Pay for the Cash, Get the $200M Business Free

This growing business is currently priced as if it will decline for the foreseeable future.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Today’s stock is an interesting one, here are the ratios:

NCAV Ratio = 6.8

TBV Ratio = 1.7

EV/5Y FCF Ratio = 5

P/5Y FCF Ratio = 6

The reported FCF didn’t really require much adjustment but the business is undergoing a huge transformation.

In fact, this is probably a bit of an understatement.

The story goes a little something like this:

The business has been operating for the last 25 years as a royalty-generator.

They had 5 (not a typo) full-time employees in 2021, while generating around $400M in annual revenue and $364M in FCF.

The underlying patents are due to expire in 2029-2030, which will basically decimate these revenues.

To counter this, management decided to build a brand new commercial operation to replace those lost revenues as quickly as possible.

Today’s price indicates that the market is basically charging you for the royalty cash while giving you everything else for free.

This includes the new operating business with all its future cash-flows, forever.

The bet here is that the company can successfully get this new business throwing off cash and growing in time to offset the upcoming patent-cliff.

To be clear, this isn’t a liquidation play.

If the business dies, we would probably lose a chunk of money at today’s price, although not all of it.

Instead, the earnings are priced as if they will continue to decline for the foreseeable future, and the transition will fail to replace the royalty income.

I took a deeper look to see if that was true…

The Business

Innoviva Inc (INVA) is a US holding company, originally founded in 1996.

As mentioned they currently have two core revenue streams. The royalty revenues and the new ‘product’ revenues.

The royalties come primarily from GSK (the pharma giant), who use Innoviva licenses to sell drugs globally.

This revenue is likely to be gone by the early 2030’s so our focus must be on figuring out the likelihood of the new product-lines replacing this in time.

Before we dive into that it’s worth looking at how much ‘juice’ is left in that particular lemon.

Right now, the business holds around $366M in ‘royalty cash’, which includes actual cash and outstanding royalty invoices.

I also estimated (from the annual report) that there is around $960M in revenue remaining before the patent cliff expires.

This gives a total ‘remaining royalty value’ of roughly $1.35B.

This is interesting given today’s market cap ($1.40B) which is virtually the same figure, and the basis for the title of this post.

Anyway, the transition began in 2022.

They acquired Enstasis Therapeutics and the La Jolla Pharmaceutical Company, along with their product portfolios (drugs).

This is the core of the new ‘Innoviva Specialty Therapeutics’ platform (IST for short).

The focus of this new platform is on the treatment of ‘hospital-based, critical-care and infectious disease treatments’.

Basically their medications specialise in killing life-threatening bacteria that seem resistant to ‘normal’ drugs.

There are five drugs in the portfolio currently.

GIAPREZA, a vasoconstrictor used to increase blood pressure in adults with septic or other distributive shock.

XACDURO, which is targeted specifically for hospital-acquired bacterial pneumonia, which is a difficult-to-treat pathogen often resistant to other antibiotics.

XERAVA, which is used for treating complicated intra-abdominal infections in adults.

ZEVTERA, an advanced-generation antibiotic for treating blood infections, bacterial skin infections, and general bacterial pneumonia.

Zoliflodacin, is a first-in-class single-dose oral antibiotic for treating uncomplicated gonorrhoea, recently approved in December 2025.

This new platform has a high fixed-cost base.

So the first $150M of revenues are likely to generate zero FCF.

However beyond that point, we can expect 60%+ yield from every additional dollar in revenue.

In other words, once revenues have scaled up to breakeven ($150M ish), every $100M of revenue should convert into roughly $60M in FCF.

The Financials

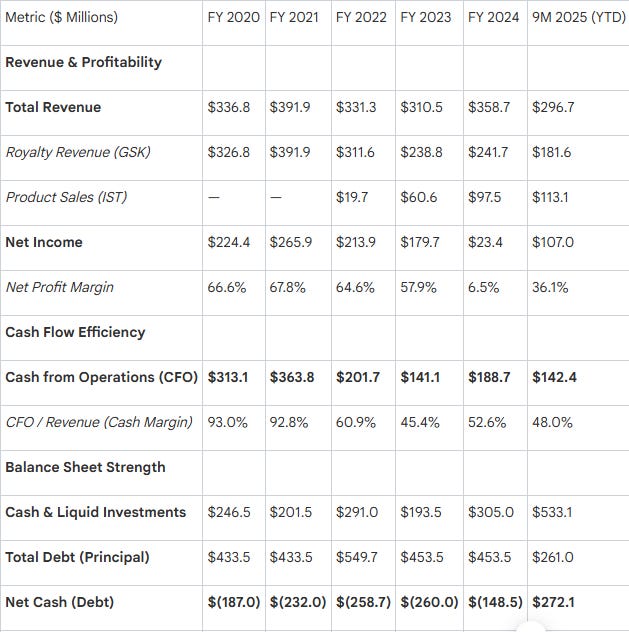

The following table kind of illustrates the business and its transition as recorded in the financials:

The story here is one of transition of revenues and cash-flow from stress-free royalties to a full-on commercial operation.

What interests me (as a private owner) is the fortification of the balance sheet during the process.

They seem to have decided on the plan, loaded up on liquidity, and then started executing.

This is exactly how I would initiate and manage a similar transition, if I was doing it myself.

I have no experience in pharmaceuticals of course, but the principle can apply to any business model or industry.

Historical financials are only useful to the degree they help us figure out how likely the transition will be.

