A Japanese Net-Net for 1.6x FCF

A business priced for liquidation that's far from dying.

Get a 90% discount off Bloomberg’s No.1 competitor. Get a 30-day free trial here

Today’s business is being priced like it’s worth more dead than alive.

In fact, the current market cap implies that the tangible assets alone are worth around half of their stated value.

This is the type of extreme valuation that Benjamin Graham focused on during his ‘net-net’ era.

The reality, however, is quite different.

For example, this business is not bleeding cash. It’s profitable and cash-generative.

The tangible assets meanwhile are mostly cash and liquid assets.

On top of all this, revenues have actually grown through 2024, 2025, and TTM.

The market is pricing this business for liquidation or failure, while the reality is a stable, profitable manufacturer with a fortress balance sheet and growing diversification.

Here are the valuation ratios:

NCAV Ratio = 0.8

TBV Ratio = 0.5

EV/5Y FCF Ratio = 2.5

P/5Y FCF Ratio = 8.8

EV/FCF Ratio = 1.8

P/FCF Ratio = 6.3

EV/TTM FCF Ratio = 1.6

P/TTM FCF Ratio = 5.8

What’s pretty obvious from these ratios is that the earnings power of the business is fairly stable and actually improving.

This is unusual for a business priced at literally half its liquidation value or even below the value of its net-current-assets alone.

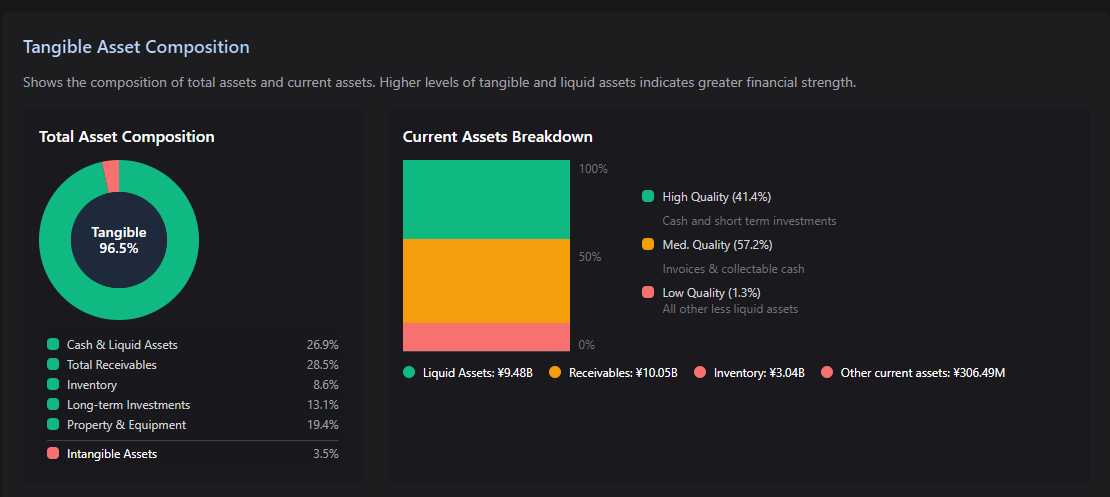

Meanwhile, those assets look pretty decent too…

Almost entirely ‘tangible’ and mostly highly liquid.

This is also a pretty simple situation.

The FCF figure is relatively straightforward with no major adjustments required to reflect the ‘owners earnings’ formula.

The Shareholder yield is steady but small.

The company pays a rigid dividend every year that seems fixed, regardless of performance.

This is nice but the yield is around 2.4% per year.

We get paid to hold this stock, but it’s nothing special.

On the flip side there is zero dilution going on and zero SBC activity either, so that 2.4% yield is real and true.

Best of all, there is no major risk from concentrated owners. No one owns enough of a stake to force an involuntary delisting.

There is plenty of free-float for an activist to take a position.

If you like undervalued businesses that have a huge, asset-based margin of safety along with strong, healthy earnings yields, this one is worth a look.

Let’s dive in…

The Business

Dainichi Co (5951.T) is a Japanese manufacturing company, founded in 1964 and specialising in heating equipment.

They primarily sell oil fan heaters (flagship product) and environmental equipment (air purifiers and humidifiers etc).

The business handles the development, manufacturing and sales of these products and is (according to management) the market leader in oil-heating devices in Japan.

They report revenue across three segments.

These are ‘heating equipment’ (68.1%), ‘environmental equipment’ (25.4%), and ‘other’ (6.5%).

The core heating business produces and sells oil fan heaters, which are renowned for their ability to heat up a room rapidly.

However, they also sell things like electrical heating equipment and gas fan heaters to complement the main products.

The ‘other’ segment is basically coffee machines along with sales of parts and components.

They don’t sell their products directly to consumers.

Instead, they sell through major electronics and retail chains across Japan.

The three largest partners (by revenue) are K’s Holdings Corp (11.8%), Kakuda Wireless Electric Co (10.9%), and Yamada Holdings Co (10.4%).

One thing that jumped out to me was the fact that there wasn’t as much concentration risk as is typical in similar Japanese businesses.

As you probably guessed, almost all revenues come from the Japanese market (90.7%), with 7.3% from Europe and 2% from the rest of Asia.

The business is highly seasonal.

Because heating equipment makes up nearly 70% of sales, revenue is heavily concentrated in the second half of the fiscal year (October to March).

The company typically builds inventory during the first half (April to September), resulting in cash outflows, and generates the bulk of its sales and cash inflows during the winter months.

Obviously, oil fan heaters are a declining industry.

This has led the company to evolve away from the flagship product more and more and into the more future-proof environmental segment.

The heating business also struggled recently thanks to warmer weather and sales in that segment declined by 6.0% in FY25 alone

Despite the heating decline, the company grew total revenue in FY25.

This was driven by the Environmental segment (humidifiers and air purifiers), which surged 28.6% year-on-year due to dry weather and influenza outbreaks in Japan.

This period proved the viability of their diversification strategy.

The non-heating business successfully carried the company when the core heating business struggled.

TTM figures also suggest a continuation of this success.

For example, sales for the six months ending September 2025 increased 6.6% and Operating Profit tripled.

Dealer inventory levels normalised, meaning retailers needed to restock after clearing inventory last year, and exports of oil heating equipment grew.

Going forward, management has a clear plan involving product diversification and manufacturing efficiency.

The main goal is to increase the sales composition of environmental equipment to reduce the company’s susceptibility to warm winters.

They have been busy with this goal for a few years.

In October 2022, Dainichi re-entered the air purifier market after a 15-year absence, launching hybrid models that combine their quiet-fan technology with filtration.

In October 2019, they began contract manufacturing fuel cell units (tanks) for Kyocera, securing stable year-round work to smooth out seasonal factory usage.

The surge in sales recently prove that these moves are bearing fruit.

Next, they’re focused on making their products ‘high-value’ rather than ‘the cheapest’.

Between FY22 and FY25 they launched a few new products to address specific customer pain points and build a little moat around their brand.

These features have allowed them to maintain dominance in the niche oil heater market and maintain margins despite rising material costs.

Overall, they are aware that oil based heating is declining and have successfully focused on maintaining dominance in the niche, while expanding to the environmental segment.

The Financials

The cash-generation of this business is a lot like running a crop farm. First they sow their seeds and then they harvest the produce.

Dainichi spends the first half of the year (April - September) building its heating products for sale during the second half of the year (winter).

This shows up in the financials pretty clearly.

In the interim report (April to September 2025), the company had a negative operating cash flow of -¥5.57B.

This wasn’t because the business was struggling; it was because they spent cash to increase inventory.

If you look at the full year (FY25), the company generated a massive ¥2.82 billion in positive cash flow.

The cash pile refills, covering the costs of the ‘sowing season’ and leaving a healthy profit.

With business models like this it can be very misleading to look at an interim report and try to judge the performance of the business.

It’s also a classic example of why I often use multi-year FCF figures.

The balance sheet is a fortress of liquidity, and pretty simple in its composition.

For example, the liquid assets total around ¥11.25B.

This is made up of cash and marketable securities that can be sold quickly.

This is offset by total liabilities of just ¥3.23B. They also have virtually zero interest bearing debt.

If Dainichi stopped selling products tomorrow and had to pay off every single penny it owed, it could write a check for all its debts (¥3.23B) using its liquid assets (¥11.25B) and still have ¥8 billion left over.

Dainichi’s Equity Ratio is 87.6%.

This means nearly 90% of the company’s assets are owned free and clear by the shareholders, with very little leverage or debt.

The financials show clearly that Dainichi is a high-quality, niche manufacturing business disguised as a distress situation by the market price.

It is financially bulletproof and operationally sound.

Why It’s Cheap

I think there are two main reasons that this stock is cheap relative to the value of the underlying business.

Firstly, the market likely views the company’s massive cash pile as inaccessible to minority shareholders.

The company holds net cash and securities far exceeding its operational needs.

Despite this, the pay-out ratio is often low (e.g., 24.3% in FY21, 29.4% in FY23).

The Return on Equity (ROE) is also structurally suppressed, ranging from 0.5% to 6.2% over the last five years.

On paper this looks dreadful, but it’s masked by the cash-pile.

If we strip out all the excess cash and leave in only the cash that is required for working capital, the ROE figure is over 9% for FY25.

This is one of the loudest arguments for something being a ‘value-trap’.

Secondly, the core business is in secular decline. People are switching to electrical based heating instead of oil.

The business is heavily reliant on kerosene oil heaters (almost 70% of sales).

As Japan pushes for decarbonization and electrification, the terminal value of an oil-burning appliance business is viewed with scepticism by the market.

The stock is cheap because the market sees no catalyst for the realization of its intrinsic value.

While the company is rich in assets, the reports show a management team focused on survival in a shrinking industry (oil heating) and maintaining a fortress balance sheet.

Right now, there isn’t any stated goal to return any of this excess capital back to shareholders.

These two things above all else are most likely holding the price back to some degree.

The Risks

Apart from the general risks like the weather (warm winters etc) and cost-price volatility (inflation, geo-politics etc), there are some specific risks to Dainichi.

These are the risks that come with having all their production centralised in one location in Japan.

If there is a disaster such as an earthquake or flood or fire, then production would be 100% stopped immediately.

You don’t need me to tell you that this is bad for business.

The other big red-flag for me is in the fact that the world is obsessed with decarbonisation.

As Japan targets carbon neutrality, regulations could eventually ban or penalise kerosene heaters.

The company is diversifying into fuel cells and air purifiers, but these segments are not yet large enough to replace the core heating business earnings.

There is some risk from the ownership too.

For example, if we strip out the treasury stock, the total voting power of the majority owners rises to 50%.

This is enough to sway big decisions however in Japan you need 90% or 66% (depending on how you do it) to actually force it through.

They don’t have this and it would likely be tricky to get that kind of extra support from remaining shareholders at an absurdly low price.

Overall I’m not concerned about the risk of involuntary delisting, but it’s worth keeping an eye on how that 50% control fluctuates over time.

For me, the biggest thing that would build conviction here is the development and growth of the environmental segment.

They needs to replace all revenue from oil heaters and other things that use fossil fuels.

From the available information, they seem to be making sturdy progress in that area.

The Investment Case

It’s worth noting that despite the low stock price (relative to value) the price itself has reacted to positive developments.

For example, the growth in revenues and the new segment was behind a 48% stock-price increase over the last year.

This is a little-known feature of cheap stocks.

Even if they stay ‘cheap’ on an absolute basis, the price appreciation YoY can still outpace the general market due to the sheer amount of upside potential.

Over the last 12 months, the stock increased almost 50% despite the current price valuing the business below its NCAV.

If nothing else, holding a basket of extremely cheap stocks, can and does still beat the market quite effectively over time.

The good news is that this upside potential for the coming years is very much still present in the set up.

At the current market capitalisation of ¥15B, the investment provides exceptional downside protection (still).

You are effectively buying a bank account and getting a factory (and all its products) for free.

The company holds ¥11.25B in highly liquid cash and securities (Cash ¥2.27B + Securities ¥5.83B + Investment Securities ¥3.15B).

This liquid pile alone covers 75% of the purchase price.

From a purely rational perspective, the stock seems priced for death or (best case) permanent stagnation.

Literally any positive business update will be enough to generate significant upside.

A single severe cold snap can clear inventory and spike operating margins, as seen in FY21 when Operating Profit surged 1,012%.

A cold winter acts as a natural, unpredictable catalyst that can rapidly generate the type of positive update we need.

The company is also hoarding cash that generates minimal returns.

With a TBV ratio of 0.5, the company is a prime candidate for pressure under the Tokyo Stock Exchange’s initiative to improve capital efficiency.

A change in policy toward higher dividends (currently flat at ¥22) or share buybacks would force a mechanical re-rating of the stock price.

This pressure is real and becoming more and more impactful on the decisions of businesses such as Dainichi.

An activist position or even management buyout is an option too. The structure would most likely require a ‘reasonable’ offer rather than an opportunistic one.

This could be another catalyst to upside.

What makes this most attractive is the massive discount to assets and the fact that the business almost certainly won’t die anytime soon.

Related to this is the fact that it’s possible for any of the three main catalysts to play out (turnaround, buyout, special return).

Therefore the longer the business trundles along and stays cheap, the more chance of something happening to rerate the stock.

If you’re interested in this setup, the TBV price is around ¥1850 per share.

While I would consider this a better idea than investing into a major index, I do have better ideas that my capital is allocated to.

If you like this type of setup and want to see exactly what I’m holding myself, you’ll probably like the annual subscription plan.

It saves you 20% but also gives you exclusive access to bonus content that’s unavailable to standard monthly subscribers.

Learn more about the bonus content here.

Get a 90% discount off Bloomberg’s No.1 competitor. Get a 30-day free trial here