A UK stock trading at 30% of its fair value

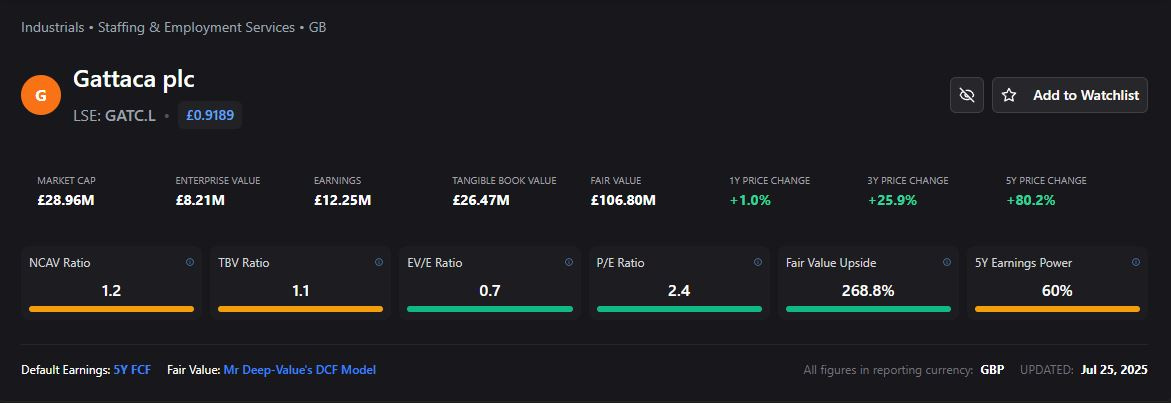

This stock currently trades at 0.7 x EV/FCF, 2.4x P/FCF and 1.1x TBV.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

When I found this stock it had a healthy looking 5Y FCF figure.

This was somewhat distorted by a large one-off change in working capital a few years ago.

I decided to continue with the investment because it was trading very close to TBV, and I knew the operating business was definitely worth more than nothing.

In early 2026 however, I found a better idea and needed the cash.

This stock was one of those on the ‘meh’ list, and so, I cashed it out to recycle the money into the new idea.

If there is a lesson here, it’s probably the idea that it’s usually better to keep cash liquid than invest it for the sake of being ‘fully invested’.

I almost always don’t make much when I do it, and its a big hassle to liquidate everything when I do find the better idea.

There’s nothing wrong with holding cash and waiting for the truly exceptional set-ups.

Publish price = £0.88

Exit price = £1.07

This equates to a gain of roughly 22%, which is fine in half a year. Especially considering that this wasn’t the highest-quality Idea.

I’ve left the original post below in case you’re interested to read it.

===

Original post published 25th July 2025:

===

Every so often, a stock shows up that’s so cheap, it’s suspicious.

This one trades at just above tangible book and at 2.4x earnings (5Y FCF).

And while the free cash flow profile has been erratic, it's been consistently positive over the last twenty years (80% of the time).

More importantly, the market is ignoring both the earnings power and the asset base.

You’re essentially paying fair value for the liquidation assets and getting the business for free.

It’s not a high-flyer. It doesn’t promise growth. But it does offer real-world downside protection and a rational path to upside.

Let’s take a look…

The Business: Gattaca PLC (LSE:GATC)

Gattaca plc (LSE: GATC) is a UK-headquartered staffing firm operating across engineering and tech sectors.

Originally founded in 1984 as Matchtech Group, the company rebranded in 2016 as Gattaca.

It operates through three main segments: UK Engineering, UK Technology, and International recruitment.

Most of its work is in contract and permanent recruitment, with additional services like employer branding, workforce compliance, and outsourced talent solutions.

Its brands, Matchtech, Networkers, and Resourcing Solutions, are fairly well known within UK engineering and telecoms staffing.

They work with clients in defence, infrastructure, public sector tech, and manufacturing. This isn’t a start-up pretending to disrupt HR.

It’s a specialist supplier with decades of operational muscle.

The business is headquartered in Fareham and led by CEO Matthew Wragg. It's had a mixed history, but it generates cash when the cycle turns, and that’s the point here.

The Deep-Value Set-Up

Let’s begin with the balance sheet. At the time of writing, Gattaca trades with:

Market cap: £29.0M

Tangible Book Value (TBV): £26.5M

TBV Ratio: 1.1

Net Current Asset Value (NCAV) Ratio: 1.2

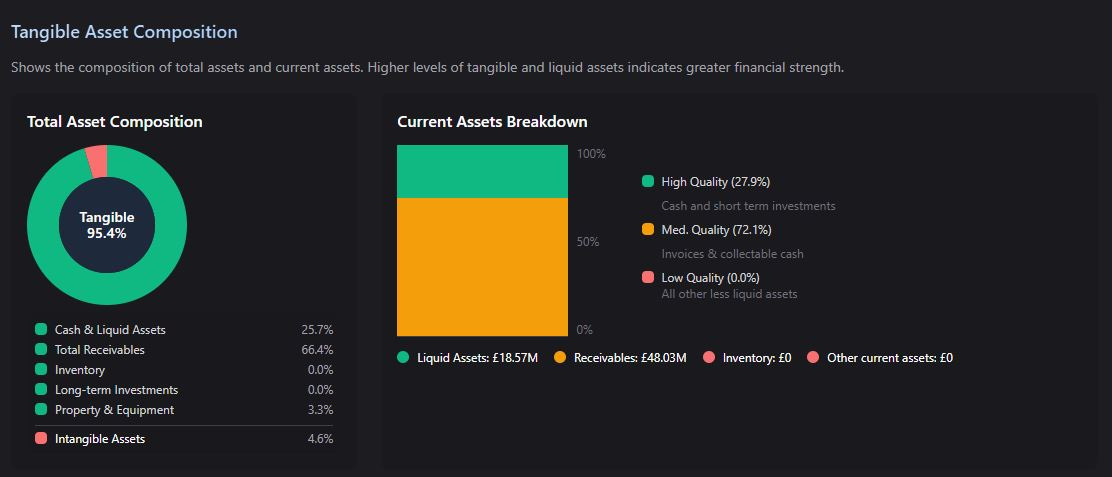

On an asset basis, this offers little downside risk.

You're paying roughly 1x tangible book, which sees the business basically trade at its scrap value.

A large chunk of the assets are also cash and liquid assets, which also compares very nicely to the market cap (£29m).

But the real asymmetry lies in the earnings multiple.

PE Ratio: 2.4 (5Y FCF)

Last year’s Owner Earnings: £2.37M

Last year’s FCF: £3.24M

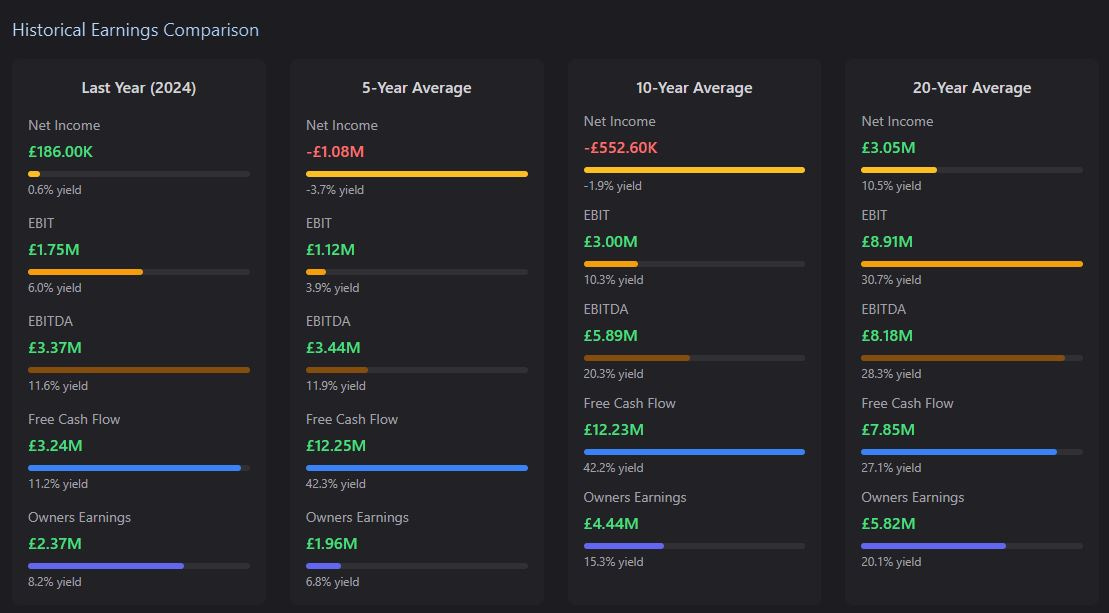

Owner earnings and free cash flow are both positive, not blistering, but respectable.

The most recent 5 year average (£12.25m) is inflated by a one-off cash-influx that occurred during COVID (They used invoice factoring to speed up collections).

But the 20 year average FCF figure is still almost £8m, with a single year FCF figure of £9m in 2023.

It is slightly inflated but definitely not radically different from ‘normal’ FCF levels over time.

In other words, if you bought the entire business for its current market cap, you could most likely recoup your investment from free cash flow alone in around three years.

There is no financial alchemy needed here. You’re buying a pound coin for £1, but that coin spits out cash dividends most years.

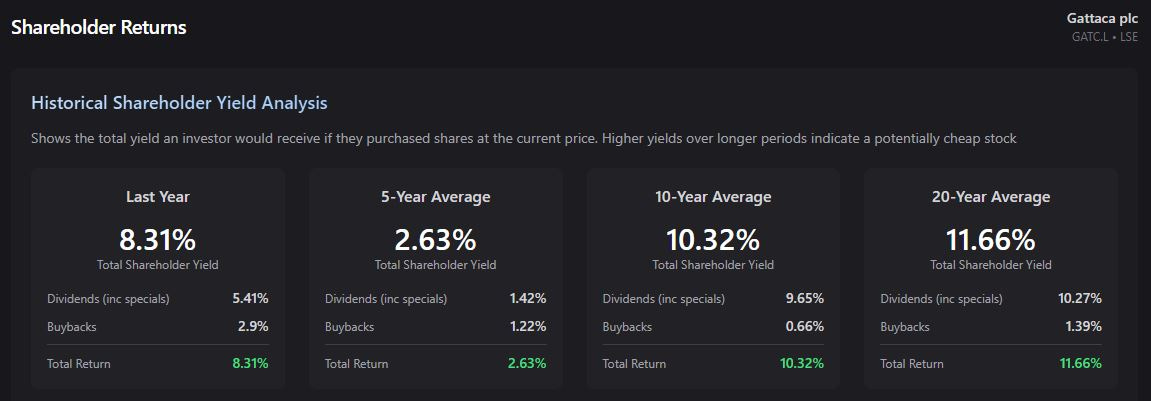

In fact, based on todays market cap, the average shareholder yield is currently 8.31%. The 20 year average is 11.66%.

The business isn’t sexy. But that’s kind of the point.

It's a mature, semi-cyclical staffing firm. But the market seems to have priced it like it’s going out of business, which it's not.

The Stock Price

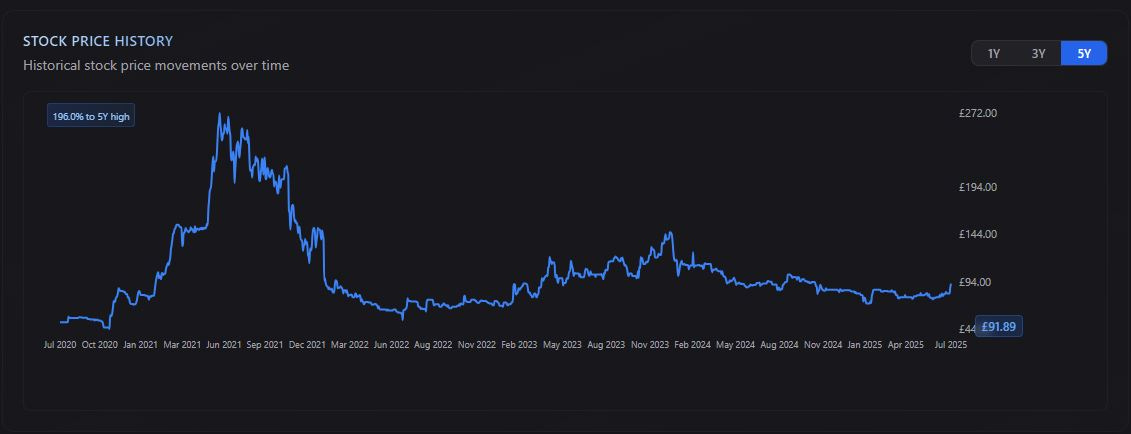

The stock price dropped from its 5-year peak of £2.60 down to around £0.71 by early 2025.

The main reasons were the falling profits from the business (last year FCF was half the 20 year average).

The market was also concerned about the staffing sector. These concerns have recently been exacerbated with the development of AI.

This drop pushed it well below its fair value and even below its liquidation value.

This is always a sign that the market has mispriced the business OR it’s about to go under.

Gattaca is cash-rich, cash-flowing and healthy. There is almost no chance that it goes out of business any time soon.

This sets it up as a catalyst magnet — a stock that has already exited the dead-zone and could easily re-rate higher once sentiment catches up to fundamentals.

But first, as ever, let’s look at what could go wrong.

The Risks

First, the staffing industry in the UK is cyclical and competitive.

Engineering and tech hiring have been weak post-COVID, and margin compression across the industry has made most players look worse than they are.

Second, Gattaca’s historical performance has been patchy.

The company swung to losses during downturns in the past, including a rough stretch between 2020–2022. Investors remember that.

Third, the business has lacked a strong narrative. There’s no AI angle. No SaaS multiple. Just contract recruitment and payroll processing.

That said, recent results show stabilisation:

Positive free cash flow in FY23 and FY24

No material debt

Tangible equity covers the market cap

A new management team (Wragg took over the CEO role in 2022) appears to be focused on operational efficiency, not empire-building

In short: this isn’t a melting ice cube. It’s a cyclical operator with a cleaned-up balance sheet and some dry powder.

I don’t see anything right now that leads to the terminal decline of this decades old business.

Catalysts

A few things could unlock the valuation:

Cycle recovery in UK engineering hiring: As infrastructure and defence spending rebound, Gattaca’s contract business could benefit.

Dividends and buybacks: With positive cash flow and no debt, returning capital to shareholders is a logical next step, and they have a good history of dividends.

Acquisition target: At 1x TBV, it’s a classic “bolt-on” candidate for larger recruiters and the industry is ripe for M&A.

Re-rating based on earnings: A move from a PE of 2.3x to even 5x would be enough to double the share price.

There’s no rocket fuel here.

But there are enough quiet tailwinds to support a reversion to fair value.

A Note from Mr Deep-Value

Gattaca is a mature, cash-generating staffing firm that:

Trades at just 2.3x trailing earnings

Sits close to tangible book value

Has positive free cash flow and owner earnings

Operates with no material debt

This isn’t a growth story. It’s a mispricing story. And it’s hard to find a rational scenario in which you lose much money at this level.

You get the assets. You get the earnings. And you get them at a discount.

This stock is part of my portfolio. I purchased shares near current levels and plan to hold until it re-rates toward fair value.

My earnings figure is based on the 5Y Avg FCF cross-checked for consistency.

Currency and valuation metrics have been standardised in GBP, and all upside projections are based on conservative DCF assumptions with zero growth and a strong margin of safety.

This is a real-world, investable opportunity that fits perfectly into my model:

A stock that’s cheap to both assets and earnings, with clear downside protection and multiple paths to upside.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here