A Healthy, UK-Listed Business Priced At 1x FCF

There is also 600% upside to liquidation value at today's price.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

This article was originally a premium idea that I was invested into myself.

In November 2025, management announced a low-ball delisting offer. They would buy out all the shares for 6.27p.

If all shareholders tendered their shares then they would only buy back 97.5% of them. This means the rest would be held by shareholders.

The offer was pretty abysmal but is also a great lesson for dee-value investors.

If the ownership structure allows controlling owners to conduct an involuntary delisting, then the lower the price falls, the more tempting it will become.

This offer represented around 5-10% profit on the publication price, but it should have been 100-200% or more.

I bought OPG, knowing about the ownership structure, and the shady management team.

I went ahead because the price was so low I couldn’t resist. Of course, I only hold one or two of these things at a time, for this very reason.

Overall, over the years, I’m still very much in the black from these specific types of set up.

But, this happens and we move on.

If you’re into deep-value investing this episode serves as a fantastic example of a proper ‘value-trap’.

Be very careful for this scenario when buying cheap stocks, and my biggest advice is to avoid exposing too much of your portfolio to this risk.

Read below to see the full write-up in its original form…

===

Original Article Published September 30th 2025:

===

Today’s UK-listed business:

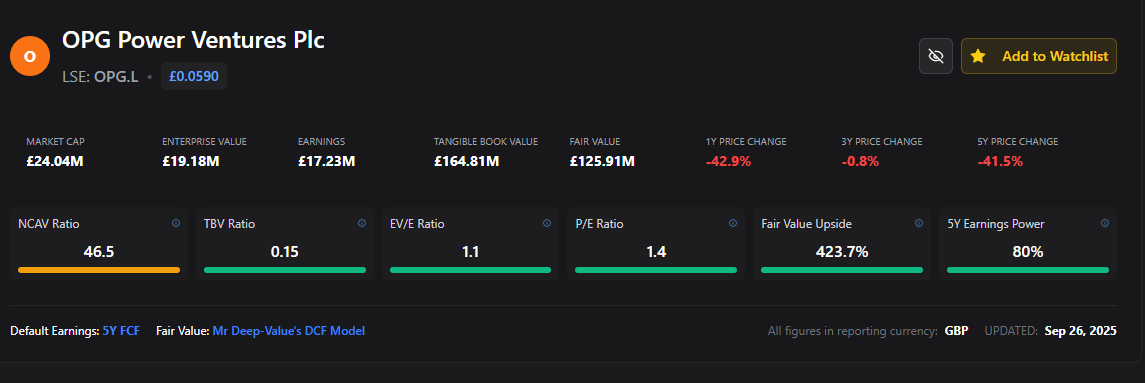

TBV Ratio = 0.15

EV/5Y FCF Ratio = 1.1

P/5Y FCF Ratio = 1.4

The business has generated positive free cash flow in 9 out of the last 10 years, and I estimate the upside to fair value from current prices to be around 400%.

(My calculation of fair value is explained at the start of this post.)

The upside to liquidation value alone is almost 600%.

It’s very much a cigar-butt style investment, with a very high probability of having at least one significant puff left in it.

This is largely due to two factors:

First, the price.

We’re paying 1x FCF while having a huge margin of safety within the asset value.

Secondly, the industry it’s in is priced for long-term decline, despite having a pretty bright (and profitable) short term future.

I believe this is an asymmetric opportunity, and have recently allocated 5% of my portfolio to the stock.

Let’s dig in…

The Business

OPG Power Ventures (OPG) is an Indian based, London-listed company, that owns and operates power-generation facilities.

Specifically, they own a coal-fired plant in Tamil Nadu, and a smaller solar facility within the grounds of the main plant to supply internal power.

I found this curious when I first read it…

A coal-fired power plant using solar energy for their internal power needs.

Anyway, they generate revenue by producing electricity (via the coal plant) and selling it to the market.

I guess running the small solar operation allows them to run their operations for free while selling every drop of electricity they produce.

Their customer base is mixed between short, medium and long-term contracts to ensure consistent revenues that are somewhat protected against fluctuations in energy prices.

They balance their coal usage between imported and domestically sourced varieties.

According to their latest annual report, they generated £156.7m in revenue during the last financial year.

Their business model is known as contract-led base-load generation.

This just means that they can easily switch between contracted revenue streams or the open market, based on prevailing prices.

This protects them when prices adversely impact their business but also gives them upside when prices offer an opportunity for increased cash generation.

When I first analysed the business, I was struck at the price.

Most of my stocks are cheap, but this one is really cheap.

Of course, coal scares investors away and we’re relying on a single plant to deliver all the revenue, but still.

As I dug deeper I found that the management team recently carried out an impairment test, to comply with accounting rules.

This process involves calculating the current value of future cash-flows.

In the FY25 annual report the management team estimated that the present value of the cash-flows was around £176m.

In other words, the cash generation over the next 20 years is worth around £176m today, on a market cap of £24m.

Of course, the £176m might not be perfectly accurate, and it doesn’t factor in things like financing structure, interest payments, future capex beyond the model and taxes etc.

It is, after all, an accounting ‘model’.

But it does indicate how undervalued the stock is right now, imo.

On top of this they own (freehold) all the land and buildings that their core plants sit on, in Chennai.

Management doesn’t provide any appraised current market value, but it’s always highly likely that land and buildings bought decades ago are worth far more than book.

I understand there are issues, but as Warren Buffett once said:

“Price is my due diligence.”

And this is definitely the situation here.

The Stock Price Decline

Today, the stock price sits at just £0.06, down from its 5 year high of £0.20.

The decline has been caused by a few different factors.

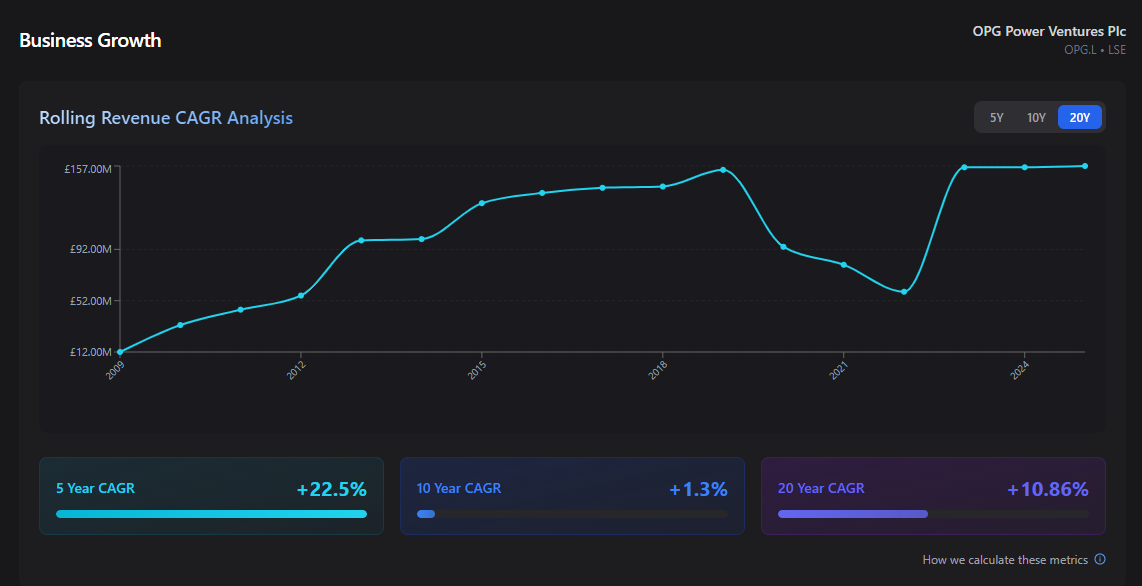

First, earnings have basically flatlined for a decade. There have been some ups and downs which, to an investment analyst, appears like a deterioration.

Revenues were £128m in 2015 and £157m in FY 2025.

They dipped significantly in 2022 to just £59m, due to a decrease in power generation, caused by COVID related hangovers and the Russian invasion of Ukraine.

These things reduced production and increased global coal prices, which forced the company to reduce their activities.

The fact that OPG has never exactly been a growth stock, made the recovery more difficult.

The stock price has fluctuated, hitting £0.13 in 2023, but it’s now back to where it was during those dark days of £59m annual revenue.

The business has turned things around since those days, and revenues are higher than ever, but the market hasn’t noticed.

Another thing keeping the stock price down is the market’s concern over payments.

Historically, a material share of OPG’s sales is to a state-run distribution company (TANGEDCO) in Tamil.

Over the years, OPG has revealed that TANGEDCO invoices have been 180 days past due, with a loss-allowance of £5m carried for them.

This isn’t unique to OPG, it’s systemic bureaucracy across India.

