0.6x TBV With Consistently Positive-FCF

The operating business is priced at zero while being a proven cash-flow generator over decades.

Mr Deep-Value also offers:

A 90% discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Today’s stock is a classic, Walter Schloss style, cigar-butt.

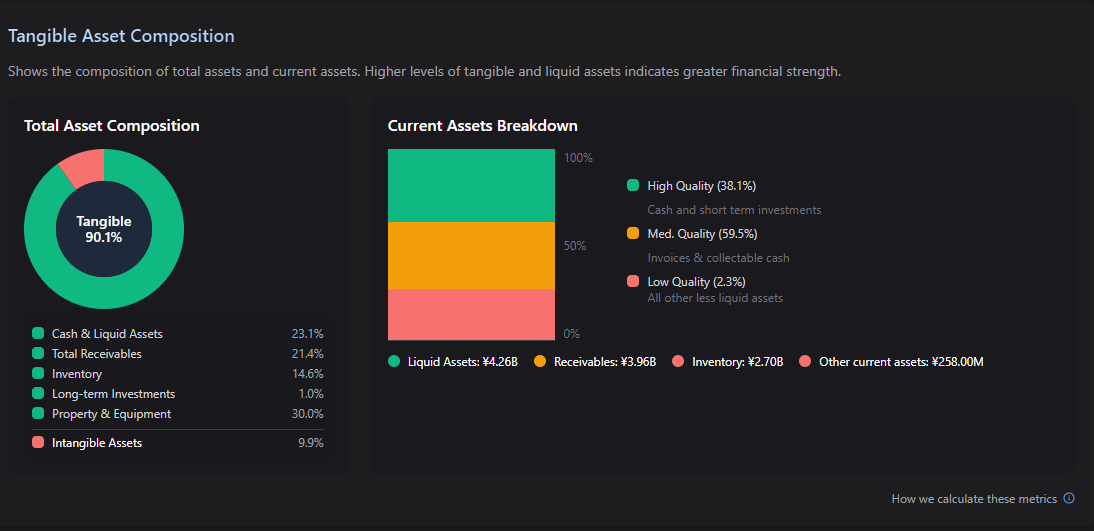

It’s cheap compared to its assets, and those assets are almost 90% tangible.

In fact, their composition is as follows:

Cash and liquid assets = 23%

Receivables = 21%

Inventory = 15%

Property and Equipment = 30%

The current market cap prices the business at just 60% of the TBV, which means there is over 50% upside to liquidation value alone.

Earnings are not bad, at all.

EV/5Y FCF Ratio = 9

P/5Y FCF Ratio = 8

At today’s price these earnings are valued at nothing, despite the fact that FCF has been positive 94% of the time over the last 18 years.

From my perspective, this stock is all about downside protection, above all else.

The curious thing about focusing on the downside is that it becomes much more likely to actually generate consistent profits.

When a stock price sits far below the value of assets, pricing the operating business at zero, there is always upside lurking in the shadows.

This seems counterintuitive to the fact that stock prices are moved by earnings, which, of course is true.

However, the fact remains, that deep-value stocks, with very limited downside risk, consistently generate solid profits, over time.

You just need a little patience.

And a framework you can follow consistently. The framework isn’t as important as the consistent application of it, imo.

To help with this I share my personal framework here, and also offer some alternative frameworks here, here and here.

Before we begin, it’s important to note that I haven’t bought this particular stock yet.

It’s just on my watchlist for now.

This is because my portfolio is full, and it’s not better than what I already have.

But I decided to write it up to illustrate the ‘asset-based’ component of any self-respecting deep-value portfolio.

Let’s take a look…

The Business

Toyo Shutter Co., Ltd. (5936.T) designs, manufactures, sells and installs shutters, steel doors and related hardware across Japan.

The group reports a single segment and includes one consolidated subsidiary in Kyushu, that performs outsourced processing for the parent.

It’s straightforward, capacity-backed manufacturing tied tightly to installation and after-sales service.

The customer base is Japan’s construction economy.

This includes large commercial facilities, office buildings and logistics sites, where most products are made to order and fitted on site.

In FY2025, sales by line were as follows:

Light shutters ¥2.65bn

Heavy shutters ¥5.81bn

Steel doors ¥4.12bn

Repair/inspection ¥5.12bn,

Other ¥3.18bn

All for a total revenue of ¥20.87bn.

The prior year (FY2024) shows a similar mix at ¥21.49bn revenue. Domestic sales (Japan) exceed 90%.

