20% ROI Without a Catalyst...

A story about how to manage portfolio turnover and optimise deep-value returns.

Mr Deep-Value also offers:

A 90%+ discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients

There are only really three reasons I’ll cash out a stock.

The market rerated it back towards its fair value and I took my profit.

The value of the business has declined, and it no longer looks ‘cheap’ compared to the price I paid (melting ice cubes).

I found a much more appealing bargain that I believe has a far superior asymmetric profile, and want to swap it in for the least attractive of my current stocks.

Sometimes, these things combine conveniently.

For example, I bring in a new stock for a melting ice cube, or just cashed out a profit and immediately have a new stock to recycle the capital into.

Other times, I just have a bunch of stocks that are not priced fairly but are not melting ice cubes either.

In this scenario, I need to figure out which of my existing stocks is worth replacing with the new one (if any).

These decisions almost always revolve around my assessment of opportunity cost.

Today’s stock is a perfect example of this process in action.

When I found it, in early 2024, it had the following ratios:

NCAV Ratio = 0.6

TBV Ratio = 0.4

P/5Y FCF Ratio = 8

It also had a negative EV, which, in real-world terms, means I’d actually get paid to buy the business.

Upside to both fair value and liquidation value was around 60%.

Solid, but nothing special.

This is the type of stock that you won’t lose money on, but that you might be holding for a few years before seeing much profit.

The value of this stock, to me, was its downside protection.

In my mind, If I can protect the downside, the upside will take care of itself (and it usually does).

After around a year of holding it, I found this stock.

I really liked the new stock and wanted to buy it.

With my portfolio full, I needed to either forget the new stock or figure out which one to sacrifice.

This is the story of how I decided which stock to replace…

The Business

Itokuro (6049.T) is a Japanese company that manages websites.

Specifically, their websites act as review sites and information portals for the education industry.

In other words, people visit Itokuro’s websites to check reviews and figure out which nursery, school or university they want to send their kids to.

The business model is basically that of an affiliate marketing firm.

They drive the traffic to the schools and then the school pays Itokuro a commission for every successful sale they make.

They also make money from advertising.

Their entire market is in Japan and their HQ is in Tokyo, with another office in Osaka.

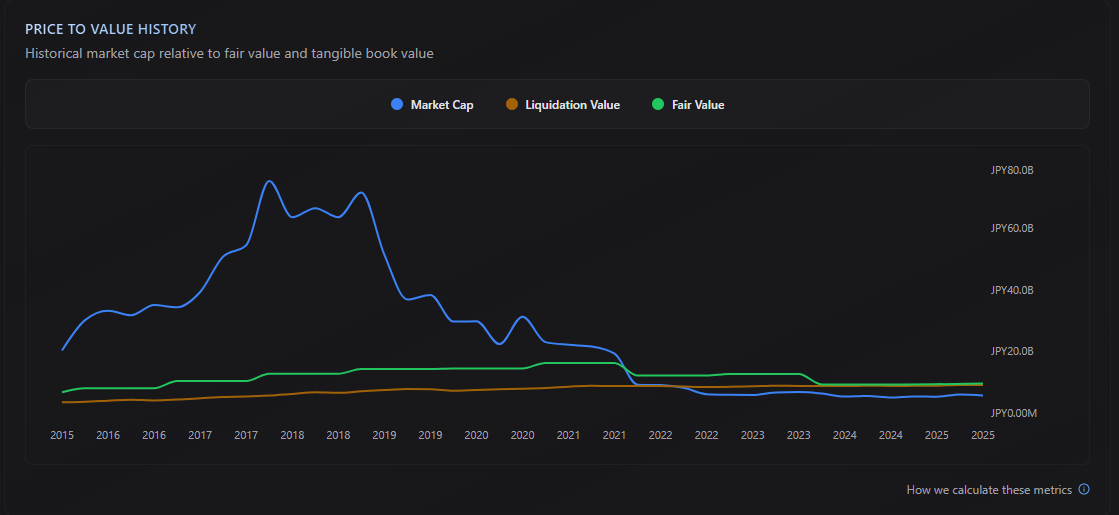

When I found the stock, it was beaten up by the market and trading almost 80% below its 5-year high.

One of the first things that drew my attention was the fact that it has, historically, always traded above both fair value and liquidation value.

This isn’t always true of Japanese stocks, as I explained here.

This made me curious to dig deeper.

The reason for the stock price decline was a multi-year fall in website traffic (less people visiting the sites), and inconsistent profits.

This probably had a bigger effect because website traffic is one of the company’s core KPI’s.

Once the stock is priced below liquidation value, the only question is whether it will die soon or not.

The Investment

Itokuro had an interesting set-up.

On the one hand, the traffic was clearly declining over multiple years.

I’m no website expert, but this seemed like a bad thing, given their entire business model revolved around driving website traffic in exchange for commissions.

On the other hand, revenues actually remained steady.

There was no massive decline in actual money through the door.

The management team stated, repeatedly, that their goal is to become the number 1 education media business in Japan.

They’re going to do this by increasing their content, improving their UX and making sure more people are aware of the brand.

Their ‘north-star’ metrics are website visitors and operating profit.

The execution of these stated goals has been… ‘lumpy’.

Visitors have obviously kept declining, and profits have been a little volatile. The business has swung between losses and profits over the last 5 years.

My opinion is that the management team has a clear desire, which has consistently been the same for years, but executing on it, seems a bit of a struggle.

Another thing I found interesting was the CEO.

He seemed to own a very large stake in the business (over 50%), according to the annual report.

He’s also been in place since 2015, leading from the front, and building out their core platforms.

This indicates that he has skin in the game and is very unlikely to allow the business to simply wither away.

The bottom line, in my view, was that the business would not be dying any time soon, and would likely rerate back towards liquidation value at some point in the next couple of years.

This would most likely be because of a normalising of profits, but it could also be driven by a (friendly) buyout deal or sudden capital-return to shareholders.

They have the cash to conduct a buyback or special dividend, and they did conduct a buyback in the past.

Whatever the catalyst, I would then take my money and recycle it into the next one.

So, I bought it, and held it.

The Exit

By summer 2025, the stock price was up over 20% from where I initially bought from.

Nothing happened, in terms of a catalyst. It kind of just plodded its way up over the months.

When a business is priced so cheap, sometimes ‘up’ is the path of least resistance.

This happens frequently with deep-value stocks.

By the time I found the new stock, Itokuro had released a couple more statements and had the following ratios:

NCAV Ratio = 0.8

TBV Ratio = 0.6

P/5Y FCF Ratio = 16

The EV was still negative and the upside was still around 60% from both angles (liquidation and fair values).

As I was comparing my stocks, I noticed that Itokuro had two things going for it, in terms of being replaced.

First, the P/5Y FCF ratio was now quite high.

This indicates that earnings are generally weak, over multiple years, compared to today’s price.

It reminded me of a classic Walter Schloss style stock. Cheap to assets but with pathetic earnings.

Secondly, it was up 20% from where I bought it, in around a year.

This represented a solid return, considering the investment idea was nothing particularly special.

All my other stocks had solid earnings to match their asset discounts. I view this as an additional margin of safety.

(My approach is explained in full here)

After some deliberation, I decided to cash out Itokuro and recycle the capital into the new stock, immediately.

The new stock is cheaper to assets with a much stronger earnings profile.

My process goes on.

I search for stocks, and put all the interesting ones on my watchlist, which I’m slowly writing up here.

I constantly compare them against what I already own, and calculate the best one to replace, or not.

This keeps the portfolio turning over naturally, while remaining optimised for maximum growth.

Mr Deep-Value also offers:

A 90%+ discount off Bloomberg’s No.1 competitor

Separately managed accounts for US clients