So much so, that the central government introduced legislation in 2022 specifically designed to reduce this type of situation.

No one expects them not to pay, they just take ages, which negatively impacts cash-flows, and investor confidence.

As a result of all this, the stock price (unfairly) sits at the lows induced by the worst of the COVID pandemic and coal price spikes induced by the Russian invasion.

The Risks

When I was buying businesses in the real-world, the only obsession was the risks.

“What can go wrong?”

Or

“What’s going to cause the business to fail to pay back the acquisition loan, and result in me losing my home?”

That kind of thing.

When buying stocks, my risk-radar is no different.

With OPG Power Ventures there are several risks that jump out to me, as a potential buyer of the business.

The main one is that it’s a foreign, coal-fired power station.

There is always the risk of margins being devastated by things like regulatory / policy shocks (outright coal-bans etc), negative FX exchange rate moves (INR/GBP), and other issues.

In my view, these are just ‘standard’ things that any business has to deal with in one way or another.

Coal is being phased out globally, but at nowhere near the rates that would make OPG Power a bad investment (at today’s price).

For example, global coal demand reached an all time high in 2024, thanks to growth in usage from China and India.

The fact that OPG operates in India, gives me comfort that demand will continue as they push their economy forward and drive up general living standards.

They are a fast growing economy and, right now, need all the energy they can get their hands on.

Even the US recently issued an order to immediately cease the closure of any more coal-fired power stations.

This is not a business I want to own for the next 10 years, but I do believe there is plenty of room for ‘one last puff’ of the cigar.

Remember, we’re buying the entire business for a single year’s worth of FCF.

That implies that the company won’t make more than around £24m during the rest of its remaining life.

It generated almost £19m in FY2025 alone.

Having said that, regulations are getting more stringent. There is a December 2026 deadline to meet certain emissions targets.

OPG seems confident that it already meets most of them and will be fully compliant in good time.

India also announced an increase in GST on coal in September 2025. This weighed in the stock price, but in reality, this can be passed through.

Even if OPG absorbed it fully, the extra £2.5m that it will add to costs, doesn’t dent the £19m in FCF too much, relative to the current cost of buying the business.

The company is also in a dispute over tax payments, to the tune of £4.5m.

They seem confident in their case, but even if they were required to pay the full amount tomorrow, they have enough cash on hand.

It’s also worth mentioning that everything is dependent on the operation of their core power plant in Tamil Nadu.

If the plant had to close or somehow went out of existence, the business would essentially die.

This technically creates an over-reliance on a single revenue stream, which I wrote about here.

However, in this case, I don’t view this as a huge risk, because the company has lots of cash (to cover liabilities) and the land could be sold if required.

In other words, in the worst case scenario of the business closing tomorrow, buyers at today’s price would most likely not lose money.

The risks are real, but I believe the price is low enough to mitigate most of them over the next 2-3 years that I plan to hold the stock.

Investment Case

OPG is a very simple thesis.

It’s cheap.

Dirt cheap.

Buying the entire business whole, at this price, would make it virtually impossible to lose money.

Buying stock is slightly different, of course, but I believe a price this low creates a perfect catalyst attraction.

This could come in the form of a buyout or delisting, a buyback programme (which they did previously), or even a special dividend if cash flows continue as normal.

The simplest way to a rerating of the stock price is that the business continues to earn similar amounts of FCF to the past decade.

We have a huge margin of safety from asset values, and a cash-flowing business giving us plenty of upside potential.

We don’t need growth and we can be content with the fact that coal generated power probably won’t be with us in 100 years.

Over the next 10 years though, it’s not going anywhere, and demand may even continue to rise thanks to Chinese and Indian economic expansion.

The play here is simple:

We buy a healthy, cash-flowing business at seriously depressed prices and sell when the price rerates due to some near-future catalyst.

The end.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients

Thanks for the great idea. We have seen a wave of delistings of iliquid small AIM-listed stocks at terrible terms for minorities. Often the majority owner just cancelled the listing to shift to bargain trading platform. You only need 75 percent of votes cast to approve this on AIM (which can be easily achieved when you own 50 percent , or even less, as minorities rarely vote, even on important matters ). So i am afraid that something similar like Brightonpier, hornby, annexo , celadon, biome,mobile tornado, …. Could happen . Thanks for your thoughts on this

Hi thanks for the analysis here. What do you make of the FEMA investigation and raid of OPG offices from November 2024? That sent the stock down 50% and I can't find if it has been resolved