Deep-value or value-trap? You decide

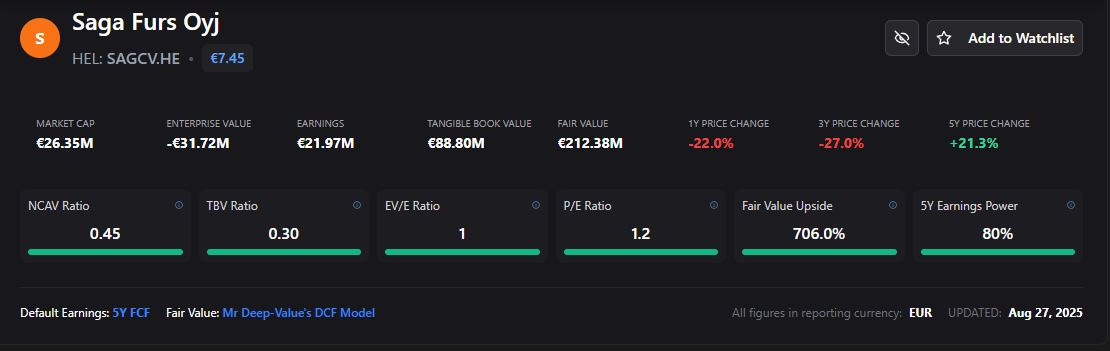

0.3 TBV Ratio, 1.2x earnings and negative EV, but still too expensive for my liking.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

When I first started stock-market investing I soon came across a term that struck a primal fear into the core of my soul.

The Value-Trap.

Internet-people were quick to label pretty much every stock I shared as a ‘value trap’.

I imagined all my money slipping away down the drain and having to work my way up the McDonalds corporate ladder to make ends meet.

I asked Google what exactly a value-trap is.

It gave me a handy list of signs to look for:

Financial difficulties and instability

Poor management

Lack of growth potential

Corporate governance issues

The problem was, my portfolio was always FULL of these things.

For example, I invested into a business that lost all its earnings. Literally, all of them.

The stock price ended up tripling within a few weeks.

Another one got hammered by inflation and had its earnings eaten away.

I doubled my money on it, in less than a year.

This business not only suffered catastrophic earnings decline, but it also had its main customer acquisition channel virtually eliminated.

The stock generated a 75% return in a year.

You get the idea.

I was confused.

So, I decided to ignore all that and carry on.

Over time, I started stumbling into stocks that I instinctively felt were value-traps.

I decided to share one of these, in case you find it interesting, and help define my idea of what a value-trap is.

I wouldn’t invest into this stock myself, but you might like it, so, it’s free to read.

Let’s dive in…

The Business: Saga Furs Oyj (SAGCV)

Saga Furs Oyj is not your average small-cap.

It’s one of the only listed, full-service fur auction house in the world, operating out of Vantaa, Finland.

Founded in 1938, it sits at the centre of a long-standing European fur trading ecosystem.

The business model is simple:

It runs international auctions where European fur producers (mainly mink and fox) offer their pelts to fashion houses, manufacturers, and brokers across the globe.

Think Sotheby’s, but for industrially-murdered furry animals.

Over the years, Saga Furs has tried to evolve beyond just auctioning furs.

It operates a ‘Creative Hub’ for fashion partnerships and has heavily emphasized traceability and sustainability.

They’re clearly an optimistic bunch.

The Deep-Value Opportunity

From a purely quantitative perspective, the stock is dirt cheap:

NCAV Ratio = 0.45

TBV Ratio = 0.30

Negative Enterprise Value (-€31.72M)

P/5Y FCF Ratio = 1.2

Last year it generated €23.36M in FCF. The 5 year FCF average annual figure is €21.97M.

Its 20 year average FCF figure is €7.07M, and the 10 year figure is €14.78M (Versus a market cap of just €26.35M)

If Saga Furs closed its doors today and simply sold the tangible assets, you’d probably double or even triple your money.

The asset mix confirms this is no accounting illusion:

Cash & Liquid Assets: €58.1M (49% of total assets)

Receivables: €19.9M

Inventory: €10.1M

PPE: €18.8M

Over 90% of assets are tangible and nearly 66% of current assets are cold, hard cash.

This is the kind of balance sheet that gives me a warm fuzzy feeling when I go to sleep at night.

Meanwhile, the business still generates consistent cash.

