historical market pricing (above liquidation and fair values) gives me confidence that the price will return to those ratios in the future.

The fact it’s a family controlled business gives me confidence that they will continue grinding away as they always have, making money and buying up shares.

It’s also very likely that the business holds assets that are worth materially more than the balance sheet suggests.

For example, the recent annual report mentions the fact that the group owns depots, storage sites, farms, vineyards and several other freehold buildings and developments.

These are all recorded at historical cost, rather than today’s market value.

I didn’t dig into this too deeply, but I believe there is certainly a lot more value in the tangible assets than the balance sheet shares.

This alone is a worthy investment thesis (if proven with more detailed research).

I believe that at today’s price, it’d be difficult to lose money on this stock.

However, I also believe that growth and share-price appreciation may take some time (years) to play out.

After hours of research, this stock looks like both a value trap and a cigar-butt opportunity, depending on the angle you look at it from.

I haven’t invested, and probably won’t, simply because I have many better opportunities that I expect will rerate 50-100% over the next 2-3 years.

I definitely don’t expect Compagnie de l’Odet to reprice that much in the same time period.

Despite all this, it was a very interesting stock to look into and I believe someone in my audience may find it attractive.

Get a 90% discount off Bloomberg’s No.1 competitor. Get a 30-day free trial here