A Growing Market-Leader Priced at 3.8x FCF

Also buying back stock and holding more cash than market cap.

Peter Lynch once wrote:

“If you stay half-alert, you can pick the spectacular performers right from your place of business or the neighborhood shopping mall, long before Wall Street discovers them. This is where you’ll find the tenbaggers.”

I don’t believe today’s stock is necessarily a 10-bagger, but I do believe it has plenty of room to double within the next 2-3 years.

When I looked into it, it reminded me of the quote above.

This is because I first found this business as a customer. I was so impressed, I immediately checked out the stock.

To my great surprise, it was pretty cheap.

Here are the ratios:

TBV Ratio = 1.6

EV/5Y FCF Ratio = 1.5

P/5Y FCF Ratio = 6.7

The total shareholder yield last year, at today’s price was over 7% (1% dividends and 6% buybacks).

The company also started a new buyback programme in 2025, equivalent to around 10% of the current market cap.

Before we go any further it’s probably a good idea to clarify exactly what this situation is, and what it isn’t.

There is no margin of safety in the assets.

If the business liquidated tomorrow, we would lose money at today’s price.

Probably not all our money, but a good chunk of it.

Therefore, everything that follows rests on the assumption that the business will continue operating for the foreseeable future.

If we’re comfortable with this assumption, then I believe that this business is selling very cheaply relative to its future earnings power.

This is unusual for me, because I normally like asset protection too, but I do make exceptions where the business looks strong.

I’ve written up a few examples of this, here, here, and here.

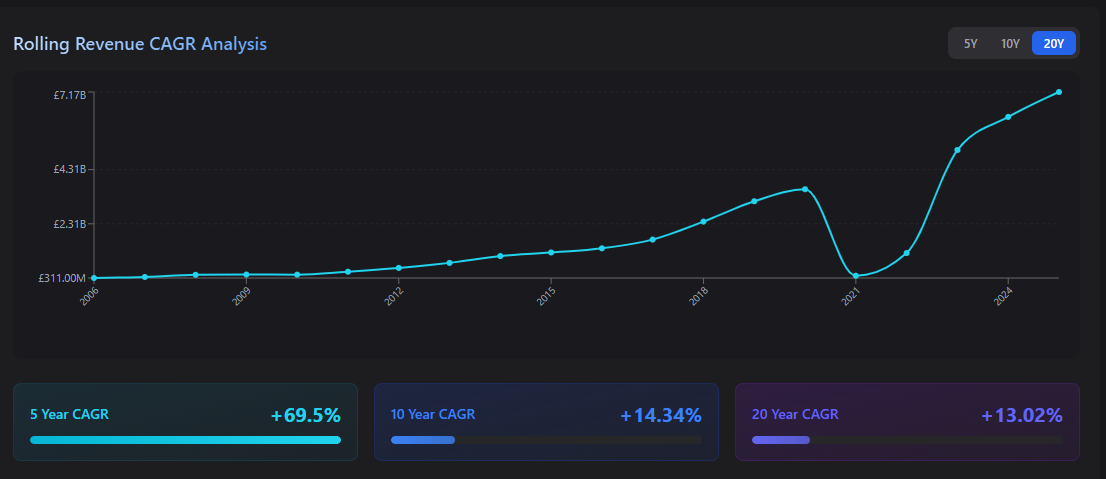

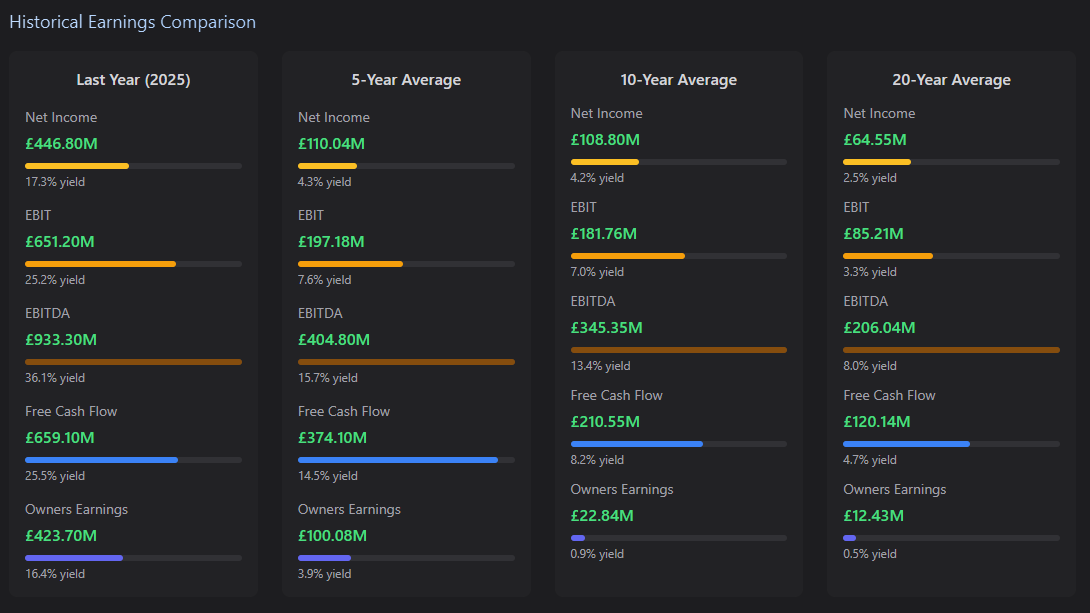

Today’s business appears strong with growing revenues (even after the COVID dip).

Earnings have also grown nicely, over the long-term.

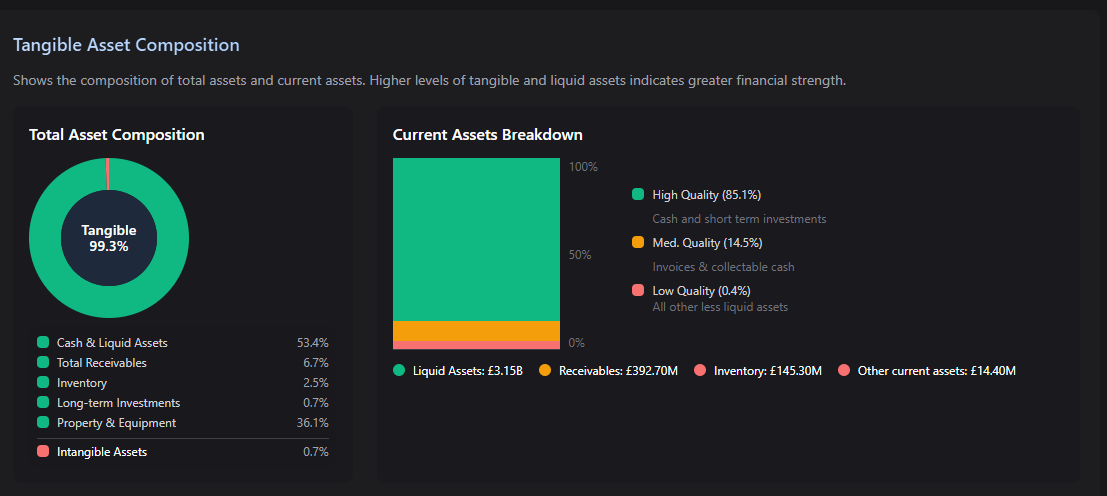

Even though we can’t rely on the assets in a liquidation event, the quality of them is still important to the health of the business.

As you can see, the assets are high quality and liquid.

All in all, this is a business that is strong, healthy, and cash-generative.

Let’s take a closer look…