Bras, Bullets, and Sanctions: The Tale of an EU Net-Net

This stock trades at 60% of tangible asset value and with a 5y FCF ratio of just 4.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Today’s business is almost certainly mispriced, but there’s a catch.

Before we get into it, let’s take a look at the stats:

NCAV Ratio = 0.7

TBV Ratio = 0.6

E/5y FCF Ratio = 1

P/5y FCF Ratio = 4

The business has generated positive free-cash-flow 85% of the time during the last 20 years, and the 20y average annual shareholder yield (at today’s price) is 14.5%.

By my own conservative estimation of fair value, there is at least 150% upside, before the business can be considered priced fairly.

(I share my FV calculation method here)

This is one of those rare little unicorns that has a solid margin of safety in its mostly-cash asset values, while also being a cheap-to-earnings cash machine.

This is a very healthy business that’s extremely cheap.

To find out why, and figure out the catch, we need to visit a war zone, and stare at pictures of beautiful women dressed in lingerie.

Deep-value investing isn’t boring.

Let’s take a look…

The Business: Silvano Fashion Group (SFG)

Silvano Fashion Group designs, manufacturers, and sells lingerie under established brand names.

They operate both retail stores and operate their own wholesale network alongside it. They also own their physical production facilities.

They operate a franchise model and sell their products to both distributors and franchise partners, for revenues of around €35.5m in 2024.

They also operate their own retail stores, which sells their products directly. This generated an additional €22.5m in 2024.

In all, the company generated around €58m in 2024, almost entirely from selling lingerie to customers across its core channels.

And now, for the catch.

The business operates in several markets, but two of them dominate with 86% of sales.

Russia and Belarus.

I know what you’re thinking:

Since the war in Ukraine, most businesses have terminated their operations in Russia. This business is likely in terminal decline.

Not quite.

The annual report notes that Russian revenues decreased slightly in the last financial year (-2.1%), however, this is due to currency fluctuations rather than demand.

In real terms, ignoring the impact of currency conversion (RUB to EUR), sales in Russia actually grew by 6.3% YoY.

The impact of the war that saw foreign brands leave, has been to open up new customers to Silvano, and allow a very modest expansion.

It’s also worth noting that the business has not suffered as a result of sanctions. For some reason, the EU decided that lingerie didn’t need to be sanctioned.

They have needed to adjust supply chains, especially around Belarus, but overall, everything is chugging along nicely.

While generating cash doesn’t seem to be a problem, moving it certainly is.

Since 2022, moving cash from out of Russia and Belarus is heavily restricted. The cash is tied up in the subsidiaries.

For the time being, dividends are on hold, however the management team have indicated that they will return as soon as the situation normalises.

In the meantime, the cash continues to stack up on the balance sheet.

There’s more…

The market value of the land and buildings is significantly higher than the recorded book value.

For example, the book value of these was recorded at €1.224m, while the original acquisition cost was €3.183m.

In the magical world of accounting principles, the building has lost value through ‘depreciation’.

In the real-world, where we all live, those buildings are worth at least €3.183m, and most likely much more today.

The business also owns what it describes as an ‘investment property’ in Minsk, which also serves as a warehouse and production premises for their operations.

This building is valued at market rates. The latest valuation puts it at €2.244m (versus a book value of €837k).

Therefore, the total value of their buildings alone is (conservatively) estimated to be almost €5.5m.

Combine this with the €37.5m in net-cash and liquid assets (after debt), and you have a total asset value of €43m, which is pretty much the current market cap.

So, you pay for the buildings and liquid assets and get everything else (inventory, receivables and all future cash flows) for free.

My favourite way to buy a business.

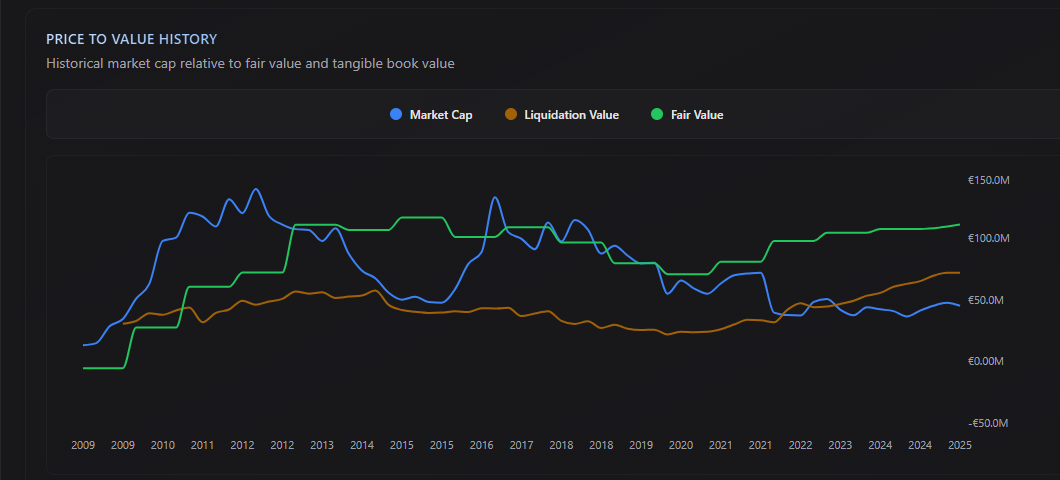

The Sell-Off

Prior to the war in Ukraine, the stock price regularly fluctuated in and around the fair value of the fair value of the business.

This is something I like to see, as it gives me confidence that I’ll see a nice profit, if I’ve bought cheap enough and the business remains alive.

At the end of 2021 (just before the invasion) the stock price was almost €10 per share.

Today, it’s around €5.34.

Most of this, of course, was driven by the uncertainty of the situation in Ukraine and with Russia's relationship with the west.

None of this reflects what’s actually happening with the underlying business, which presents an asymmetric opportunity to make a profit.

The problem is that you cannot purchase stock, with the sanctions in place. This is the main reason I’m not holding it in my portfolio.

However, it’s on my watchlist and I’m waiting eagerly for an opportunity to buy it, when the situation improves.

The Investment Case

Silvano is a mediocre business with strong brand recognition and a loyal customer base in multiple countries.

Revenues are probably not going anywhere fast, but earnings are fairly consistent.

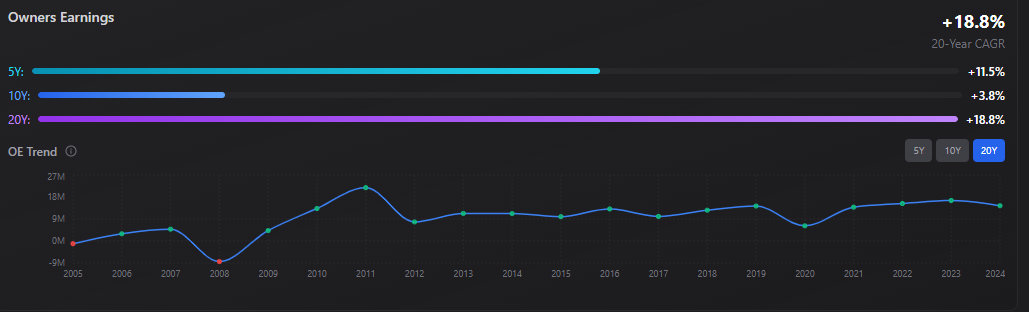

The ‘owners earnings’ have been basically flat for 20 years…

However, the business is stable. Even during a war between its key markets.

It’s cash positive and has a history of returning capital to shareholders. And, crucially, it’s dirt cheap.

If you purchased this business, at today’s price (EV), you’d make your money back in a year.

No rational owner of a cash-flowing business would ever sell it to you for such a ridiculous valuation.

Trust me, I negotiated with plenty of them over the years. It doesn’t happen.

Therefore, this is a mispricing that, more than likely, will lead to a rerating of the stock (eventually), which will yield a healthy profit.

The Risks

The only obvious risks are political. The risk of the war escalating, and the risk of the sanctions increasing.

The other ‘risk’ here is that the stock price immediately shoots back up towards €10, as soon as sanctions and trading restrictions are lifted.

This is a risk of opportunity cost, rather than actual losses.

And, of course, there are the general risks inherent in every mediocre business.

All of this creates the potential for an infamous value trap or melting ice cube that every individual investor seems to fear.

I personally, don’t believe there is too much risk in this situation.

The business will likely carry on generating cash. The political situation will fade away at some point in time. The management team will likely return some cash eventually.

My money would be on either a special dividend or a competitor buyout being a key driver behind any future rerating.

For this reason, I’ll watch the situation closely and will take a fresh look when sanctions are lifted and the stock can be purchased, as normal.

A note from Mr Deep-Value

Silvano Fashion Group, perfectly summarises exactly what I look for in a deep-value situation.

A very healthy business, full of cash, churning out more cash with each passing year, priced as if it will surely die tomorrow.

The cash and cash-flow make it almost certain that it won’t die and that I’ll generate a healthy profit when the stock rerates.

The net-net pricing provides an incredible margin of safety.

Of course, the sanctions make it impossible to purchase, and maybe that’s the only reason the stock price is so low.

The only way to know for sure is to wait and see.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients