A Nano-Cap Cash Machine at 4.5x FCF

It also has a 13% dividend yield at todays price (5Y average).

Today’s stock:

EV/5Y FCF Ratio = 4.5

P/5Y FCF Ratio = 5.5

There isn’t any protection in assets, but the balance sheet is a mini-fortress of liquidity.

It has a positive NCAV ratio of 29.7, which indicates a healthy, liquid set-up.

In fact, its assets are basically just cash and invoices.

It has zero debt and a small amount of lease obligations. This is outweighed by the cash alone.

This is a pure earnings play.

In other words, we can buy a decades old business with highly consistent, long-term cash generation, and make our money back in around 5 years.

After that, every drop of cash flow is pure profit, for as long as the business continues.

Today’s market cap is €5.5M.

The enterprise value is €4.5M.

Over the last 5 years, the business has averaged around €1M per year in FCF.

That FCF is pure.

It mostly comes from its core operating business with some small swings in working capital, and very minor capex spend.

They also have a policy of paying virtually every penny of available cash as dividends.

This produces a 5Y average annual dividend yield (at today’s price) of over 13%.

The business model appears intact and is going through its normal cycle, rather than any kind of terminal or structural decline.

What attracted me to this (obviously) was the quality of its cash generation and the management teams focus on generating cash and returning it to shareholders.

Let’s take a look…

The Business

Trainers’ House Oyj (TRH1V) is a Finnish company founded in 1990.

The business model sounds a bit ‘fluffy’.

“Our mission is to help people progress towards meaningful goals. We build reputation, create opportunities and generate methods for success.”

This is accompanied by pictures in the annual report, like this:

It took me a while to work out what they actually do.

If I owned this business whole, in the real world, I’m not exactly sure how I’d feel about all this.

I ploughed on regardless.

I finally figured out they have two prongs to their business model.

The first one is kind of like a marketing agency that specialises in booking sales calls for their clients.

They basically generate leads, warm them up and then get those leads into some kind of conversion call.

The second part is like a management/sales consultancy that provides training and coaching to their clients to help them convert those leads into customers.

Whatever it is, it involves a very close, integrated relationship with each client and nice juicy retainers.

They must be pretty good because they have been going for almost 40 years and seem to generate operating cash flow constantly.

The business works mostly in Finland with hubs in Helsinki, Oulu and Turku, plus a small presence in Torrevieja, Spain.

At this point, I assumed, perhaps cynically, that the Spanish office is just an excuse for some winter sun.

Through an owner’s lens, this is a simple, stable business, with low capital needs, modest scale and a focus on cash.

Revenues have stepped down from 2021 highs but appear to be stabilising, with a mild profit recovery in 2024 and cash strengthening.

The company has cash on hand, limited interest-bearing liabilities, and a management that has shown it will cut costs quickly when demand weakens.

There is no evidence of any kind of structural decline.

Growth depends on the general sales environment and clients’ willingness to invest in demand generation and coaching.

If the recent order momentum holds, the reports point to a steady or modestly improving base rather than a shrinking one.

Why It’s Cheap

The recent stock price peak came in early 2022, when it hit €9.40 per share.

Since then it has fallen hard, all the way down to the July 2025 low of €1.98, before settling at the current price of around €2.50.

On April 1st 2022, the board approved a 10-1 reverse share split.

The reports say this was done to improve trading conditions and to make dividend distribution more flexible.

Markets can view this type of action with scepticism, and this is one of the reasons the price declined from that 2022 peak.

In October 2022, the company released a profit warning which accelerated the sell-off.

Over the next couple of years, revenue fell from the 2021 high of €10.3M, down to €9.75M in 2022, €8.44M in 2023, and €8.05M in 2024.

The stock price has tracked this reduction in revenues and earnings.

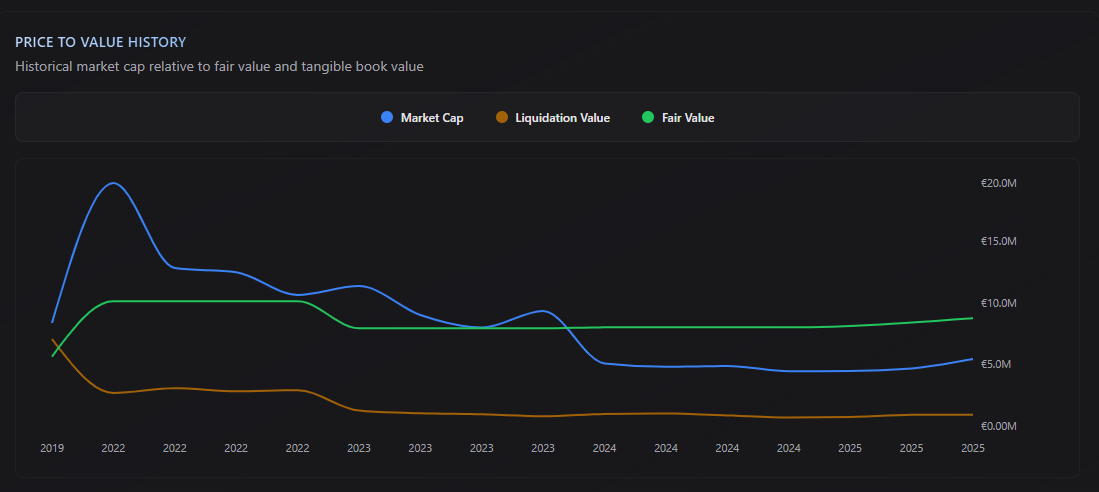

The chart above illustrated how the price fell, until it eventually dropped below the ‘fair value’ (as I calculate it).

Previously, it tracked above fair value quite consistently.

The Risks

Trainers’ House says its business is sensitive to the wider economy.

When economic activity slows or Finnish demand weakens, customers delay or cut projects, which reduces orders for the company.

Management groups the key risks into five buckets: market and business risks, people risks, technology and data security risks, financial risks, and legal risks.

They track performance and forecasts monthly and adjust sales focus, staffing and costs quickly when conditions change.

They also book expected credit losses on trade receivables based on ageing and individual risk reviews.

Market and business risks arise because the company’s work is largely project based and the order book is short, which makes forecasting harder.

Changes in global trade and geopolitics can hit Finnish export companies and feed through to domestic demand, which then hits the company’s order flow.

Higher interest rates and inflation can also dampen activity.

Management’s mitigation is close monthly control of sales pipelines, resources, and operating costs so they can react fast when conditions shift.

People-risks are important because this is an expert organisation. Success depends on hiring and keeping skilled staff.

Management addresses this with competitive pay, incentives, training, career opportunities and workplace well-being initiatives.

They note that tight labour markets can make recruitment and retention harder, although they said the situation eased during the last year.

Technology and data security risks include supplier dependence, internal system risks, technology change and information security.

The company mitigates these with long-term supplier co-operation, appropriate security systems, staff training and regular security audits.

Overall, the risks described are typical for a project-based advisory and software-enabled services business.

The company’s stated mitigations are hands-on: tight monthly controls, cost flexibility, staff development, strong receivables management, annual insurance reviews and regular security work.

None of the reports claim immunity from downturns, but they present a control system designed to react quickly when demand softens.

I didn’t find any risk here that threatens the businesses ability to recover back to its long-term averages and continue on.

Well, maybe AI, but that’s too vague at this stage, given the inter-personal nature of how the business operates.

The Investment Case

The core of this thesis is that we have a stable, cash-generative business that is likely to continue operating for the foreseeable future.

It’s currently priced slightly below what a private owner would value it at.

This is due to the cyclical earnings which dipped in the last three years, but now seem to be recovering.

For example, the TTM revenue is currently €8.48, which is already back above both 2024 and 2023 levels.

If this trajectory continues, the stock price will likely follow, as it always has, and mean-reversion will take care of the rest.

To illustrate this we can look at the earnings volatility.

Over the last 10 years, earnings appear very cyclical.

This matches what the management team states in the annual reports. They explain that the business and its profits have always been this way.

Right now, earnings are on their way back up towards their cycle highs, but the stock price hasn’t quite caught up.

The simple play here is to hold the stock and sell it again once the earnings recover back to historical norms, and the stock price inevitably follows.

Even during the ‘bad times’ the business generates positive operating cash flow. That cash flow just increases when the ‘good times’ roll around again.

The stock price hasn’t quite caught up with this recent recovery, which is why this opportunity exists.

In case you’re interested, I believe the fair value for this stock is around €4 per share, which is almost 60% upside from current levels.

I believe this will play out over the next 1-2 years as the earnings continue normalising.

A final note I found interesting is regarding the dividend policy.

In 2021, they formalised a policy which stated their goal of paying roughly €1M per year in dividends.

They followed this up with dividend payments of roughly €1M per year in 2021, 2022, and 2023.

Even during the ‘bad’ year of 2024, they still scraped together €80k to pay something to shareholders.

As earnings rebound, the dividends alone would generate double digit returns for anyone buying at today’s price.

All of these things together make this one a decent set-up imo.

It shows a dividend rate of only 1.68% on Google Finance, at a price of 2.98 euros per share. Why so low if the 5 year dividend average is 13%?