A Japanese Cigar-Butt for 2X FCF

Trading at liquidation value while its operating business prints money ever year.

Today’s stock is trading very close to its liquidation value, which implies that its operating business is worth virtually nothing.

On closer inspection, however, the operating business appears to be just fine.

Here are the ratios:

NCAV Ratio = 8

TBV Ratio = 1

EV/5Y FCF ratio = 2

P/5Y FCF Ratio = 9

P/FCF Ratio = 5.5

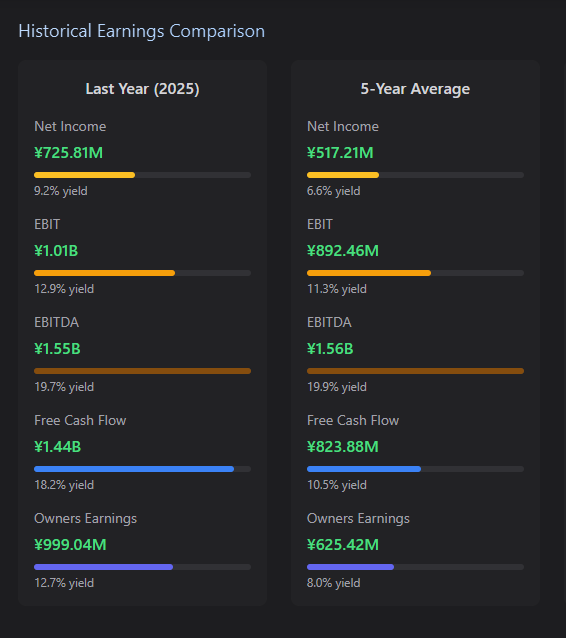

This means that last year’s FCF is sitting higher than the 5Y average, and it looks pretty cheap to the current market cap (¥8.0B).

This is also true of every other ‘earnings’ metric.

Most of the FCF generation for this business comes directly from the operating business, and funds-from-operations specifically.

Working capital contributes, of course, but most of the cash is from its healthy core business.

Let’s take a look….

The Business

HYOJITO Co., Ltd (7368.T), was founded in 1967 and became a public company in 2021 when its shares listed on the Tokyo Stock Exchange’s Second Section.

This caught my eye, because the business is very established but only recently decided to list.

The reason for that also brings us back to the irrationality of the current valuation.

They had a very successful business and wanted to raise money to expand it further.

HYOJITO installs official maps and information boards where people need directions, such as station concourses, street corners and public buildings.

Imagine you’re at a railway station and you’re trying to find a platform.

Hyojito makes the little ‘you are here’ signs that help you navigate your way around.

They help travellers find exits, platforms, shops, toilets and nearby services.

Local businesses and brands pay to place small ads or information tiles on the map. This serves as an additional revenue stream.

HYOJITO maintains the boards, updates content and sells the ad-slots.

The company also runs conventional ad-promotion work for clients and manufactures or maintains signs.

If you need a new sign for your shop, you can call Hyojito to make it and install it for you.

The model is robust because the boards sit in high-traffic, physical locations and solve a daily navigation problem.

If you’ve ever taken two screaming kids to a large park or zoo, you’ll know how invaluable they are, even in the age of smart phones and AI.

In 2025, the business is built around three segments:

Navita (the way-finder boards), Ad-Promotion, and Signs.

Navita is the core engine.

In 2025, Navita generated ¥8.07B of revenue, or 80.6% of the total ¥10.02B.

Ad-Promotion produced ¥0.76B, or 7.6 percent.

Sign delivered ¥1.19B, or 11.8 percent.

Within Navita, Station-Navita and City-Navita contributed the bulk at ¥3.59B and ¥4.11B respectively, with Public-Navita at ¥0.38B.

Why It’s Cheap

As mentioned, the expansion they planned for actually happened and profits are up.

One thing you might notice, however, is that revenues appear significantly lower, between 2020/21 and last year.

It looks like they are almost 30% lower today.

This could be something that concerns investors and scares them away from the stock, but the reality is quite different.

This drop has nothing to do with the business making less money.

It’s actually down to an accounting change.

Previously, Hyojito would record all advertising income in its revenue but now it only records the part it keeps.

For example:

Think of Hyojito as the middle-person between an advertiser and a station or city site owner.

An advertiser might pay ¥100 for an ad slot. Hyojito keeps ¥10 for doing the work and passes ¥90 to the site owner.

Before 2022, the accounts showed the full ¥100 as “sales” and ¥90 as “cost of sales,” so revenue looked bigger.

After Japan’s new revenue-recognition rule, if Hyojito is acting as an agent, it must only book the ¥10 it keeps.

So the same job now shows ¥10 of revenue and no ¥90 cost.

The work and profit are the same, the presentation is just “net” instead of “gross.”

This change reduced the reported top line by about ¥1.79B and reduced cost of sales by about ¥1.83B in the adoption year, with a tiny uplift to profit.

But you wouldn’t really understand that unless you spent some time figuring it out.

In other words, the business is trundling along as it always has and is actually growing its profits, but it doesn’t look like that at first glance.

Secondly, the shareholding is concentrated.

At the time of writing this, five corporate holders controlled roughly half the shares outstanding, with the largest at 21.7% and several others around 8–11%.

These holders are basically the founding families and insiders.

It’s tricky to nail down the exact figure, but free float appears to be around 30%.

This makes this stock naturally more risky for minority holders, due to the fact that a forced delisting could occur at a ludicrously low stock price.

Third, the company’s model bills customers in advance and delivers over time.

That pushes cash onto the balance sheet and defers revenue recognition.

On the face of the income statement, revenue growth looks muted around ¥10.02B in 2025 versus ¥10.14B in 2024.

A very large deferred revenue balance also sits in current liabilities and makes the leverage picture look heavier than a layman might expect.

Yet, those contract liabilities are obligations to deliver ads and services, not interest-bearing debt.

They unwind into revenue and profit as work is performed. This conservative presentation can still weigh on headline ratios and screens.

This is another element of the accounts that make things look slightly worse than the reality.

All of this probably creates a drag on the stock price, in the short term.

The Risks

There are few risks that the annual reports mention.

First, the company relies on permissioned, physical media space in and around railway stations and public venues.

This creates exposure to counterparties that control those locations and to safety obligations for equipment installed there.

Basically, if everyone decided not to have way-finder posts any more, the business would die.

This is obvious, but also, imo, unlikely. They serve a function that people still use on a large scale.

Second, the business recognises significant customer prepayments as contract liabilities.

These are advance cash receipts for advertising and related services that are earned over time.

The balance is material in recent years and sits in current liabilities until the service is delivered, which means reported current liabilities include obligations to perform rather than financial debt.

This means that if something happens that makes the delivery of these signs suddenly more expensive, the company could be hit.

Again, this is also quite unlikely, but a risk of this specific business model to be considered.

General, industry-wide risks also apply.

Advertising demand is cyclical with the economy.

Competition from other media formats can pressure pricing; and input costs for installing and maintaining hardware can move unfavourably.

This is the type of stuff I don’t worry too much about as a full business owner. You can’t control them, but you can mitigate their effects, which Hyojito seems to do.

Overall, the disclosed risks look manageable and mostly operational or cyclical rather than terminal.

For minority shareholders like us, ownership concentration is the key specific risk.

This is the biggest thing anyone investing here would need to dig into much deeper.

The one counter to this particular situation is that they only just listed (2021). It would be quite strange to list and delist so quickly.

It seems rational that management would try and grow the business for a few more years at least, before throwing in the towel and going private again.

The Investment Case

Hyojito is a classic deep-value setup.

It’s a perfectly healthy operating business being priced like it’s worthless to a private owner.

In reality, I’d love to own a business like this that throws off cash every year and seems to be growing that cash over time.

I’d also snap it up, if all I had to pay for was the tangible assets, most of which is cash.

On the asset side it does own some land and buildings that may be worth more than their book value.

Unfortunately, the reports don’t reveal too much information about how much land is there, but they do disclose a building worth double its current book value.

This adds a small amount of cushion (¥300M) to the TBV (¥7.5B), which improves the margin of safety slightly.

It also pays dividends.

At today’s market cap, the 5Y average shareholder yield is almost 4%.

So, you get paid nicely to hold this stock over time, while waiting for a catalyst.

As a minority shareholder there are generally one of three catalysts required for us to make money.

The first catalyst is continued operation and mild growth.

Since the change in accounting presentation, revenues are generally up, from ¥9.6B in 2022, to ¥10.04B TTM.

The company sells advertising on its wayfinding media and delivers signage and promotion services.

Customers often prepay, which shows up as contract liabilities that unwind into revenue as services are delivered.

This model has produced stable revenue and improving profit in 2025, with operating cash flow comfortably covering the modest capital spending.

On the numbers shown, it is reasonable to expect the company to keep operating at recent levels and to keep generating free cash flow, unless there is an unusual shock.

At some point, this will lead to a positive update that will cause the market to rerate the stock significantly towards its fair value.

This generally occurs, in situations like this, within 2-3 years.

The second catalyst is a buyout or activist outcome.

The business is clean and compact, with negligible debt and predictable cash conversion, which can make it attractive as a bolt-on for a buyer.

Maybe a large facilities management business or similar.

This is much less likely due to the ownership concentration, unless the offer price is attractive.

This would be good, but a higher price generally means less chance of a buy out happening, and the current majority holders have all the cards.

The third catalyst is higher cash returns.

The company has a record of paying dividends each year and raised the total to ¥61 per share in 2025, which is ¥283M in total.

Buybacks have been minimal in the last five years.

The balance sheet can support returns because there is no meaningful financial debt and free cash flow is positive after the routine capital spending needed to refresh media assets.

However, going off their actual behaviour it seems unlikely to expect any special dividend or large buyback programme any time soon.

It’s more likely that they simply continue creeping the dividend payments higher each year, which will cause the stock price to continue higher.

Hyojito is a solid business priced far below its real-world value, which should eventually be corrected as the market catches up.

For anyone interested, my estimate of fair value for this stock, right now, is around ¥2500 per share.

This would be around 50% upside on today’s stock price.