My Favourite Deep-Value Stock (2025)

It's a cannibal cash machine, eating its own shares and paying dividends while trading with an EV/FCF ratio of 5.

Mr Deep-Value also offers:

A 90%+ discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Today’s stock is the golden-child of my current portfolio.

If, for some reason, I was forced to pour all my capital into a single stock from my current holdings, this would be my choice.

It’s different from everything I own (except maybe this one).

The business itself has never had any ‘issues’ typically associated with deep-value situations.

The management team exists solely to return cash to the shareholders.

And, since holding it, the intrinsic value of the business has increased consistently, pushing my estimate of fair value higher and higher.

(I explain my calcs at the start of this post)

Here are the ratios today:

NCAV Ratio = 5.6

EV/5Y FCF Ratio = 5

P/5Y FCF Ratio = 7

When I first found it, it was around half the price it is now. It was trading at around 3x its 5Y FCF (using market cap).

At today’s price, it has around 30% upside left until it hits my current estimation of ‘fair value’.

When I dug into it, I literally couldn’t believe that the market was pricing it so low.

I understood why, kind of, but still, it was irrational and, quite frankly, ridiculous.

This is the one stock I’d actually consider just holding forever and never selling. Which is a ludicrous thing for a deep-value investor like me to say.

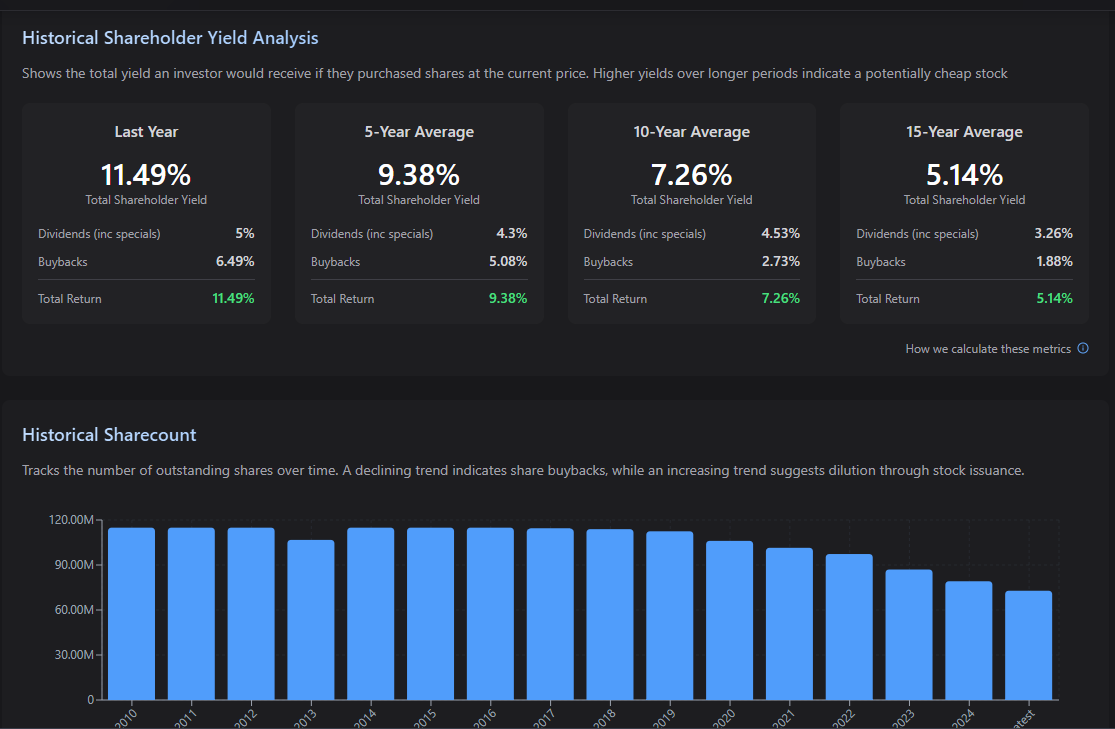

One reason, is that even if it didn’t grow from here, the SH yield is impressive:

Not only is it high, but it’s increasing, even as the stock price goes up.

This illustrates how much of a cash-machine the business is, and how dedicated they are to pumping that cash back to shareholders.

Let’s take a look…