A Profitable Landlord Trading Below Property-Value

It's net-cash is 32% of the current price and it's generated positive FCF for 17 years straight.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Today’s stock is an interesting set-up.

Here are the headline valuation ratios before we start:

NCAV Ratio = 7.5

TBV Ratio = 0.8

EV/5Y FCF Ratio = 5

P/5Y FCF Ratio = 8

However, this situation requires a bit more analysis in order to get an accurate picture.

It’s one of those rare instances where I’m comfortable using a 20-year horizon for building a valuation.

I also included a terminal value to the calculation.

The market cap is just €33.47M and the enterprise value is around €22.2M.

The average FCF over the last 5 years is around €4M per year.

In addition to this, they have net-cash of €10.5M and the fair market value of their main building asset is currently €35.6M.

So, we pay €22.2M today (EV) and get a €35.6M property asset and all the future income it generates.

This seems like a good deal, so I decided to dig in further.

For clarity, I’m using the following logic to value this particular set-up, which you may or may not agree with.

First, despite trading below TBV, I’m not treating this business as a liquidation play.

If I was buying this business in the real-world, it would be the potential longevity of the business that would excite me most.

Therefore, I’m assuming it continues on for the foreseeable future, and valuing it as such.

To value this, I’m using three distinct components.

First, the extractable cash-flows that the core business generates. The ongoing FCF is likely to be lower than the 5Y average because they recently sold an asset.

The ongoing FCF is most likely to be more like €3M.

However, I’m assuming zero growth in this over the next 20 years (even inflation growth). This is deliberately conservative.

Second, the interest income earned on the net-cash, that sits inside the business as the operational cushion.

The business earns around €0.5M in interest in its cash, currently.

I haven’t included this in the most likely FCF figure above, as it sits outside ‘operational’ cash-flow.

Finally, I’m applying a terminal value based on the core property asset value in year 20.

Based on today’s valuation of €35.6M, I just assume it’ll be worth double (€70M) in 20 years.

This feels very conservative, while also factoring in the reality of rising property values over decades.

I also require a rate of 10% to make the investment satisfactory over that time.

This isn’t a strict DCF calculation in the traditional sense. I don’t really use those, and they always feel a little ‘unrealistic’ to me.

Instead, I just pieced this particular idea together based on the factors I’d be happy betting on in a real-world purchase.

In essence, we base this opportunity as if we extract the cash flows over the next 20 years and then sell the building.

After weighing all this up and considering how much future uncertainty I could tolerate I estimate the fair value of this business to be somewhere between €45M - €55M.

That’s roughly 40-50% upside from today’s market cap.

Here are the details…

The Business

Accentis NV (ACCB) is a Belgian landlord, founded in 1994.

They own and operate a large real-estate asset, that they maintain and rent out to long-term tenants.

The real-estate isn’t a single building. It’s more like a ‘campus’ style set up.

It has multiple buildings across the single site. These include offices, production space, storage and logistics facilities, and communal areas, such as car parks etc..

Each year the company invites an external, independent valuation expert, called Ceusters, to update the fair-market value of the property.

This is helpful when trying to value the business, given that it’s the core asset.

The property is rented out to multiple tenants. The image above indicates 50 tenants, but the latest reports mentions 41 specifically.

The largest tenant is a commercial printing company called Xeikon. They have a current deal until mid-2027 and seem to have been there for at least the last 15 years.

In 2022, Accentis created a purpose-built logistics extension, specifically for Xeikon to use.

The impression is that Xeikon is a long-term tenant that plans to stick around for the long-term.

In 2020, revenues were €20M. Next year, they are expected to be €5.5M.

That sounds terrifying.

However, the management team has deliberately sold off assets and streamlined the business down.

They want to create a lean structure that is simple to run and that can return cash to shareholders more reliably.

To do this they sold off assets and returned some of this cash to shareholders. 2022 was a particularly fruitful year, with over €55M being returned to shareholders.

This is interesting because they haven’t really paid dividends or conducted any significant buybacks in recent years.

They don’t seem to have any plan to do that going forwards either.

It seems like they simply wanted to remove ‘hassle-assets’ and focus on their ‘crown-jewel’ asset, while enjoying the more predictable income from it.

One interesting note is that the German asset they sold in 2025, was valued at €2.50M, and sold, in the real-world for €2.51M.

This gives some credibility to the valuation of the remaining asset.

Why It’s Cheap

As you can imagine, the restructuring has caused tremendous uncertainty in recent years.

The biggest price drop came in 2022, after the large asset disposals and capital return.

Amidst all this, in 2024, a large client in Germany became insolvent and terminated their lease. This is one reason Accentis decided to sell it this year.

The market didn’t stick around to figure out what future revenues would look like or whether the current price accurately reflected the future income of the business.

The stock price just fell, and, it seems to me, that it’s now sitting at slightly pessimistic levels, given the current business structure.

There are a couple of other factors that probably concern the market.

First, 67% of the voting rights are held by a single investor (Summa NV). This is enough to concentrate the voting power and deter any activist.

Second, there is a concentration risk with Xeikon representing 75% of the income.

Given the fact that a similar situation ended badly in Germany, it’s reasonable to assume the market is discounting the situation here.

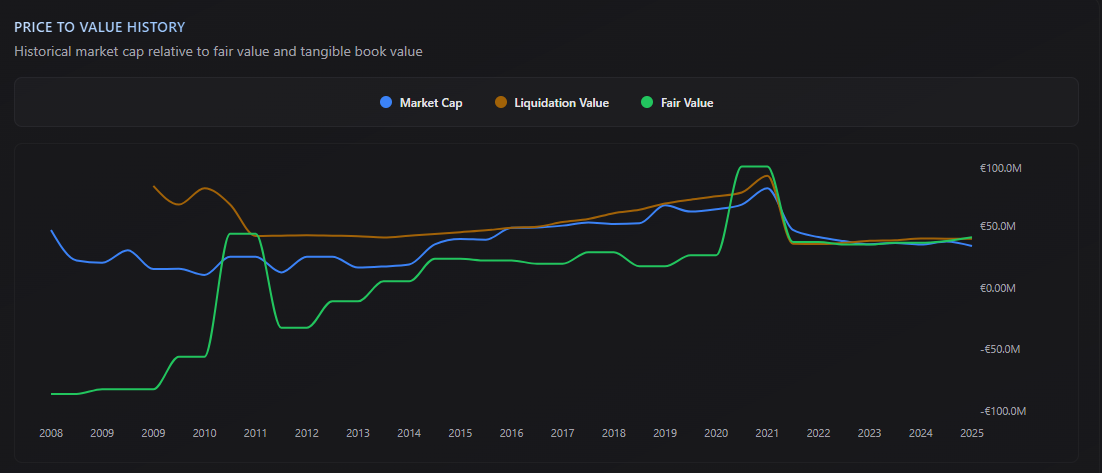

The one interesting note here is that historically, the market has tended to value the business above fair value, although it fluctuates.

The Risks

Accentis is exposed to the same general risks as every other property landlord in Belgium.

These include things like property values going down, tenants leaving unexpectedly, and operating costs rising uncontrollably.

However there are a few business-specific risks that are far more noteworthy.

As mentioned, the largest tenant, Xeikon, represents 75% of total income for the business. If they leave, or go out of business then Accentis would have a big problem.

This problem would require a new tenant of equal size or multiple tenants to equivalent size in the aggregate.

There would likely be a transition period while these new tenants are found and set up, which would be a strain on cash.

This risk is also related to the risk of asset concentration. If anything negative happens in Belgium, then the core revenues are lost.

Accentis also operates a strange ‘all-in’ type of leasing arrangement. This means that the tenant pays a fixed rate but Accentis is liable for any increase in energy costs.

This actually happened in recent years, and generated an extra cost of €0.5M in energy bills for the site.

The reports also disclose a financing guarantee provided by the controlling shareholder for financing linked to the remaining property.

Any change in that support could lead to issues.

Despite the majority ownership, it seems unlikely that a low-ball delisting could occur easily because the Euronext rules state a 95% majority is required.

With 67% of the voting rights, it might be tricky to convince everyone else to sell way below their average price.

What to Research Further

If you like this idea, there are a few things you should research more deeply.

First, the exact terms of the rental agreements in place. Especially those of the main tenant Xeikon.

You need to figure out exactly what can go wrong and what the liabilities are if it does.

It’s also worth digging into the details of the ‘all in’ lease agreements. In other words, what’s the worst case scenario if operating costs go through the roof?

Finally, I’d want to understand the value of the core property asset in extreme detail.

When they estimate its fair value, what yield assumptions are they making and how realistic is that based on the real-world?

Some of that can be found in the reports but other stuff will need to be researched independently.

These three things represent the biggest risk to the going-concern status and valuation of the business imo.

The Investment Case

After the recent transition, Accentis is a single-asset Belgian property company with a large cash-balance.

The question for deep-value investors is simple:

“At today’s price, what am I paying for, what protects me on the downside, and what would cause the market to re-rate this business?”

Let’s start with the downside protection.

The fair value of the property alone is larger than the current market cap. This is supplemented by around €10M of net-cash (€21M total cash).

This is a nice cushion in case the largest tenant really does leave unexpectedly. It provides a strong foundation to resolve that issue and replace them.

Much of the operational costs are also tied to the tenants being active. If no one is there, energy consumption etc is reduced significantly.

Today’s price is clearly below the tangible assets of the business, which is irrational considering how solid those assets are.

Next, we can look at the ongoing cash-generation.

Land is finite and buildings are costly to build both in terms of financial cost but also time and energy costs.

If there is one business that is likely to be ticking along in 20 years, while still having a sellable asset at the end, it’s something like this.

Management guide to future revenues of around €5.5M per year, which equates (roughly) to FCF for owners of around €3M per year.

Again, the nature of this business means that these figures are very likely to rise in line with cost-inflation, rental increases, and demand linked to population growth.

Each tenant is contracted on long-term leases that provide stable revenues over time.

The 2022 capital return, also demonstrates that management is aligned with shareholders when it comes to delivering cash.

For me, this supports the view that if the worst case happened and Accentis liquidated, they would do so at a fair price that would generate a healthy profit at today’s price.

Once the market sees the leaner, simpler structure generating reliable cash-flows again, the price is likely to move higher.

What to Watch For

If you’re tracking this situation there are a few things that are most likely to cause a sharper re-rating.

First, the occupancy rate at the core site is expected to generate €5.5M going forward.

Even just a year or two of stable revenues in line with this is likely to be enough to value the business more fairly.

This is even more likely when we factor in things like inflation driven revenue growth.

Current occupancy is 99%, so watching how this level fluctuates from here will be a key driver.

I’ve extrapolated a future FCF figure of around €3M based on historical figures I could dig out of the reports.

This should be closely watched over 2-3 year periods to ensure it averages out near those levels.

Finally, assuming FCF remains consistent, I think there may be an opportunity for dividends or buybacks.

I’m basing this on the fact that the new business is far more predictable and ‘owner-friendly’ than the previous iterations.

This may give management more confidence to implement a regular capital return programme, in line with the 2022 one-off.

They did mention this as a specific benefit of the restructuring, so this is another thing that could generate a nice re-rating.

If the business can trundle along at these boring levels for the next 2-3 years, without any further uncertainty, I believe the fair value is around €0.045 per share.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here