A US Stock Trading At 4x FCF With 115% Upside

The business is priced like earnings will die when it's been FCF positive in 9 of the past 10 years.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Today’s stock reminds me of something similar I own here.

The market currently values the entire business at about $85.3M, with an enterprise value of roughly $25.0M.

This for a business that generated $120.8M of product sales in 2024 and positive operating cash flow of $26.4M.

Cheap to earnings, not to assets: that’s the setup here.

This is on my watchlist, simply because I cap the number of stocks with this kind of profile, and I have enough better ideas for now.

But I do like it, so I’m sharing the write up freely, for anyone interested.

Here are the ratios:

EV/5Y FCF ratio = 1.34

P/5Y FCF ratio = 4.56

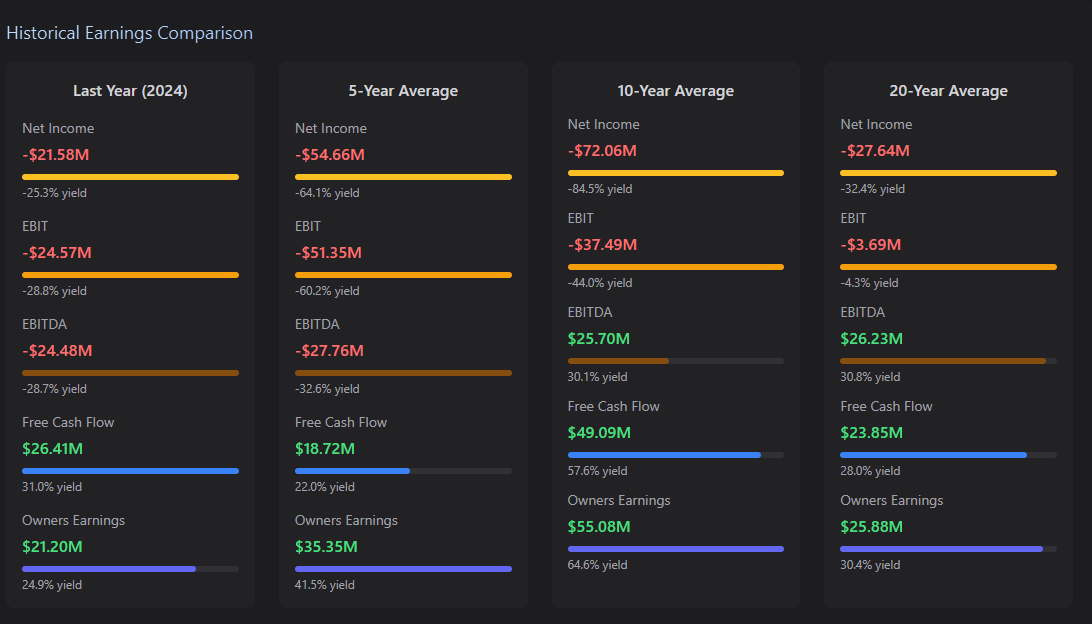

And here are those earnings figures over the last 20 years:

Despite obvious GAAP issues, the business sure does know how to generate cash for its owners.

It’s trading at the sort of multiple where a private owner expects their money back briskly, and that would never exist outside of the stock market.

The hook (for me) is simple:

A collection of cash-generative brands, put on sale after the predictable hammer blow of generic competition and a hefty 2023 impairment.

Management has kept the lights on with cash generation, cut legal knots, and right-sized the portfolio.

The price implies a near-term death of the business. The filings show a more investable picture.

About the Company

Assertio Holdings (ASRT) sells a handful of specialty pharmaceuticals across oncology, neurology, and pain.

The portfolio today centres on Rolvedon, a long-acting G-CSF for reducing febrile neutropenia in certain adult cancer patients.

Sympazan, INDOCIN, Otrexup, SPRIX, and CAMBIA round off the portfolio.

Assertio markets Rolvedon with a field team and supports the rest through an omni-channel model.