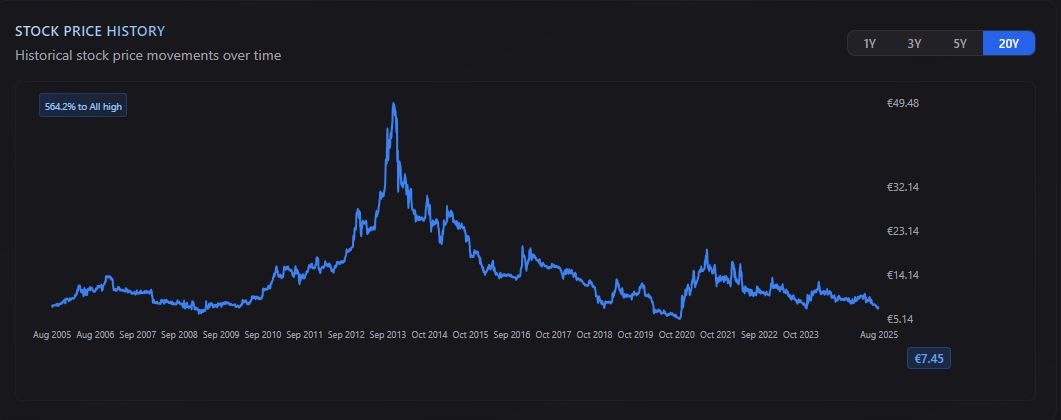

The Stock Price

Saga’s share price trades at €7.45, down from a 52-week high of €10.67. It sits around 160% off its 5Y high (€19.30).

The stock price is low by almost all measures, across all time frames.

The market simply doesn’t care. The price has been grinding lower and lower.

Under normal circumstances, this has all the hallmarks of a fantastic mispricing.

The Risks

This is the part where I explain my ‘value-trap’ thesis.

The fur industry is in terminal decline.

In fact, I had to read the annual report twice and double check the stock was active, because I was in disbelief that such a business could still exist.

I genuinely thought the fur trade was long-gone, and only existed in black-markets.

Fashion brands are distancing themselves from animal products.

I’m no fashionista (I last bought clothes in 2017), but even I know that fur clothing is a big ‘no, no’.

Fur farming is literally banned in most European countries, and Israel and Switzerland ban the sale of fur clothing completely.

Even in countries without formal bans, some cities have imposed direct bans independently.

Saga Furs, in my opinion, is a melting ice cube.

I don’t necessarily mind melting ice cubes, per se, but I literally cannot see any possible catalysts arriving any time soon.

Catalysts

In deep-value land, there are several ways for a stock to get re-rated.

Dividends

Saga is a strong dividend payer. However, I don’t play the dividend game. I’m looking to flip cheap stocks and double my money, rather than take home 8% from a dying business.

Turnaround in Fashion Demand

This just seems impossible. In no world, can I imagine society at large suddenly deciding to support industrial fur farming.

Takeover or Privatization

The structural decline of the industry makes any buyout or takeover pointless.

If I owned this business outright, my strategy would be to keep it pumping cash for as long as possible, while injecting that cash into something with bright future prospects.

I just don’t see anyone buying it, and if they did, there is zero justifiable premium from the current stock price.

Taking it private, most likely, wouldn’t generate any kind of premium (for me) either.

Buybacks / Special Dividends

This is an option and could generate solid short term performance. But it would also be risky for the business to spend all of its cash with terminal decline in progress.

Liquidation

The most realistic option imo is a voluntary liquidation of the business. If done soon, this would yield an acceptable return.

However, there seems to be no desire from management to do this.

They still seem to be fighting the tide with things like ‘traceability’ and ‘sustainability’.

After considering all of this, and drawing from my experience over the years, It doesn't seem like anything will happen to generate the re-rating.

A Note from Mr Deep-Value

Saga Furs is cheap. In fact, it’s unusually cheap, even by deep-value standards.

You’re buying a debt-light, cash-rich business with a history of profitability for 30 cents on the euro.

That kind of setup doesn’t rely on heroic turnarounds or multi-decade growth forecasts.

However, it gives me the impression that it would be stagnating in the portfolio for 3, 4 or even 5 years with nothing happening.

This is the epitome of a value-trap (for me at least).

I do not own this stock and have no intention to do so. I believe it will be extremely difficult to make money, however I do have it on my watchlist.

I check in on it regularly, with fascination, to see how it all plays out.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients