A Growing EU Business Priced at 3x FCF

It's riding the energy transition while consistently paying dividends and doing buybacks.

Get a 90% discount off Bloomberg’s No.1 competitor. Learn more here

Today’s business gets more interesting the deeper you dig.

After a while, I found myself turning into a growth investor.

After splashing water in my face and pointing at myself angrily in the mirror, I continued.

Here are the ratios, as I normally calculate them, using the headline data:

NCAV Ratio = 2

TBV Ratio = 1.5

EV/5Y FCF Ratio = 5.5

P/5Y FCF Ratio = 14

It’s not especially cheap to assets, but a positive NCAV Ratio is generally a good sign.

It indicates the business has lots of liquid assets relative to its total liabilities.

To a deep-value investor this means it’s not going to die easily.

Earnings are decent compared to EV, but pretty lame compared directly to market cap.

This is normally a sign of a Japanese cash-hoarder. Except, this business is European, not Japanese.

As I dug into it, I realised that using the 5Y averages was wrong.

To do this business justice, I’d need to use last year’s earnings as my proxy.

This is because the core subsidiary is growing like a weed. Since 2019 it’s basically 5x’d revenues.

It isn’t slowing down either.

Management just upgraded their revenue and earnings forecasts (again) in the Q3 interim.

That growth is coming from structural tailwinds.

In other words, governments across the EU have enacted policies that directly benefit this business and its core operations.

The business knows this and has actively leaned into the situation with deliberate acquisitions and expansion efforts.

The recent AI boom has created even more demand.

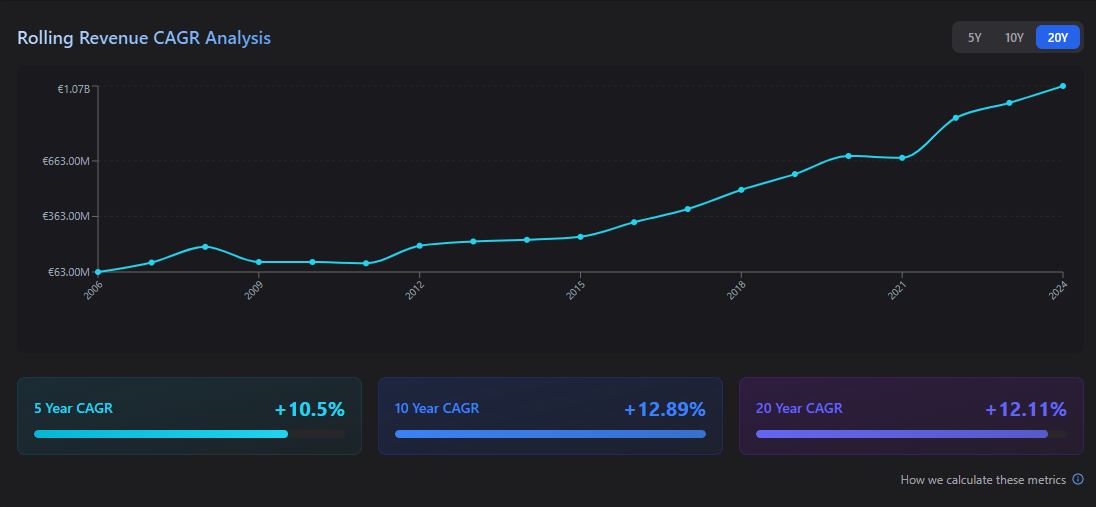

Take a look:

And earnings are not far behind…

OK, so let’s take a look at the metrics, using last year’s earnings instead of the 5Y average:

EV/FCF Ratio = 3.3

P/FCF Ratio = 5.7

As you can see, this business is priced like one of the small SME businesses I used to buy in the real-world.

We’re talking about businesses that are owner-managed, with revenues between €1-5M.

Today’s stock has revenue of over €1B.

This, alone, illustrates the absurdity of the current valuation.

At today’s price the market is implying that the revenue growth will reverse and profits will revert back to roughly half current levels.

It also implies that the business will burn through most of its excess cash without return.

To make money here, we don’t need the growth to continue. We just need it to maintain 2024 levels for a few years.

Let’s take a look…