Revenues are predominantly from the U.S. and flow through the big three wholesalers.

The last five years were built through deals:

2020: Merger with Zyla Life Sciences added INDOCIN and SPRIX.

2021: Acquisition of Otrexup from Antares.

2022: Exclusive Sympazan license from Aquestive; 6.5% 2027 convertible notes issued.

2023: Spectrum Pharmaceuticals merger brought in Rolvedon and CVRs tied to Rolvedon sales milestones.

2025 (interim): Divested Assertio-Therapeutics as part of a streamlining push; Rolvedon unit demand hit a high, Sympazan grew, INDOCIN fell (as expected) with generic competition.

Rolvedon is now the leading contributor (2024 net sales $60.1M), with INDOCIN sliding under generic pressure ($26.8M in 2024) and Sympazan growing modestly ($10.5M in 2024).

The company uses single-source manufacturers and has had to manage quality write-downs on batches that didn’t meet spec.

This is one reason cost of sales bumped in 2024.

Despite selling through wholesalers, Assertio promotes directly to providers to stimulate extra demand.

This is a ‘buy, integrate, and milk’ model.

They acquire approved products with remaining exclusivity or angles, run them through an efficient commercial platform, and redeploy cash into new products.

The emphasis today is oncology and neurology, with field sales for Rolvedon and digital for the rest.

The Deep-Value Opportunity

Tangible Book Value Ratio = 2.73 and NCAV Ratio = 2.87.

Trading above tangible book means there’s no liquidation-value cushion here. This is not an asset-based cigar butt.

Meanwhile, it does fit very nicely into the ‘cheap to earnings’ territory.

At these multiples, a private owner with steady FCF wouldn’t need heroic assumptions to get paid back pretty quickly.

The bet here is that the income streams will continue as they have, rather than withering away into terminal decline.

The consistency of FCF is also important to this bet, and over the last 10 years, FCF has been positive 9 out of the 10 years.

My model indicates +115.6% upside to fair value.

I explained how I conservatively estimate fair value at the start of this article.

It’s not perfect, but it strongly suggests that Assertio is currently being sold too cheaply, in relation to its intrinsic value.

2024 cash from operations was $26.4M despite INDOCIN’s generic shock and inventory write-downs.

In the first half of 2025, cash and investments rose to $98.2M after a portfolio prune.

This is why EV is only $25M.

The five-year story is also quite interesting:

2020–2022: assemble a pain/neurology basket, shift to an omni-channel model, then add Sympazan; INDOCIN is unfenced, and management flags generic risk and 503B compounding threats early and often.

2022: term out capital with 6.5% converts due 2027; later exchange $30M of converts in 2023.

2023: acquire Spectrum and Rolvedon; book a huge impairment and chew legal/litigation costs; but Rolvedon gives Assertio a growth leg outside pain.

2024: Rolvedon first full year, $60.1M net sales; INDOCIN down with generics; still positive cash from ops, >$100M liquidity.

2025: streamline via divestiture of Assertio Therapeutics; Rolvedon demand hits a high; Sympazan grows with more in-person support; INDOCIN declines ‘as expected.’

This is not a terminal decline narrative imo; it’s a portfolio rotation where one asset is being replaced by another asset.

Cash discipline seems to be succeeding in bridging the gap.

A private buyer (I believe) would value the cash conversion and the ability to redeploy into another on-market specialty product.

The Stock Price

At the time of writing, the stock price was $0.89. This is down from the 5 year highs of around $7.66.

The stock currently sits 30% below the high from the last 12 months.

In short, the market has punished the stock for a few reasons:

First, INDOCIN genericization (FDA approvals in 2023–2024) has hammered sales and caused a rethink of revenue streams.

Cheaper, generic competitors have arrived.

Second, the 2023 impairment and legal noise around antitrust, opioid legacy, and shareholder litigation post-Spectrum.

Settlements in principle are noted for antitrust in late 2024, but the drag, uncertainty, and costs were real.

Finally, Assertio suffered from inventory quality issues at third-party manufacturers in 2024, driving write-downs and fuelling the market’s scepticism about margin durability.

Investors interpret all this as terminal decline but the tiny EV and the fact that the cash engine is still humming along, indicate otherwise (to me).

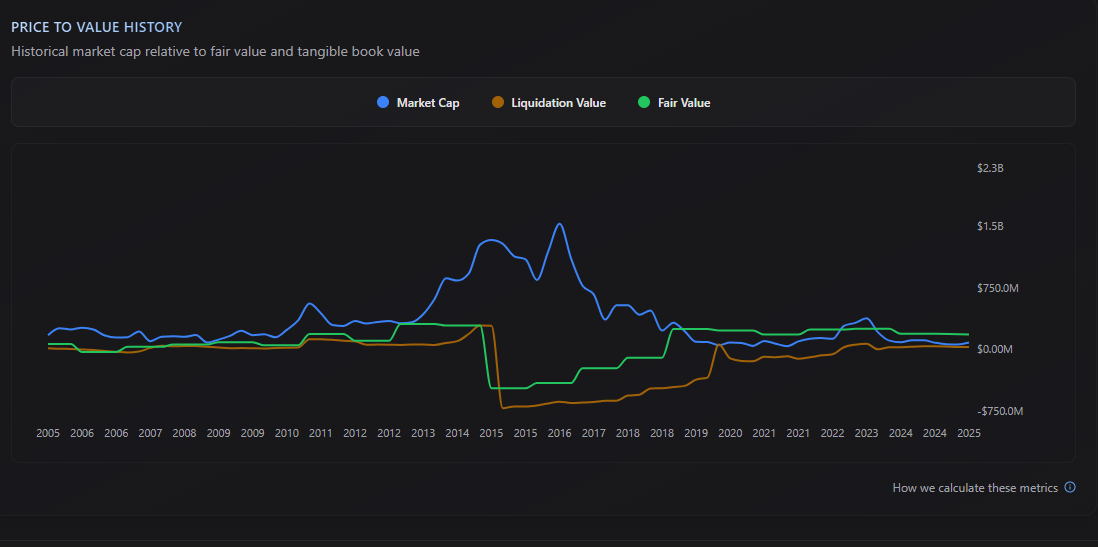

The market has also, historically, rated the stock far higher than both liquidation and ‘fair’ value (as I calculate it).

This is a clear sign that the price has potential to rebound strongly, once the uncertainty clears.

The Risks

As always, I want to know what will kill me so I can try to avoid it.

This is cheap to earnings, not to assets.

TBV Ratio 2.73 and NCAV Ratio 2.87 mean there’s no liquidation-value backstop. If the earnings power erodes, there’s little asset protection.

This isn’t a bet on whether the business will liquidate, it’s a bet on whether the earnings can continue trundling along as they have for the past 20 years.

These types of bets are always a little more risky, which is why I cap the number of ‘earnings’ bets in the portfolio.

I currently have one such bet running here.

In this case, here are the main risks as I see them:

Rolvedon execution risk

Oncology is competitive. There are other long-acting G-CSFs and biosimilars; Assertio needs continued share gains and/or niche positioning to offset price pressure.

If Rolvedon underperforms, the ‘growth leg’ under the stool weakens.

INDOCIN erosion

Generics launched; another generic for suppositories was noted in early 2025. Expect continued volume/price compression.

This is playing out already (and was planned for by management).

Supply chain and quality

Assertio relies on single-source manufacturers for each product. 2024 saw batches failing quality standards and inventory write-downs.

Further issues would hit gross margin and working capital.

Litigation and legacy matters

The company is entangled in suits tied to Spectrum, antitrust, opioid-related investigations, and more; settlements in principle were reached in 2H 2024 for antitrust and a qui tam, but legal costs and residual claims remain an overhang.

Customer concentration

Three wholesalers account for the majority of revenue; shifts in their purchasing patterns can whipsaw reported sales.