This entire idea rests on how well management can execute the transition and get those product revenues growing…

As of the latest interim, almost 40% of revenues now come from ‘products’.

The IST income started at $0 in 2021 and grew to almost $150M (if we annualise the current interim figures).

Current growth rate is 46% YoY as of the interim. YoY growth in the last couple of hits has topped 60% per year.

A further 25% increase is required to hit that breakeven point (where revenues cover fixed costs of the platform).

To match current FCF levels ($240M per year), and annualising Q3 25 figures, requires roughly 165% growth in IST revenues.

Of course, all this is down to the execution of the core products (along with any new ones they acquire).

Here is how they’re going so far:

GIAPREZA is growing 40% YoY but capped to 2032, generics will be released after then.

XACDURO grew 99% YoY. If it continues at even half that rate it could hit $100M in 3-4 years.

ZEVTERA just launched in Q325. This has much higher potential than XACDURO because there are almost no competitors ( the only FDA approved solution).

Zoliflodacin was just approved on December 25. This is also huge potential because it’s a one of a kind solution.

They also have Royalty agreements in China for their products. These will generate supplementary income.

These are the things that matter here, aside from the strength of the balance sheet, imo.

It’s also worth a quick note on shareholder yield.

I like to use this as a proxy for overall dilution or (ideally) capital returns for minority shareholders.

SH Yield is negative due to SBC (increased employees) and dilution which is occurring currently.

Average 5Y SH Yield is 1% per year. Last year it was 0.5% and TTM is -0.8%.

This should be watched carefully over time, to ensure it doesn’t snowball into significant dilution.

In 2021, you’ll notice a massive ‘buyback’. This was simply Innoviva buying out the GSK stake, and not really anything to do with returning capital to owners.

I stripped this out, because it’s not repeatable and it was part of a ‘deal’ unrelated to buybacks in the traditional sense.

If you include that, the average yield looks more like 6%.

Why It’s Cheap

This is a pretty simple one.

The market can see the value of the remaining royalty stream but doubts the viability of the new operating business.

Buying the stock here (or lower) gives us a totally free bet on whether that new business is successful or not.

The Risks

This section is also similarly short and sweet.

The primary risk here is in the execution of the new product portfolio and in the acquisition and scale of future products.

There is also a big reliance on GSK for the next few years. Innoviva has no control over whether GSK sells their products or not.

If GSK decided to de-prioritize their products, this would see revenues fall dramatically. Obviously, this risk dissipates every year, but it’s still there for now.

The business also has significant debts, into 2028. Obviously, it has more than enough cash to cover this, but things can soon go wrong if they mess their allocations up.

In terms of us, the minority shareholders, there seems to be little risk of some involuntary delisting at ludicrous prices.

The largest holders seem to be institutional investors, along with Sarissa Capital (11%), which is a related party (they have seats on Innoviva’s board).

None of this poses any particular risk to minority holders (as far as I can tell).

The one thing that did concern me was a deal with Sarissa Capital a few years ago, whereby Innoviva invested $300M into a fund managed by Sarissa.

This was a disaster and Innoviva started liquidating this position last year (to be completed in 2026).

They ended up with $187.5M.

Not a great sign of capital allocation skills there. Not a major impact on the overall operations either, but definitely something to keep an eye on.

The Investment Case

Recent growth has been strong.

You can’t really argue with the capital allocation (into products) up until now. Everything is going up and to the right.

If it continues like this, then 2027 seems like a reasonable time-period for FCF from products to replace royalties.

The timing trick here is to try and buy the stock where the progress looks unstoppable, but the market remains sceptical.

Following the quarterly updates will be key.

I like this set up because the business has clearly already made far more progress than the market is giving them credit for.

Downside protection while waiting for this to play out is also pretty robust.

The cash and incoming royalties are about as secure as they could be, and provide a decent base, at today’s market cap.

Not only this, but the liquidity of the balance sheet provides a solid base for the transition to proceed unhindered.

In other words, the management team has everything they need to make a good go of the new business model.

The biggest catalyst in my opinion is the successful growth of the IST revenues, and converting that into sustained FCF.

However, I do also think Innoviva could be an interesting takeover target to a larger player.

They operate in a tight niche and appear to have some solid products. The float allows an activist to build a stake.

I wouldn’t be surprised to see unsolicited offers roll in at some point (regardless of whether management accepts).

What to Watch For

If you like this idea there are a couple of things to dive into more deeply:

First, the growth trajectory of XACDURO, ZEVTERA, and Zoliflodacin. These are the products most likely to generate the growth required.

They are all either growing fast or right at the start of their growth trajectory.

Following the updates and tracking the progress of these drugs will be a leading indicator of future revenues and FCF.

Secondly, the so-called fixed-cost base of the new IST platform.

For this to make today’s price a deep-value set-up, those costs really must be fixed and additional revenue really should be converted to cash at massive yields.

Progress is mixed but stabilising.

SG&A expenses were $27.3 million for Q3 25, a modest increase of 4% from $26.2 million in Q3 24.

While expenses are rising, the rate of increase is significantly lower than the 52% growth in U.S. net product sales over the same period.

This suggests that the company is beginning to achieve operating leverage on its commercial infrastructure, and those additional yields are in sight.

Keep an eye on the relationship between the cost base and the scaling revenues, quarter to quarter.

To be honest, this probably isn’t quite cheap enough for me, but it’s on my watchlist.

Should the price tank (while execution is still going well), I might be interested.

At today’s level, and given all the complexity here, my estimate of fair value is around $35 per share.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here