A few waypoints from the company’s own timeline help set the scene:

In April 2022, Toyo migrated from TSE 1st Section to the Standard Market.

In May 2022, it launched the “TOYO REBORN 3” mid-term plan and introduced the TS Bench-Tight fire- and sound-insulating ventilating door.

In May 2024, it published “Responses for Achieving Management Conscious of Capital Cost and Share Price.”

In May 2025, it rolled out a five-year plan, “TOYO ADVANCE 5.”

The business is consistently focused on improving the model and also getting more cash to shareholders.

The latest interim (Q1 FY2026, three months to 30 June 2025) adds some colour to this:

Under a refreshed product categorisation, quarterly sales grew +2.4% year on year to ¥4.60bn; shutters were 52.6%, steel doors 20.1%, repair/inspection 24.4%.

This is a steady, recurring service component, alongside made-to-order manufacture.

The purpose of sharing this isn’t to suggest this as a ‘growth’ story, but rather to illustrate the robustness of the business as a going concern.

In my view, the operating business of Toyo Shutter has a value of more than ¥0.

Why it’s cheap

The short version here is that investors see a cyclical, construction-linked metal-bender in Japan and slap on a low multiple.

Add a long, slow antitrust overhang that only ended in February 2025, and you get a label the market hasn’t bothered to peel off yet.

However, profitability seems to be normalising before sentiment.

This isn’t unusual in Japanese cigar butts, because, well, no one is paying much attention.

This is also what makes them a pretty good hunting ground for cheap stocks that offer downside protection alongside upside potential.

FY2024 revenue reached ¥21.49bn with a cleaner cost base.

FY2025 held at ¥20.87bn through a softer order environment and a working-capital headwind.

TTM revenue (at the time of writing) is ¥20.98bn.

Product-level disclosure and the steady contribution from repairs/inspection demonstrate a nice steady business model.

Capital policy is also firmly on the agenda.

This can be unusual for Japanese cigar butts, because many of them ignore shareholders and simply hoard cash.

In May 2025, the board resolved an annual dividend of ¥38 per share for FY2025 and set a five-year target pay-out ratio of 40%, up from the plan that started in FY2024.

The direction of travel is clear: keep funding capex and R&D, but return more cash to owners.

This is one reason I like the stock.

The legal case

The company was charged with issues relating to price fixing and other monopolistic practices in specific locations.

They paid their fine, and then appealed the original charges.

This dragged on for over 5 years until in early 2025, the final appeal case rejected all appeals and upheld the original judgements.

This has no material impact on the business, because all financial penalties were realised many years ago.

The whole thing reads like a pointless, ego-driven exercise to me, but then again, I don’t have all the details of the situation.

I just know, from the last annual report, that the issue is now over and the company is moving on.

From here, the remaining work is cultural and procedural, involving compliance systems that the reports say are now routine.

In other words, the headline that kept people away poses no risk to future cash flows.

The story (now) is basic execution and, at this price, whether or not the business ceases to exist.

In my humble opinion, a single-segment operator with national coverage, recurring service revenue, three regional manufacturing footprints, and explicit attention to capital costs should not trade like a liquidation event if orders and input costs are managed sensibly.

And the reports describe exactly that kind of management.

The Risks

I always try to read risks like an owner:

What could kill cash, compromise going-concern, or turn the investment into a wipe-out?

The latest annual report and interim spell out both generic and business-specific risks; the mitigations are routine but credible.

General risks

Macro and private capex. Orders track investment into malls, offices, logistics. Weak capital formation cuts volumes; project delays defer cash. The company’s mitigation is to keep strong relationships with major customers and expand the base to smooth cycles.

Input costs: steel and energy. Steel drives the cost of goods. The company runs multiple-supplier dialogues to secure material and limit price shocks from becoming permanent margin leaks.

Natural disasters and accidents. If an earthquake or broader event knocks out a site, production and installation suffer. The network of nation-wide sales offices and three manufacturing regions provides redundancy to cover affected areas.

Legal and regulatory change. Building and installation are governed by codes. Breaches or rapid code changes can create cost and delay. The filings present compliance as routine doctrine now; which I’d expect after the long, exhausting, legal saga.

All of these risks are the kind of stuff that every business faces.

Any of them can happen, and management has little control beyond preparing to deal with them if they arise.

As a private business owner, these type of general risks are just par for the course.

Business-specific risks

Component concentration. Some shutter components come from specific external suppliers. A disruption compromises deliveries and can lose orders. Mitigation is maintaining appropriate inventories and regular supplier check-ins.

Product concentration. The core business is shutters and steel doors. A structural shift in design standards or a superior substitute would hurt. The answer is incremental product development and keeping the catalogue updated.

Credit exposure to large customers. With many big general contractors, a sudden failure could sting. The company emphasises upfront credit checks and tight receivables monitoring via internal audit.

Impairment risk. A sharp drop in cash-flow outlook or asset values can force write-downs. Management runs profit control at the asset-group level and drives cost improvement to protect long-run cash.

Financial covenants. A portion of long-term borrowings (¥2.0bn) carries covenants: keep consolidated net assets at ≥75% of FY2024’s level and avoid two consecutive years of ordinary loss starting with the FY2026 check. This is a real constraint in a hard downturn (historical FCF demonstrates that the business is capable of this tho).

In the latest report, there are a couple of updated risks, added, that are worth a look:

Leases are larger. Lease liabilities total about ¥1.30bn at FY2025, and the company now highlights them in the financial instruments note. If you include leases in net debt, then the enterprise value increases; if you don’t, the equity cushion looks higher. Either way, they’re contractual claims on cash, and worth noting imo.

Secured borrowing over core real estate. There are mortgages over land and buildings securing ¥2.0bn of loans. That reduces flexibility and, in a break-up, complicates asset realisations slightly.

Despite all these, this isn’t an existentially fragile business, in my opinion.

It is cyclical, input-cost sensitive, and exposed to single-supplier choke points and covenants, but it also carries tangible assets and generates cash flow, consistently.

It’s probably worth noting that the business has been operational and cash-flowing since 1955.

Investment Case

I view this like a private buyer.

What am I actually getting for my money? And where is the downside protection?

One way I judge this is how management has spoken, and then acted over recent years.

The last two years show measured pricing/mix discipline and cost control through the softer period.

The product-line granularity and steady service revenue (repairs/inspection) point to durable cash, not just project lumpiness.

The FY2025 dividend ¥38 is part of a plan to move the pay-out ratio to 40% in five years, while still funding capex and R&D.

That’s the right tone for a cash-generative business of this size, and still a bit of a novelty in Japanese cigar butts.

The 26 February 2025 Supreme Court decision finalised the old JFTC orders.

Management’s statement that no material impact on results or financial condition, is important (to me) for valuation.

Land sits on the books at cost. The consolidated balance sheet shows land of ¥3,557,343k carried at historic prices.

Buildings and structures are on the same schedule.

In Japan, industrial land around major metros can command more than its original cost.

I haven’t dug into this too deeply, but am pretty sure that the holdings it has are probably worth far more today than they were when first purchased.

If I was considering this for my portfolio right now, this would be the first thing I investigated deeply.

There are, on the other hand, a couple of things that raise my eyebrows:

The mortgage over land/buildings secures ¥2.0bn of loans. In any liquidation, that claim sits ahead of equity and shapes recoveries.

This would need to be factored into any detailed margin of safety calculation.

Also, the ¥1.3bn lease liability is contractual.

This means that they should be factored in for the most conservative estimations. Although, it’s difficult to truly figure out if these would be payable in a real liquidation.

Probably safest to assume it would be tbf.

All in all, the group’s FY2025 balance sheet shows a solid equity base and liquidity.

Cash and deposits were ¥4.26bn; borrowings were a blend of short-term and long-term with available undrawn facilities of ¥1.94bn at year-end.

That isn’t bullet-proof, but it is comfortable for a firm of this scale imo.

In my experience, deep-value rerates usually come from one of three places:

Uncertainty resolves; profitability normalises. We already have the uncertainty resolution of the legal case closing, and operating steadiness through FY2024–FY2025 and into Q1 FY2026. Normal cash and normal multiples may follow.

A bid. Shutters and steel doors are consolidatable. There is nothing in the reports that signals an active process; but this is the kind of business that could easily attract an industry buyer, looking for a deal.

Capital return. Policy is now explicit: dividends first, with a higher target payout over the plan period. Historical FCF is strong and consistent, so this is another possible trigger.

My personal view of Toyo Shutter is that they are a solid business that will likely be around for quite a while yet.

They are worth more than their liquidation value, and an investment at today’s price will offer solid downside protection, with some decent upside in the next 1-3 years.

This is firmly on my watchlist and will produce an updated write up if I actually allocate capital to the stock.

You can view my current portfolio stocks here.

Mr Deep-Value also offers:

A 90% discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients