Negative enterprise value with positive FCF for 18 years

You get paid to buy a business that has been churning out cash for almost two decades.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

I decided to exit this stock at the beginning of 2026 because I found a better idea.

The problem with this one was the fact it had a few legal cases hanging over it’s head, and the fact that, in the worst case scenario, the liabilities exceeded the cash.

I still don’t think the worst case will play out, but I just wanted to free up some cash and this was the least-conviction set up.

The lesson here is maybe that the quality of uncertainty is important.

In this case, the business was very cheap and cash-flowing, but it was also being hammered from multiple angles legally.

This is much more difficult to build conviction in than something like a dip in revenues because of a product recall.

All uncertainty causes the stock price to fall.

But, some uncertainties are much easier to read and predict than others.

This sums up why I took the loss to load the capital into the other idea.

Published Price: 2.98

Exit Price: 2.07

This equates to a 30% loss, which isn’t ideal, but not really significant in the grand scheme of things.

===

Original post published June 16th 2025:

===

Imagine a business that spits out cash, trades below its net cash balance, and is priced as if it has one foot in the grave.

Now imagine that same business has survived two decades, paid out extraordinary dividends for most of that time, and remains solvent, liquid, and intact.

That’s the setup we’re looking at today.

This stock is priced at less than its liquidation value, trades at under 5x average free cash flow, and holds more cash than its market cap.

In other words, you’re paying for the cash and getting the business for free. It’s the kind of mispricing that shouldn’t exist in a rational market.

But it does. And it’s precisely the kind of setup I live for.

Let’s dive in…

About the Company

The business in question is bet-at-home.com AG (XETRA: ACX.DE), a Düsseldorf-based online gambling operator founded in 1999.

It runs sportsbook and casino operations across Europe, serving a mix of sports bettors, casual gamers, and casino players.

Its business model is straightforward: attract users through brand awareness and promotions, generate betting revenue, and take a cut of the action.

While competition is intense, the company has historically maintained profitability by focusing on markets where it holds regulatory licenses and leveraging a lean, digital-first cost base.

Bet-at-home is a subsidiary of the BetClic Everest Group, which offers additional back-end and operational support.

The group has kept bet-at-home publicly listed while streamlining operations over the years, including exiting unprofitable geographies.

The Deep-Value Opportunity

Let’s get straight to the numbers.

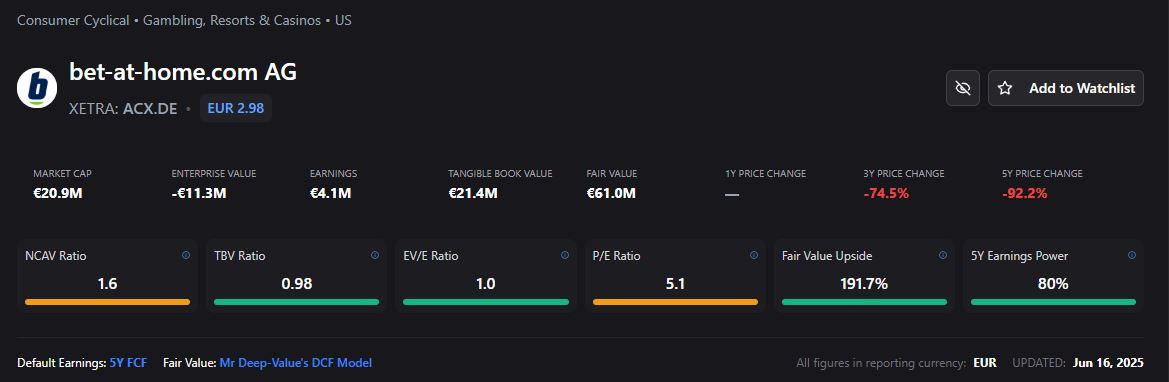

Market cap: €20.9 million

Net cash: €32.3 million

Tangible Book Value (TBV): €21.4 million

5Y average Free Cash Flow (FCF): €4.1 million

Current price: €2.98/share

On a trailing basis, the stock trades at just 5.1x average FCF.

On an EV basis, once we account for net cash, the multiple drops into the negative, which tells you that the market is valuing the enterprise at less than zero.

It also trades at 98% of tangible book value and at 63% of net cash.

Put differently, for every euro you spend buying the stock, you get more than a euro of cash and assets.

The NCAV ratio is 1.6, providing a healthy buffer against insolvency.

This is the definition of a valuation floor. Even if the business halts operations tomorrow, the assets alone could be liquidated at a profit to today’s price.

Using our conservative DCF model with zero growth and a standard discount rate, we derive a fair value of €61 million, implying 191% upside.

That’s without baking in any recovery or turnaround.

