SPACs, Lies, and Lawsuits: A US Growth Story

And a business trading at 0.7 TBV and 5x FCF

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Today’s stock has some very attractive valuation ratios:

NCAV ratio = 1

TBV Ratio = 0.7

P/5Y FCF Ratio = 5

Enterprise value is negative, so you get paid to buy this business.

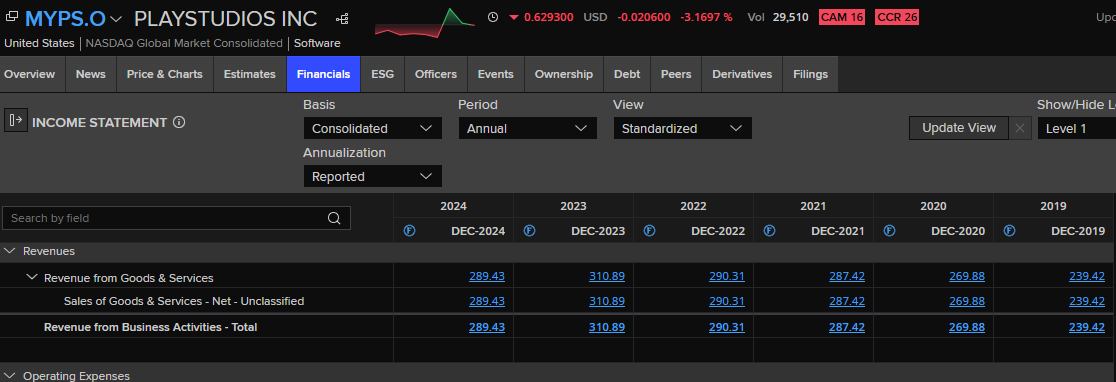

Last year, the operating business generated $46M FCF, from $289M in total revenue.

It holds net-cash of almost $100M, with relatively little debt ($8.65M).

The business itself operates a portfolio of brand-assets that are highly recognisable, and extremely sticky in terms of customer usage.

In other words, famous brands with strong earnings power, being given away for nothing.

To top it all off, the management team have been executing buybacks which average out to a shareholder yield of roughly 13%.

To a deep-value guy like me, this looks highly attractive.

First, I’m getting paid to buy a business.

That’s always a great way to start any day.

But second, the business looks pretty solid and has been cash generative since 2011.

The only questions left are why is it so cheap? And, has the market just mispriced some temporary uncertainty?

Let’s take a look…

The Business

PLAYSTUDIOS Inc (MYPS) is a gaming business, based in Las Vegas.

They develop free-to-play mobile games and run a loyalty platform called playAWARDS.

The games are things like social casino titles (myVEGAS Slots, POP! Slots, my KONAMI Slots) and casual titles such as Tetris, Solitaire and Sudoku.

Players download these for free, then either watch ads or buy ‘virtual currency’ bundles that let them keep playing or access extras.

They also accrue ‘points’ which can be exchanged for prizes (via playAWARDS). These are real-world experiences like hotel stays, cruises, excursions and so on.

The idea of playAWARDS is to drive customers into physical hotels and casinos that partner with PS.

The virtual currency purchases and ads are the company’s two main revenue streams.

Last year (2024), around 79.1% of revenue came from virtual currency and roughly 20.8% from advertising.

Virtual currency revenue was $228.9M, advertising was $60.2M, and the rest, $300K, was made up of other bits and pieces.

The United States represented 84.4% of revenue.

The virtual currency concept is interesting.

Players buy coin or chip bundles with real money.

The company recognises the revenue as those coins are actually consumed in play over a short consumption window.

Unused paid coins at period end sit as a small deferred revenue balance until spent.

In reality, almost all of the virtual currency is used within 7-days and the deferred revenue segment is usually immaterial.

The business has an interesting history.

It was founded in 2011, by a guy called Andrew Pascal and a few others.

Their first product was something called myVEGAS and it was launched through Facebook, and demand was strong.

Between 2011 and 2020 the company raised strategic capital from Activision Blizzard and MGM resorts.

They built a portfolio of social-casino titles, and won several industry awards for social gaming and marketing innovation.

At this point, the founders decided to list the business.

What I found most interesting was the reason for the listing. SEC records show Pascal stating the reason being ‘acquisition currency’.

In other words, he wanted to run a listed company and then use the stock to acquire more gaming businesses into his empire.

They could expand and grow using very little (if any) cash.

This becomes even more fascinating when you look at the stock price today.

I don’t imagine many successful gaming founders lining up to swap their little cash-machines for MYPS stock.

But what do I know?

Anyway, at around the same time, former MGM CEO Jim Murren and others (including Pascal) formed a SPAC called Acies Acquisition Corp.

In February 2021 Acies agreed a business combination with private ‘Old PLAYSTUDIOS’ that valued the company at roughly $1.1B USD.

This made sense on one hand, because all these guys had already worked together through MGM for many years.

It was also a bit weird on the other hand because Andrew Pascal was selling his own company to a SPAC he created.

This valuation came off the back of the following pitch:

First, the business had been growing revenue at a CAGR of 22% from 2017-2019. During the same period, they had grown ‘adjusted’ EBITDA (don’t ask) by 46% CAGR.

To justify the valuation further they then cracked out their ‘projections’ for the next 2-3 years.

Based on their ‘calculations’ revenues were expected to be $435M in 2022, and ‘adjusted’ EBITDA (don’t worry about it) would be $90M.

This represented strong continued growth.

Therefore, initial investors were only paying 2.5x 2022 revenues or 12x profits, for this growing little cash machine.

A good old ‘forward earnings’ pitch.

Institutional investors lapped it all up.

The merger closed in June 2021 and the combined company began trading on Nasdaq as MYPS.

Since the listing, growth has been the name of the game.

The business has pivoted towards a more ‘advertising’ driven model by focusing more on the branded games (Tetris etc) to drive larger active users.

This resulted in fewer in-game purchases, because most of the new people came for the free games.

However, management decided this was a good idea because the margins are much better on ad-revenue.

Acquiring ‘spenders’ is ferociously expensive in paid acquisition costs, apparently.

And this all brings us to today…

Why It’s Cheap

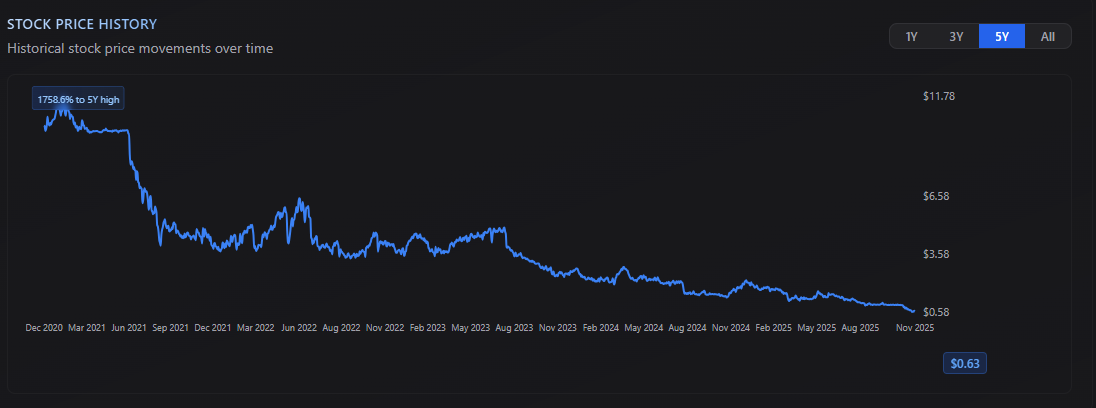

It’s worth noting that the initial IPO priced the stock at almost $13 per share. Today, it’s sitting at $0.63.

It’s not just ‘cheap’, it’s been a catastrophic destruction of shareholder value.

So what happened?

Well, this brings us to the ‘lies’.

During the SPAC pitch, investors were told that the growth would be driven, in part, by a brand new game called Kingdom Boss.

It was pitched as a new game that was about to be released and would generate significant revenues for the business.

In 2022, a lawsuit was filed that claimed all this was a material misrepresentation.

They kind of had a point because Kingdom Boss was never finished and eventually abandoned completely.

The proxy/registration statement is said to have been misleading because it repeatedly asserted that Kingdom Boss was “on track” for a 2021 launch.

It also stated that it would fuel a step-change in revenue (+$60M by 2022).

However, it also failed to disclose serious technical and playability problems.

Apparently, at least seven months before the merger, internal and external testing had revealed “intractable” defects such as glitches, lags and crashes that made the game effectively unplayable and unsuitable for commercial launch.

In other words, the game was nowhere near ready but the pitch team decided a bit of ‘fake it till you make it’ would be ok.

It wasn’t, and they ended up paying out $6.5M compensation.

On top of this, those revenues never went anywhere.

Pre-SPAC, they sat at $239M.

At the time of writing this article, 6 years later, the TTM revenue is currently $247M.

They had a little spike up to $310M in 2023, but never got anywhere near the $400M+ target sold to investors.

Over the last 5 years, FCF has averaged $15M per year.

On an enterprise value of -$17M this is excellent. Even on today’s market cap figure of $81M it’s pretty decent.

But, on a $1.1B price tag, it makes me feel a bit sick.

Every time I research a stock, I always imagine handing over the purchase price in exchange for the business.

I can’t fathom how anyone even remotely business-minded could have been convinced to pay $1.1B for PLAYSTUDIOS Inc.

This growth story became a non-growth nightmare.

But, we’re here now and the asking price is not $1.1B, it’s $81M (market cap) or -$17M (EV).

So, the question, for us, is whether or not that represents a good opportunity to start buying the stock?

To answer that we have to dig deeper…

The Risks

There is one risk that dominates everything and I can’t take my eyes off it.

It actually makes any initial investment decision even more unfathomable.

The company has a dual-class structure that gives the founder group twenty votes per Class B share and, as disclosed, more than 70% of total voting power.

This concentration lets insiders control director elections and major transactions.

The charter and by-laws also include anti-takeover features such as board-only special meeting rights, advance notice requirements, and the ability to issue preferred stock.

The reports state these provisions can delay or deter a change of control and may deprive holders of a takeover premium.

This means if the market price falls very low, insiders would still control outcomes, and outside investors would have limited ability to force a sale or resist terms they view as low.

In other words, none of the other risks matter much imo.

Andrew Pascal decided he wanted to list his (successful) business, and use the stock as ‘currency’ to continue the growth and expansion.

The structure here is about him maintaining all the power and control, no matter what.

He has also stated he has no interest in paying dividends, but he is partial to some buybacks.

Sadly, he’s also partial to some significant stock-based-compensation.

This significantly reduces the impact of the buybacks and slashes the shareholder yield from our headline 13%, down to less than 6%.

Essentially, anyone buying at any price (and especially at insanely low prices) is at serious risk of the management team simply scooping up all the shares and delisting.

In other words, this is a material risk to us making good money.

The cheaper the stock gets from here, the more tempting it will be to delist and take it all private.

The only way to avoid this is if Andrew Pascal is still holding his dream of equity currency tightly, and eventually grows revenues to match all that initial hype.

That’s the core bet.

In case this doesn’t put you off, I’ll briefly list all the other risk you should probably be aware of, and dig deeper into.

MYPS has heavy reliance on Apple, Google and other platforms for distribution and payments.

Fees, rules or access can change and hurt revenues and margins.

As mentioned, acquiring new customers for the gaming segment is hideously expensive.

If they become too large, the margins disappear completely (although the shift to ads is designed to mitigate this).

On that note, ad revenue depends on retaining a large audience and keeping ad-loads acceptable to players and attractive to advertisers.

Anything that diminishes this will hit revenues and profits over time.

This is also kind of related to the next risk, which is content pipeline risk.

New features or games require upfront spend and may be delayed, underperform or be abandoned.

The Kingdom Boss saga should be at the forefront of everyone’s minds here.

They’re also pretty dependent on partners and external brands.

For example, their playAWARDS system gives players real-world prizes in exchange for points gained through the online games.

Things like hotel rooms, cruise discounts and free drinks and meals within casinos.

If they somehow lose the most appealing prizes, then players might be less inclined to stick around.

Many of the games also rely on branding, through licenses such as Tetris or MGM etc…

Access to third-party brands can become more expensive or unavailable. Breaches or disputes can force changes or removals.

Finally, as you can imagine, MYPS is always getting sued by someone.

There are currently six cases mentioned in the filings.

MYPS states it does not expect outcomes to have a material effect on the financial statements, while carrying a $9.83m aggregate litigation accrual and $3.75m insurance receivable at year-end 2024.

I don’t view these as a material risk to the business directly, but they do seem to indicate the kind of drama associated with the company.

The Investment Case

If you can ignore the massive conflict of interest between management and shareholders, and all the lawsuits, there are a few good elements to this idea.

First, the business is highly liquid and healthy. The balance sheet is a fortress with over $100M in cash and only $60M in total liabilities.

It’ll probably carry on trading long into the foreseeable future.

Second, the portfolio of branded assets are powerful. These include brands like Tetris and MGM resorts.

It’s not hard to imagine generating cash long into the future either. People naturally view these branded games and platforms as more credible than other versions.

The core operating business is highly cash generative, year after year.

Since listing, they have never had a negative year from their operating business. It’s strong and healthy.

They are also expanding and diversifying this with ad revenues, which are, apparently, even more stable and much higher-margin.

The main reason behind the stock price decline has been expectations not matching reality.

Initial investors paid for rainbows and unicorns that never arrived.

That has nothing to do with deep-value investors today. The current price is very low for what the business is.

In fact, if I owned this business, even with all its baggage, I’d never sell it for $80M.

The management team is also keen on buybacks.

When we strip out the SBC elements, the yield, at today’s price, is still 6%, which is respectable.

It’s quite possible that the business plods away, growing a little bit here and there and using all its cash to buy back shares.

It has all the ingredients to follow this trajectory for a long time.

Eventually, there is likely to be an ‘inflection point’ where things start looking very positive for the future.

This will create a stock price spike, which will provide an opportunity to cash out at a healthy profit.

Ownership structure aside, this is a really nice set-up with everything I look for in a highly asymmetrical opportunity.

Sadly, these types of ownership structures are hard to ignore.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here