Debt and covenants

$40M of 6.5% converts due 2027; covenants govern mergers, divestitures, liens, etc.

With EV so low because of cash, the absolute debt isn’t crippling, but it’s worth factoring in, if FCF tightens.

No hidden hard assets

Assertio leases space, owns no manufacturing, and carries minimal PPE. There’s no real-estate arbitrage here.

Intangibles dominate.

Terminal decline from here would likely require a combination of Rolvedon failure, Sympazan stall, and continued quality or legal cash drains.

The filings don’t describe a terminal decline plan imo; they describe product acquisition as the core strategy, positive operating cash flow in 2023–2024, and ample cash to execute.

The going-concern evaluation at year-end 2024 explicitly found no substantial doubt about the next 12 months of operation.

That doesn’t guarantee success, but it argues against imminent failure.

Management’s plan is to push Rolvedon, via an active field force.

They also aim to keep Sympazan growing with more targeted, in-person support, and prune or streamline legacy assets and drive cost savings.

2025’s divestiture of Assertio Therapeutics is consistent with that tune-up.

In my humble opinion, with an average 5-year FCF around $18.7M and 5-year owner’s earnings around $35.4M, a control buyer paying $85M for the equity and assuming an EV of $25M is, in effect, buying near cash value and getting a live P&L for a very low multiple.

The payback period on EV via FCF is short if FCF remains anywhere close to the 20-year average, which is $24m in itself.

The Investment Case

Deep-value rerating’s usually need a catalyst.

The good news is that when things are priced ‘deep-value’ style, the catalysts start to show up more reliably.

Assertio’s current state suggests four standard pathways to a catalyst:

Operating clarity

The fastest path is a couple of clean quarters that show: Rolvedon growth holding up, Sympazan stacking prescriptions, INDOCIN stabilizing at a low base, and no new quality write-downs.

This reduces perceived fragility and raises the multiple on FCF. The interim update points the right direction.

Strategic action

Assertio has a repeatable playbook of acquiring on-market assets with remaining life.

With cash and investments pushing toward $100M mid-2025, a bite-sized product acquisition in oncology/neurology that is accretive to FCF would change the narrative quickly.

The company explicitly describes this as a core competency.

Capital return or structure

With so much cash on hand, any return to stable profits could lead to buybacks or special dividends.

A buyout or delisting

At this price, Assertio could be a very attractive ‘portfolio business’ to a larger industry player. They have proven their competence and model over decades.

Today’s price makes that decision almost a no-brainer to any cash-rich competitors.

To me, this looks like an asymmetric bet on earnings durability.

If Rolvedon and Sympazan anchor a steady FCF stream, the current EV makes little sense.

The history of the business makes this a low risk bet, especially if it remains a small part of the portfolio.

Conclusion

The market is still staring at INDOCIN’s generic cliff, 2023’s impairment, and 2024’s quality-driven inventory noise.

It sees litigation footnotes and assumes more of the same, when in reality that might not be the case.

The legacy pain decline is structural, but known and largely reflected in the price.

The new revenue-engine, Rolvedon, had a full year at $60.1M sales in 2024 and achieved record unit demand in 2Q25 while Sympazan grew with targeted in-person promotion.

Operating cash generation remained positive through the turbulence, and the company ended 2024 with >$100M in cash and investments and around $98M by mid-2025 post-divestiture.

That buys time to compound Rolvedon and add another asset, and, well, do what they have been doing for decades.

If FCF persists anywhere near the 5-year or even the 20-year average, the EV is far too low and a rerating is plausible through any of the mentioned catalysts.

If Rolvedon underperforms and quality hiccups repeat, the multiple may be ‘right for the wrong reasons.’

That’s the bet.

At sub-5x price to 5-year FCF, and barely over 1x EV to 5-year FCF, you’re almost paid to make it.

Note from Mr Deep-Value

This stock has the type of profile that I look for in a deep-value stock.

It’s currently on my watchlist, because it isn’t better than what I currently hold within my concentrated portfolio.

You can view the stocks I own here.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients