A Growing Business With 80% Upside

Also trading near liquidation value with consistently profitable and growing FCF.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Most days I’m searching for cheap stocks.

I start by looking for obvious signs and then dig deeper from there.

I like to mix it up and avoid following a rigid ‘screener’ style process. It’s amazing how often you find little anomalies.

For example, I might wake up and decide to hunt for businesses that have large net-cash balances relative to their market cap.

When I find one, I’ll then download the reports and start reading.

The goal is to see if the cash-flows would be available to me as an owner and the likelihood of the business still being here in the foreseeable future.

I ask myself how confident I am that the business will generate the current market cap in future-FCF before it dies.

The more confident I am, the cheaper the stock must be.

Here are the ratios for today’s business:

NCAV Ratio = 1.4

TBV Ratio = 1.1

EV/5Y FCF Ratio = 3.5

P/5Y FCF Ratio = 8

EV/FCF Ratio = 3

P/FCF Ratio = 7

These metrics tell me a few things.

First, the business is very liquid and healthy with very few major liabilities. This business probably isn’t dying anytime soon.

Second, the operating business is priced like it will decline over the foreseeable future.

Third, the business and its cash-generation actually seems to be growing.

This immediately indicates a disconnect that could provide a nice re-rating in the next couple of years.

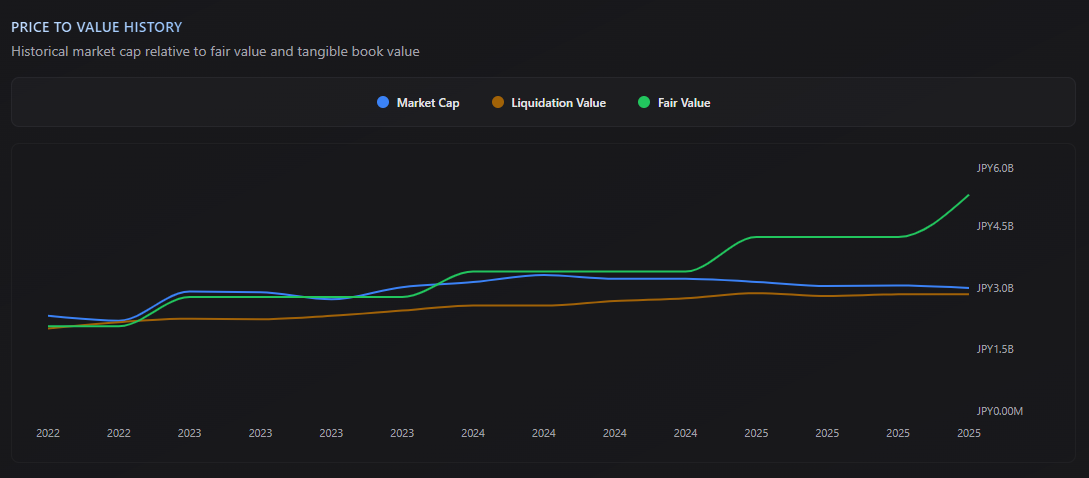

Then, there is this:

As you can see, the fair value of the business seems to be increasing significantly.

The stock price on the other hand, hasn’t kept pace.

Given the historical relationship between stock price and fair-value, it seems to me that there is some room for upside.

In fact, after a quick tap on my big-buttoned calculator, it seems the stock should rerate around 80% to close this gap.

Interestingly, this also correlates pretty much perfectly to how I’d value this business in the real-world.

Therefore, we have a business priced for decline while it’s actually growing YoY.

To make money, we don’t need the growth to continue.

We simply need the business to maintain the new levels of revenue and cash-flow over the next few years.

Let’s take a look…

The Business

Care Service (2425.T) is a Japanese company founded in 1991. Their head-office is in Tokyo.

They mostly operate in Japan (90%) with a small subsidiary in China covering the rest.

The business earns fees for providing care-related services and operates two core segments.

The first segment is what they call ‘At-home care services’ and the second segment is called ‘senior comprehensive services’.

The at-home side is basically where they travel to the client and provide services like assisted-bathing, changing of bandages, care-planning, and similar services.

All the stuff you’d expect from a nurse coming to your home to help out.

The senior stuff is a bit weirder.

This basically involves preparing dead people for their funerals and clearing up the places they died in.

Not a job I’d like to do, but I guess someone has to do it.

The annual reports actually break down the revenue sources within these two segments.

In most years, the largest revenues come from day services, assisted bathing and the funeral prep.

This is one business model that seems to line up nicely with the massive aging population of Japan.

Demand for this type of business isn’t going to ‘die’ (sorry) anytime soon.

Overall revenues are split 72% from the at-home care and 28% from the funeral and related services.

Another interesting feature of the business model is that payment comes mostly from insurance companies, businesses (funeral homes etc) and the Japanese state.

These entities bring Care Service in, and then Care Service invoice these clients and get paid under standard payment terms.

This adds a certain level of stability to the business.

Over the last 5 years the business has trundled away, doing its thing.

During that time, revenues have increased consistently from ¥8.7B (2021) to ¥9.54B (2025).

Operating cash-flow has followed along even more impressively, from ¥340M (2021) to ¥554M (2025).

This suggests that not only have the numbers grown, but the margins have improved too.

Remember, this is a business currently priced for decline.

Overall, this looks like a solid, operationally sound business that is slowly expanding while improving its margins.

The Financials

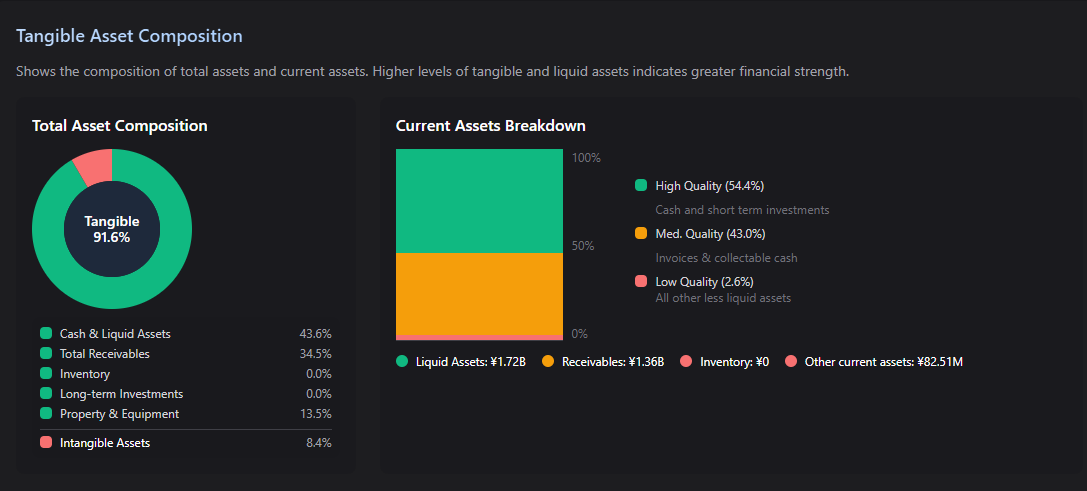

The financials are pretty simple.

The company does work and then invoice their clients.

This means that a lot of the current assets (35%) are unpaid invoices that move working capital around from year to year.

This is fairly low-risk because the clients are mostly good-payers (government and large corporations) and invoices are mostly due within 60-days.

Most of the OCF (aside from WC changes) comes from the core businesses cash-engine, which is nice and simple.

Another interesting feature is the lack of capex spend.

This business doesn’t require a lot of ongoing maintenance to generate its cash or growth capital to expand its footprint.

In FY25, the OCF was ¥554M but the total Capex was only ¥145M.

What this means in the real-world, is that the business can scale up its operations, across different locations, without actually needing to buy any land or buildings.

The downside of this model is the high-cost of labour.

They need people to carry out the work, and labour costs can be a real drag on scaling revenues.

This is because they generally need to find staff, train them and increase wages in line with competition and inflation to keep them.

The balance sheet also looks pretty solid.

It’s almost all cash or invoices (due in 60 days).

They don’t own much free-hold property and there doesn’t seem to be any hidden assets off-balance sheet that I could find.

In fact, I couldn’t really find anything in the financials that looks strange for what Care Service is.

It seems like a classic, conservatively operated Japanese business.

Why It’s Cheap

This business has never traded much above its fair value, even though it’s always traded pretty close to it.

It’s a really boring, small business that isn’t going anywhere fast.

This is probably the main reason the business has never traded at high-multiples.

However, I think there are a couple of reasons why the current price hasn’t caught up with the real improvement in the business.

Either it hasn’t noticed (which is quite likely with a business this size), or it has noticed but doesn’t believe it can be sustained.

Digging in the reports I found a few instances where impairment losses have been recorded.

This means that some new sites didn’t bring in the revenues required to justify all the leasing and staffing costs.

None of these impairments are really massive or significant, but it probably helps explain why the market is hesitant to rerate the stock.

The Risks

Care Service is exposed to some general risks.

First, the sector is labour-intensive. Services cannot be delivered without qualified staff, and staffing levels are regulated.

Shortages, higher wages, and training costs can quickly reduce margins, even if demand remains strong.

Second, much of the revenue is linked to public insurance and reimbursement systems.

Changes in reimbursement rates, service classifications, or compliance rules can reduce revenue per service without warning.

Third, operations are exposed to health and safety disruptions.

The reports describe how infections and outbreaks can force temporary service suspensions, especially at day-service sites.

These interruptions reduce utilisation while fixed costs continue.

Finally, this is a high-compliance industry.

Failure to meet staffing ratios, reporting requirements, or operational standards can result in service suspension or loss of designation, directly cutting off revenue.

But, everyone in this industry is exposed to the same risks, so they aren’t really something to worry about beyond mitigating them with reasonable measures.

In terms of business-specific risks, there isn’t really anything that stands out.

This business is just ticking along and leaning into the high structural demand that is likely to exist for a long time into the future.

There is, however, a risk to minority shareholders.

The ownership structure is controlled by a large, long-term shareholder along with the founder of the business.

The free-float appears to be around 30%, which isn’t enough to do anything with.

This naturally leaves us exposed to involuntary delisting.

I have to admit that Japanese companies pose a lower risk of this than stocks on other exchanges.

This isn’t something I’d be too concerned about here, but, of course, anything that can happen will happen… eventually.

Where to Build Conviction

If you like this idea, and want to dig in a bit deeper, there are a few places I’d suggest looking.

First, the site-level economics.

Try to understand how many sites are highly profitable, marginal, or loss-making, and how sensitive those economics are to staffing levels and wage changes.

This is the single most important determinant of long-term cash sustainability.

Second, I’d dig a bit more into the capital allocation behaviour of the controlling owners.

The goal is to assess whether minority shareholders are likely to share fairly in future cash generation or whether value could remain trapped.

These are the two areas most likely to build conviction or reduce it, depending on what you find.

The Investment Case

Most of today’s market cap is covered by invoices that are due in the next couple of months and cash.

The operating business is also growing YoY and the OCF margins are growing at slightly better rates than the revenues.

This is an improving business that is priced like it is declining.

At this price, we don’t need anything magical to cause a re-rating. A couple of positive updates will do it.

Those updates simply need to show the business sustaining the recent levels it has grown to.

Any further growth, will just make the re-rating that much sharper.

What makes this even more compelling is the fact that the business doesn’t require any major capex spending to fund those expansions.

Finally, despite being conservative, the management team have increased dividends as the business has generated cash.

In 2021 the total dividend was ¥26.2M and last year it had increased to ¥61M.

This is a CAGR of almost 23% in the dividends over the last 5 years.

Meanwhile, the stock price hasn’t really gone anywhere.

In other words, the business has meaningfully improved in multiple ways, but the stock price hasn’t recognised any of it.

The Likely Catalysts

If you like this idea, and want to buy some stock, there are a few things that will likely cause the re-rating.

The top thing will be either sustained revenues and OCF or continued growth in those areas.

Even just a few periods of positive performance are probably enough to provide a very satisfactory return on an investment at today’s price.

Specifically, look out in the reports for continued expansion to more sites, and track how these perform.

It’s unlikely there will be a buyout or an activist takeover, because of the shareholder structure.

However, there is a small chance that cash may be returned via a buyback or, more likely, a special dividend.

The pattern over recent years has been management carefully increasing the dividend, pretty consistently.

However, with the governance changes kicking in across Japan, and the cash-rich balance sheet, there is a chance that a special might be paid at some point.

For anyone interested, I estimate the fair value of Care Service to be around ¥1391 per share.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here