The Stock Price

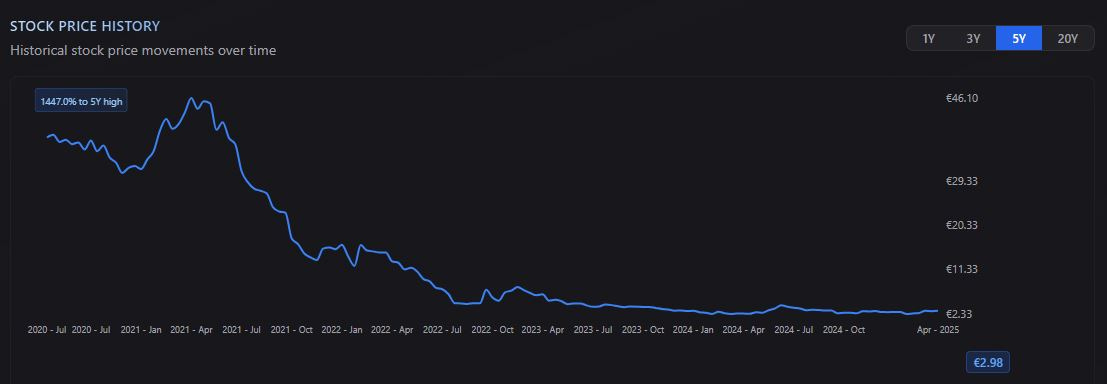

The past few years haven’t been kind to shareholders.

3-year price change: -74.5%

5-year price change: -92.2%

The price chart resembles a melting ice cube, but with a twist: the core remains frozen.

Despite market pessimism, the business has stayed liquid, maintained net cash, and avoided dilution or debt spirals.

Investors have fled, assuming the worst. That creates our opportunity. When prices collapse but assets remain, mispricing follows.

For deep-value investors, this is familiar ground.

The Risks

So why is it cheap?

Earnings have dropped off a cliff in recent years. Regulatory tightening across Europe has squeezed margins, and the business exited certain geographies under pressure.

The 2022-2024 period included negative net income, cost restructuring, and operational reset.

However, free cash flow remained positive, albeit modestly.

The business didn’t implode.

It simply shrank. Like many others in the gambling space, bet-at-home is transitioning to a more focused, compliant, and margin-conscious model.

Management appears realistic. There’s no overpromising. Costs have been cut, and the cash pile has been preserved. They’re not betting the farm, they’re sitting on it.

Catalysts

Reversion to the mean: Just a modest recovery in FCF back to the 5Y average would reset investor expectations.

(Earnings are well below the 18 year average and even the 5 year average)

Shareholder activism or buyout: With 150% upside to fair value and net cash exceeding market cap, the setup is ripe for an activist or acquirer.

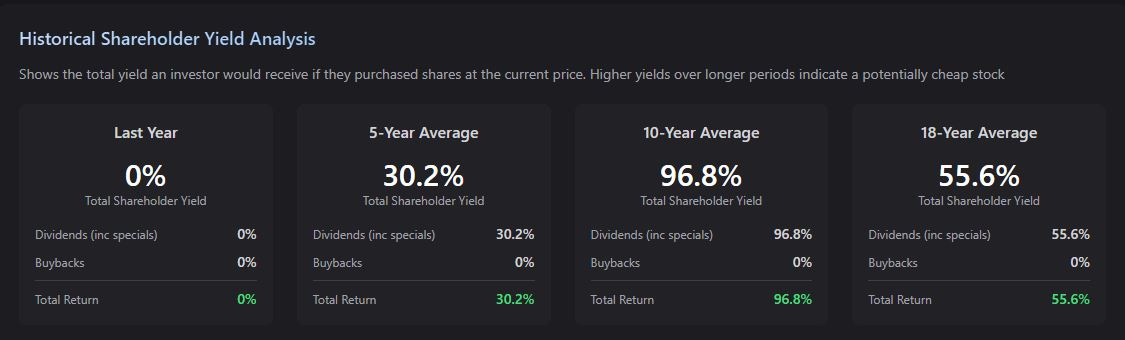

Return of dividends: Historically, this was a dividend machine. A reinstatement would signal confidence and attract yield hunters.

(At today’s price the historical dividend yield is insanely high.)

Sector tailwinds: As European regulation stabilizes, operators with cash and compliance get stronger. We’re seeing that shakeout play out.

We’re looking at a business that’s cheap to assets, cheap to earnings, and fully liquid.

The price implies a terminal decline, but the fundamentals suggest otherwise.

This is a classic deep-value setup with asymmetric return potential and real-world downside protection.

A Note from Mr Deep-Value

This stock is in my portfolio. I’m holding until the price returns to fair value, which I calculate using a 5-year average free cash flow of €4.1 million and a no-growth DCF.

Currency and market cap figures are standardized in euros, using a clean EV model that strips out noise.

This isn’t a hypothetical exercise. It’s a real-world opportunity with real-world money on the table.

Sometimes, you really do pay for the cash and get the rest for free.

Mr Deep-Value also offers:

Dirt-cheap access to Bloomberg’s No.1 competitor

Separately managed accounts for US clients