A Leading-Brand Priced at 0.6x TBV

It also trades with a negative EV and P/FCF ratio of 8 while growing revenues consistently.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Many deep-value stocks have great brand-positioning in their niche.

This is surprising to many people who assume they are all just lame businesses on the verge of extinction.

Today’s business is the proud owner of a pretty solid brand.

But, first, here are the valuation metrics that attract me first and foremost:

NCAV Ratio = 1.1

TBV Ratio = 0.6

P/5Y FCF Ratio = 8

P/FCF Ratio = 4

This business is trading below liquidation value alongside a pretty decent earnings valuation.

The positive NCAV indicates that it is a very liquid business, which means healthy.

The enterprise value is negative, which means we get paid to buy the business.

There are a few things to factor in with the valuation.

First, the FCF figure is lumpy because they are a manufacturing business that relies on working capital swings.

To help smooth this out I believe the 5Y FCF figure is most accurate here, which still makes the business quite cheap to earnings.

It’s not ‘dirt-cheap’ (to earnings) but still significantly below what you’d have to pay in the real world.

Second, the enterprise value seems even more compelling than the headline figure suggests.

The standardised figure, using cash and equivalents to offset market-cap + total debt is -¥183.18M.

However, the business owns marketable securities (bonds etc) that live in non-current assets on the balance sheet.

This is because they don’t consider them part of the working capital (which is correct), but in the real world these are liquid and easy to convert into cash.

If we add those to the mix, the EV is actually -¥2.6B.

This just makes the valuation even more appealing imo.

Let’s take a look at that brand…

The Business

Zett Corporation (8135.T) is a Japanese sporting goods company, originally founded in 1920, as Watanabe Ryozo Shoten, and renamed to Zett in 1980.

It IPO’d in 1981 and then merged into a TSE listing in 2013.

They sit in the middle of Japan’s sports-goods ecosystem, and operate in four segments.

Wholesale, Manufacturing, Retail, and Logistics.

The wholesale side buys from well-known manufacturers (like Yonex, Goldwin, Descente) and sells to large retailers (like AEON and Seven & i).

I found this cool because I actually use Yonex products for playing squash.

Anyway, to keep those relationships stable, it holds small shareholdings, but does not control them and is not controlled by them.

This is quite a common thing in Japan, and results in a tight network/ecosystem for the business to thrive in over the long-term.

It also has licence agreements and partnerships with brands such as Converse Japan and Thule.

This wholesale business buys up branded products from around 300 smaller suppliers and sells these, in bulk, to sports retailers and mass-merchants.

They also commission and manufacture their own branded products. They have two core brands (Zett Baseball and Prostatus) that they produce products under.

The Zett baseball brand is highly regarded and has large adoption in Japan.

Think of this as competing against the likes of Rawlings, Wilson and Mizuno.

The prostatus band seems to be the one with the most loyal customer base and brand recognition.

The manufacturing unit is a subsidiary called Zett Create Co., Ltd..

Zett creates plans and develops baseball goods and sportswear, then makes some items itself, and sources other items from outside factories.

It then sells those products mainly to Zett (the wholesaler division), which distributes them to retailers nationwide.

The latest annual report gives an interesting example of how manufacturing links to demand.

It states that in FY2025, Zett Baseball benefited because its hard metal bats, that comply with the new high school baseball standards, received strong user evaluation and support.

As a result, the usage rate of these bats in tournaments rose sharply.

Zett also operates its own, highly specialised stores.

These are targeted to loyal customers that appreciate the technical qualities of the high-end branded products.

Customers go there to receive guidance and explanations on how specialist products can help improve their game.

The logistics business exists to help the group move products around in the most cost effective manner.

They also handle external logistics and act as kind of a sideline revenue stream. This is insignificant to overall revenues but an interesting bolt-on.

Control of the end to end process is something I’d find highly appealing, buying this business whole.

The wholesale business is the main engine (90%) for revenue, but the manufactured products offer solid brand equity and a loyal customer base.

This, combined with the retail/logistics ecosystem and partnership- network-effect allow them to upsell and cross sell many other products to their core customers repeatedly.

