3.8x FCF And Priced at 0.6x TBV

A growing German business priced below liquidation value.

When you operate through the lens of a private business owner, things become much simpler.

I could never buy a ‘tech stock’ with a 40x P/E ratio, because I could never justify personally paying for that kind of valuation in real-life.

I understand that tech-stocks have anomalously good business models, and that they have a great chance of growing exponentially and sticking around for decades.

The quality of those businesses is undeniable.

I just don’t feel comfortable paying upfront for the rosy future.

It feels too much like playing snakes and ladders, when my preferred game is monopoly.

As strange as it sounds, I feel much better about prices that make it really hard to lose money.

The upside takes care of itself, but that downside protection is what lets me sleep at night.

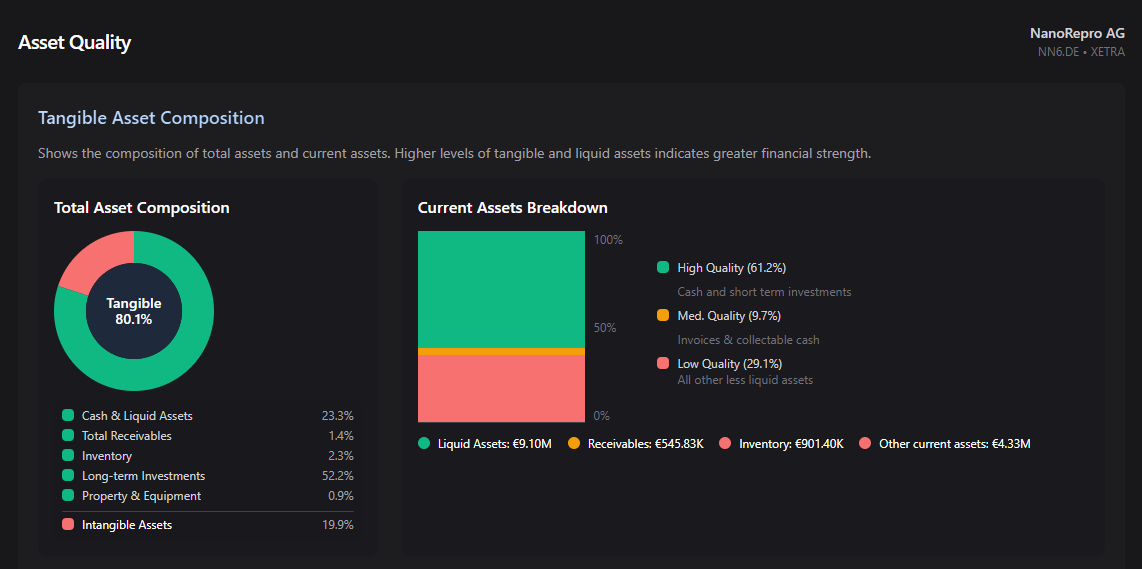

Today’s stock is trading below its liquidation value, and the assets backing that up are mostly cash and investment stakes in profitable businesses.

It has zero debt, and the management team has proven to be disciplined when it comes to capital allocation.

Here are the valuation metrics:

NCAV Ratio = 1.5

TBV Ratio = 0.6

EV/5Y FCF Ratio = 3.8

P/5Y FCF Ratio = 6.5

Its FCF has been lumpy over the years, and it experienced a COVID boom in revenues and profits, that has long-since dissipated.

This masks an interesting situation when you dig below the surface.

Despite the headline drop-off in revenue and profits, the business is also in transition.

This transition has already made progress.

Post-COVID revenues are now double pre-COVID revenues, and if you strip out that entire COVID period, the trajectory looks interesting.

The nature of the transition is also logical.

As I researched all this, I found myself nodding along with the reasoning and rationale.

I was thinking to myself that this is the kind of direction I would follow if I owned the business whole.

The stock price today sits around the same levels it was before this transition started to take place (and before COVID happened).

The market has abandoned this stock because of pure uncertainty.

The transition isn’t complete, there have been setbacks and profits are still (deliberately) negative.

However, I believe that at this price, with the amount of net-cash available, and with the lack of debt, this is an asymmetric opportunity.

Most importantly, the downside is protected, first and foremost.

Let’s take a look…

The Business

NanoRepro (NN6) is a manufacturer of at-home diagnostics tests, based in Germany, and founded in 1992.

Their products include testing kits for things like pregnancy, ovulation, menopause, drugs/alcohol and various types of bloods.

They also offer detection kits for things like food allergies and intolerances and produce liquid supplements for things like beauty therapies and male fertility.

They mostly sell their products through retailers like supermarkets, pharmacies and other types of drug-stores. They are sold both online and offline.

Aside from the B2C sales, they offer products through B2B channels, such as medical clinics, hospitals and professional-only web shops.

They don’t actually own any factories or manage large production teams.

Instead, they outsource the creation of their products to contractors, and white-label other products directly.

In FY24 they had total revenues of €4.47m. This represented a 40% increase from the previous year (€3.18m).

This is technically a nano-cap stock, that larger investors have no chance of investing into.

Of this revenue, the testing kits made up €3.72m, and the supplements were just €0.75m.

Historically, the business has focused on Germany, Austria and Switzerland, the so-called D-A-CH region in Europe.

The situation here is somewhat clouded by the COVID boom.

On paper it looks like a tiny business that did nothing much, suddenly riding the exponential demand for COVID testing kits, and, now, back to where it was.

But that isn’t quite the case.

In 2020-2021, their revenue hit a staggering €162.7m.

I can only imagine the euphoria inside the little business, as that was happening.

This lifted the business from cash reserves of between €1m - €2m on average, to having over €31m in the bank.

To a business of this size, that was a HUGE inflection point.

The market was focused on the fact that COVID revenues disappeared, but so far, it seems to have missed the fact that the business has now almost quadrupled non-COVID revenues.

The year before COVID, revenues were €1.2m.

Last year it was €4.47m.

The stock price is virtually at the same levels it was back before COVID.

Rather than being a transitory ‘boom’, COVID actually set them up for structural growth, away from their former model and into something much more scalable.

For example, in 2024, they decided to move away from selling their own branded testing kits, to focus on partnering with retail chains.

NanoRepro would create the product, but the branding is the retail chains, and they push it hard through all their channels.

This was an instant scale-up, and the loss of brand recognition was replaced by sheer volumes.

The interesting thing about this is that it’s only just getting started.

The plan is to roll out more of these white-label partnerships with other chains across the entire EU.

Another benefit of the COVID windfall, was that they could now pass the IVDR audit (an EU regulation) that would allow them to sell EU-wide.

This gives them much more credibility and was a major factor in securing their first retail-chain partnership.

Finally, they added a second growth pillar by kicking off an inorganic growth plan (acquisitions).

The goal is to expand and broaden the product range beyond ‘testing kits’ and into an ‘innovative health company’.

These initial acquisitions gave them a platform in the health/beauty space, and a new product range to further expand.

I’m always sceptical of ‘acquisition’ strategies. Most of the time they just burn cash.

Sometimes, it’s just an excuse for management to give their mates a buyout at the shareholders expense.

We won’t know how this goes until we have a few more years of reports to analyse, however I did notice one interesting thing…

Last year, NanoRepro was looking to buy into a small firm called Terraplasma. Apparently, they have some clean-wound med-tech business.

The plan was to take a minority stake initially and then a full takeover later.

However, during the DD process, NanoRepro concluded that the value in the business didn’t warrant the asking price and pulled out.

This is a small signal, to me at least, that management is disciplined, to some degree, and not just running around with a money-gun.

The CEO has also been with the business for over 20 years, which is a further good sign, imo.

She has run a tight ship and avoided debt, even when the business was tiny and debt could have been easily justified for ‘growth’ and expansion.

Overall, the business looks like it’s in a very interesting position and has a desire to push on and take full advantage of the COVID windfall.

Why It’s Cheap

This business is tiny in the grand scheme of things.

It always has been, and COVID was kind of like winning the lottery. The market doesn’t like these kinds of stocks, for obvious reasons.

They have also experienced volatility and uncertainty in recent years.

The price chart looks horrifying, with the price down around 1,000% from its all-time COVID induced highs.

Anyone glancing at this business, would be immediately put off by this fact alone.

It looks like one of those cash-burning, pre-revenue, bio-tech stocks.

There are also operational uncertainties going on.

Firstly, it’s loss-making.

But, this is by design.

The management team has stated that they are spending more on building out the new revenue channels and that this will mean short term losses.

The losses have narrowed and they expect the narrowing to continue, but, a loss is a loss, and that creates uncertainty.

Another issue is that management signalled an entry into the continuous glucose monitoring (CGM) market, back in 2022. They will license the product and sell it through their channels.

I personally think this will be big in the near future.

CGM is a huge health trend that will only get bigger as people want to try and stay healthier for longer and stave off disease caused by lifestyle.

The problem is that the approval for this product has not yet been attained, and the timeline has already been pushed back from FY24 to Q425.

This adds another layer of uncertainty, although the management team seem convinced it will happen and is just a matter of form-filling and time.

Finally, the business hasn’t really returned much capital to shareholders over the years.

They had a couple of dividends from the COVID times, but other than that, SH yield hasn’t been anything to get excited about.

Markets love a business that shovels cash back to shareholders, but NanoRepro is focused on growing revenues rather than paying dividends.

This actually makes sense, and is a stance I support, even if I owned this business privately.

My read of this situation is that this creates a variety of uncertainty that the market simply doesn’t want to look at.

This, to me, explains the low valuations, right now.

The Risks

The bottom line here is that NanoRepro is clearly making progress with its growth plans, but it still hasn’t quite happened yet.

The opportunity here is to get in just before the market recognises that success is happening.

Right now, the operating business is priced at zero.

The question is, when will it return to profit and start benefitting from the increasing revenues?

The stock is already cheap, but how much cheaper will it get before the business achieves stability and consistently positive FCF?

With this in mind, there are several key risks to bear in mind:

Firstly, the regulatory risks.

The company is going through the IVDR approval process that will allow it to sell all its products across the EU, increasing its available market.

This is off to a great start, with them receiving an initially positive review and its first product certified.

They are allowed to sell all their products in the meantime, but they do need to complete the process in order to be fully safe.

If it doesn’t, then it could significantly halt the expansion into retail-chains in Europe.

From what I can gather, this seems a small risk, given the process and positive feedback the business has received, so far.

Aside from this and the general risks of running a business in this space (regulations, supply-chain, competition, legal, key-man and general economic), there is only one main risk.

The risk of execution.

They have a plan, they seem to be executing the plan but will they have the competence to succeed?

This is now central to the theory of the business being cheap today.

If the ramp up in white-labelled retail products and chain partnerships continues successfully, and CGM comes online in the next 12 months, things look good.

If they cannot sustain the progress they have made, and return to pre-covid revenues, then the stock price will likely halve from here.

The Investment Case

In my view, the chances of the company succeeding, to some degree, with its plans are high.

This is because we can already see clear progress being made.

Revenues are up dramatically, and partnerships are already in place.

They have almost completed the IVDR regulatory approval process, which will allow full scale across the EU.

Acquisitions have been made and other opportunities have been rejected, which looks like cost-discipline (and competence?).

The management team has been in place for decades and have been at the helm through all of the recent periods of volatility.

It’s likely that they have long-known how to grow and build the business, but simply haven’t had the cash to do so, and not wanted to risk large debt to ‘have a go’.

As soon as they had some cash, they got to work and had a clear, rational plan.

The business is still loss making and management states they expect 2025 to continue in that vein, although to a much lesser degree.

2025, seems to be the transition year when the business confirms the stability of revenue growth, while continuing to make progress on its partnership roll-out.

The CGM approval will add a high-quality (imo) product to the mix that offers genuine scalability.

Any further green shoots of progress and/or signs of profitability is likely to rerate the stock strongly.

Even if the business stayed roughly where it is, based on last year’s figures, there is still upside potential.

FCF was boosted by a couple of ‘one-off’ items, but if we strip those out and look at the ‘pure’ figure, we still get roughly €2.7m in FCF, last year.

The TTM figure, right now, is €2.5m.

This is very close to the 5Y FCF figure of €3.2m (which includes the COVID boom and pre-transition period).

This in itself is a pretty positive signal.

Essentially, I’m pretty confident that the operating business, as it is today, with no further growth or improvement, is definitely worth more than zero.

This provides an estimated upside of around 50-60% from the current price. I estimate a target share price of €2.75.

Literally, any kind of further growth or success in the plan from here, will provide even more upside.

I’m not currently invested in this stock because it’s not better than what I already hold, in terms of upside potential.

But, it does perfectly fit the type of profile I look for: Priced for death, but clearly not dying any time soon.

The only way to lose money here is if the transition plan falters and the business regresses back to pre-COVID revenues.

This is enough, imo, to make this a solid bet with very nice upside potential.