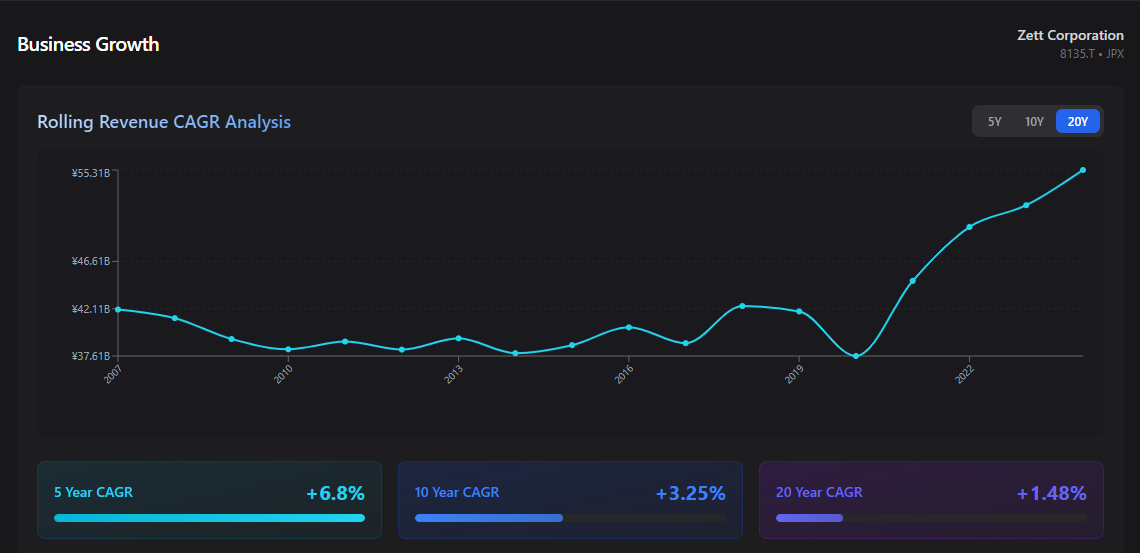

Over the years the business has grown pretty well.

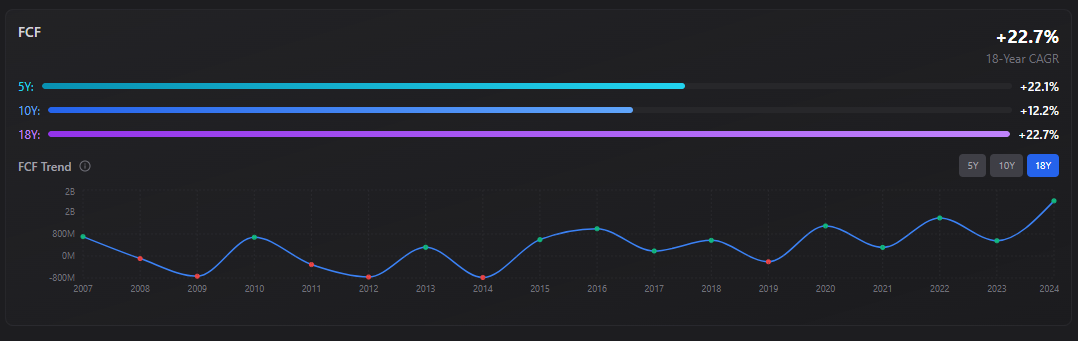

FCF has been consistently profitable (90% of the time) over the last decade.

COVID aside, the growth has been fairly consistent and even when revenues dipped in 2020, they almost immediately recovered and started growing again YoY.

TTM revenues indicate that the current financial year will be the highest level of all time.

The business is one that just gets on with building out its product line, serving its customers and expanding operations where it can.

The Financials

The statements show the cash-engine clearly.

Zett sells products to retailers, collects cash later and pays suppliers on agreed terms.

The impact of working capital causes FCF to be lumpy, and is one reason I use the 5Y average figure.

The average FCF (adjusted for accuracy to a private owner) is around ¥1.07B per year.

This compares well to the market cap of ¥8.0B.

Despite being lumpy, the FCF and cash generation of the business is very consistent. This explains why the only OCF loss over the last decade came during COVID.

There was also a one-off sale of some investment securities during FY2025 which generated ¥2.95B in cash.

This isn’t included in OCF so isn’t something that needs to be adjusted for, as far as I can tell.

The income statement also looks pretty decent.

Revenues grew from ¥42.0B in 2018 to ¥57.2B on a TTM basis (¥55.3B in FY2025).

Net-income followed suit, growing from ¥713M in 2018 to ¥2.9B on a TTM basis.

It shows us that Zett moves a lot of physical products, but most of the gross profit is consumed by selling and distribution costs.

That is normal for a wholesaler with logistics, sales-staff, warehousing, and fulfilment.

One thing that would catch my eye as a business-buyer is that profitability is thin relative to sales.

Any small changes in pricing, freight, warehousing, or discounting can swing operating profit meaningfully.

The interim illustrates this sensitivity: despite higher sales in FY2026 Q1, operating profit fell 25.1% to ¥328M, and profit attributable to owners fell 41.1% to ¥209M.

This is pretty normal for this type of business though. It wouldn’t necessarily put me off.

Margins are always going to be tight and difficult to expand, despite the solid business model, consistent cash-generation and growing revenues.

With any business trading below liquidation value the natural concern is over the quality of assets on the balance sheet.

In Zett’s case, most current assets are made up of cash and invoices.

This is significantly less risky than a balance sheet heavy in inventory (depending on what the inventory is, of course).

The main risk of cash is that management will spend it on yachts and cocaine.

I doubt that will happen here because of the conservative nature of the management team.

Invoices face the risk of not being paid.

Unfortunately, the reports don’t detail too much about things like customer concentration in invoices or the ongoing days-sales-standing figures.

My assumption here, given all the tight relationships and conservative balance sheet, is that invoices pose a very small risk of non-payment.

If the business liquidated, it seems rational that most of those invoices would be collected and converted into cash during the process.

Inventory is probably the biggest risk because a lot of it is products that can become obsolete pretty quickly as trends change.

Almost all inventory is finished goods.

The positive side to this is the inventory is a pretty small segment of the overall current assets.

After sifting through everything for a while, there isn’t much to cause me to doubt the TBV of the business, as initially calculated.

Why It’s Cheap

Zett is a high-volume, low-margin wholesaler. Revenues go up but margins always stay thin.

In other words, it has to grind out profits bit by bit, and will never scale up like Amazon.

We can illustrate this using the interim report.

In FY2026 Q1, sales rose 6.9% year on year to ¥14.47B, but operating profit fell 25.1% to ¥328M, and profit attributable to owners fell 41.1% to ¥209M.

This snapshot illustrates why the market doesn’t exactly get excited about stocks like this.

The market cap of ¥8.5B reflects a business that looks financially resilient, but structurally low margin, with recent profits distorted by a one-off securities gain, and with near-term evidence of margin pressure even as sales grow.

There isn’t anything ‘happening’ to threaten the business, in fact, it’s growing nicely.

It just looks like the main uncertainty is whether or not management will be able to grind out improvements in earnings alongside revenues.

Any positive signs there are likely to cause a pretty significant rerating.

The reason I’m here is that the current valuation implies a much worse situation than the actual reality.

The Risks

Being the boring business that it is, the reports don’t really disclose anything exciting in terms of risks.

They show general risks like competition or FX risks.

They also indicate a few business specific risks worth looking at, if you like that kind of thing.

These are things like inventory obsolescence risk and the risks associated with being a working capital heavy operation.

In other words, unless everyone in Japan stops playing their favourite sports, it’s likely that Zett will still be trundling along, generating cash for the next couple of decades.

There does seem to be some risk in the ownership concentration.

The top holders are all associates and partners, rather than fragmented investors, and together hold around 48% of the votes.

This probably isn’t enough to delist at a ridiculously low price, but it probably does deter an activist from building a stake.

The Investment Case

Zett is selling at half the value of its tangible assets.

This implies the operating business is worthless, which clearly isn’t true.

Yes, it’s not exciting and probably isn’t going to 10x, but it still deserves a higher value than the market is currently prescribing.

The current price is very low compared to the fair value of the stock.

The image below shows how the value of the business is actually increasing to a private owner, while the stock price hasn’t caught up.

If you believe that the business is solid and will continue its current path, then at some point an update or a successful period has the potential to cause a large rerating.

This situation is one that usually leads to the price grinding higher over time and then popping up in reaction to the good news.

This is usually the exit point for deep-value investors.

The overall return is usually market-beating because of how much ground the price needs to make up from its starting point.

What to watch

Management’s stated goals are clear and measurable.

In the most recent annual report, they cite targets including a 2% consolidated operating profit margin and a 50% equity ratio.

Progress, recently, has been mixed.

The interim equity ratio was 44.5% at the latest interim, still below the 50% goal.

On profitability, FY2025 operating profit was ¥0.64B on sales of ¥53.7B, which is materially below a 2% operating margin.

The interim also shows near-term margin pressure.

In FY2026 Q1, sales rose 6.9% to ¥14.47B, but operating profit fell 25.1% to ¥328M.

That does not mean the plan is failing, but it does mean a 2% margin target may take time and execution.

The strongest signs of success are operational stability and cash generation, rather than margin expansion.

FY2025 operating cash flow was ¥2.05B.

However, the composition matters.

In FY2025, operating cash flow benefited from trade payables increasing by ¥1.75B, while receivables increased by ¥571M.

Good news over the next 2 to 3 years is therefore not only ‘profit up’, but also ‘profit up without payables being the main driver’.

This is another thing to watch out for.

These targets are not exactly trying to put people on Mars. They should be achievable at some point, which could cause the rerating.

Aside from business updates, I believe another plausible path to a rerating lies in a return of capital to shareholders.

They have a lot of cash and governance standards are changing in Japan.

Pressure is growing on these traditional cash-hoarders to unlock their cash boxes and return the excess capital to owners.

This would also lead to a nice re-rating for any deep-value investor.

While you wait for all this, you likely get some nice appreciation (the stock is up 20% this year and 120% over the last 5 years).

This comes from the business grinding away, doing its thing.

The re-rating will be the cherry on the cake.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here